Cryptocurrencies Price Prediction: Bitcoin, PEPE & SNX – American Wrap 26 July

Bitcoin and crypto market unphased as FOMC commits to a meeting-by-meeting approach

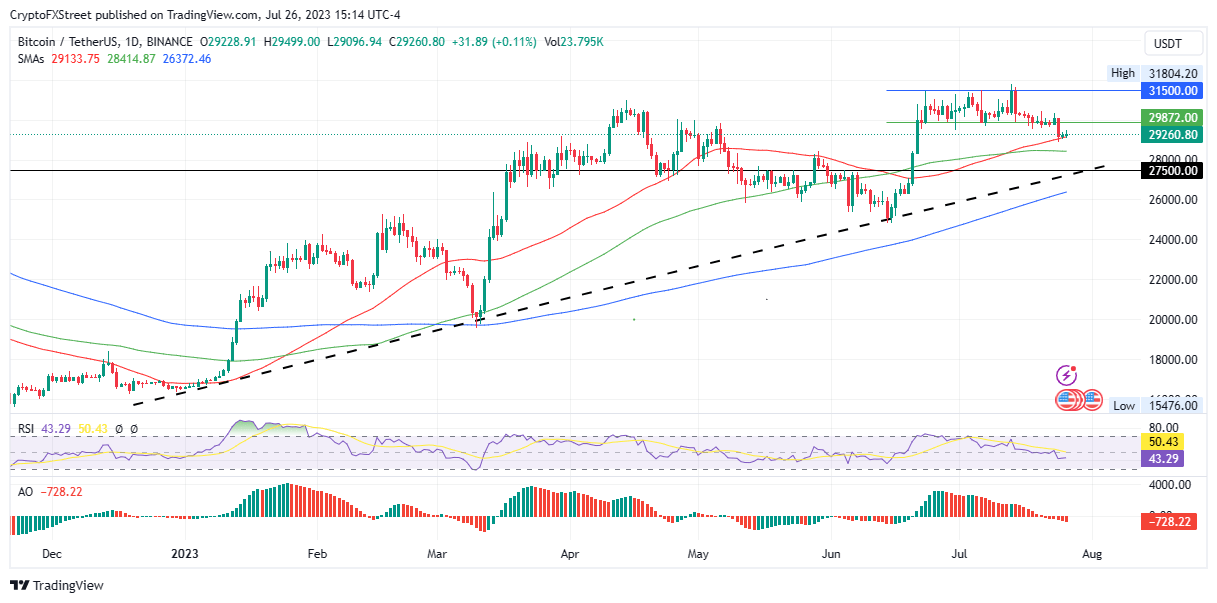

A highly anticipated decision to raise interest rates in line with expectations and the insertion of a slither of hope in otherwise mixed messaging from the Chairman of the Federal Reserve, Jerome Powell, was not enough to raise the pulse of the moribund crypto market on Wednesday.

Bitcoin price remained in a range it has been bobbing around in for most of the week, trading at $29,353 at the time of writing, slightly up after a minor jerk down following the Fed’s July meeting announcement.

Can PEPE kill SHIB just as Shiba Inu killed Dogecoin?

Crypto markets are taking a break from rallying as Bitcoin (BTC) price consolidates. But altcoins are rallying massively, and meme coins take a special place right now due to various reasons. In this article, we will pay attention to the new meme coin on the block, PEPE, which has shed 17% in under 72 hours. But this downtrend has inadvertently pushed the frog-themed crypto into an accumulation zone and could now be an opportunity for long-term investors.

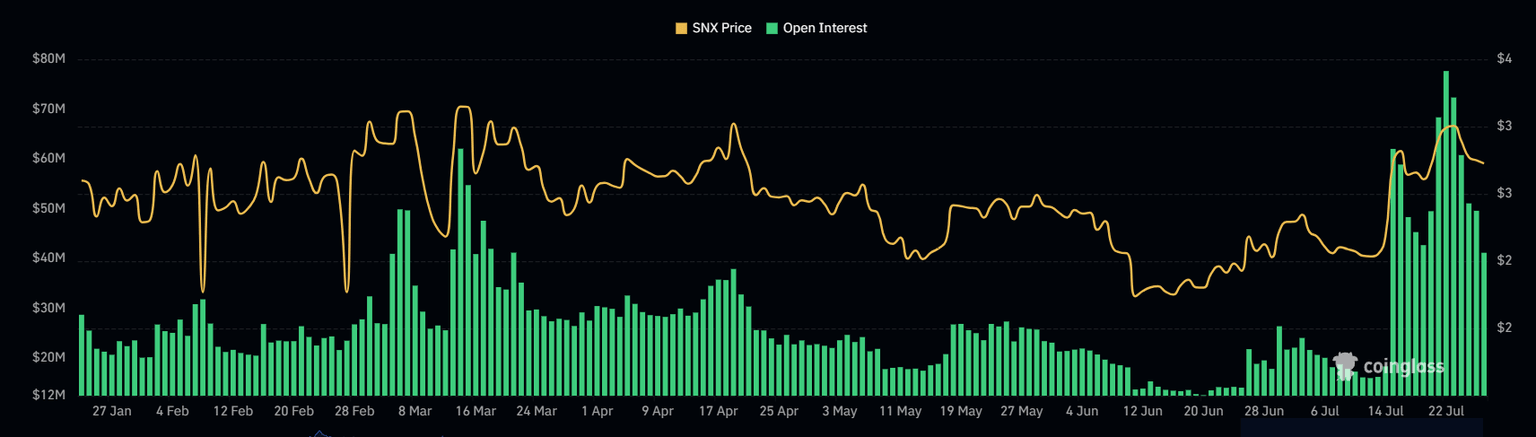

Synthetix price crash scare leads to liquidation from investors as open interest falls by 20%

Synthetix price had an impressive run these past two weeks as the altcoin increased to hit a three-month high. However, in the last three days, SNX has posted red candlesticks, with July 26 almost observing a significant decline. This fear of losses was reflected in the investor's behavior.

Author

FXStreet Team

FXStreet

-638259634604798021-638260050164299433.png&w=1536&q=95)