Cryptocurrencies Price Prediction: Bitcoin, Meme & Crypto – European Wrap 21 November

Bitcoin Weekly Forecast: BTC drops to seven-month lows as selling pressure intensifies

Bitcoin (BTC) price continues its downward slide, trading near $82,000 at the time of writing on Friday and plunging to seven-month lows as bearish sentiment tightens its grip on the crypto market. Institutional demand continues to weaken as spot Bitcoin Exchange Traded Funds (ETFs) recorded a weekly outflow of $1.45 billion as of Thursday, marking a fourth consecutive week of withdrawals. Adding to this, deteriorating on-chain conditions signal that traders may not yet have seen a definitive bottom, as the largest cryptocurrency by market capitalization remains vulnerable to further downside in the days ahead.

Meme Coins Price Prediction: DOGE, SHIB, and PEPE extend losses as bearish momentum intensifies

Meme coins continue to face selling pressure at the time of writing on Friday, with Dogecoin (DOGE), Shiba Inu (SHIB) and Pepe (PEPE) extending correction nearly 8% so far this week. The momentum indicators for these three meme coins are flashing weakness, suggesting a deeper correction on the horizon.

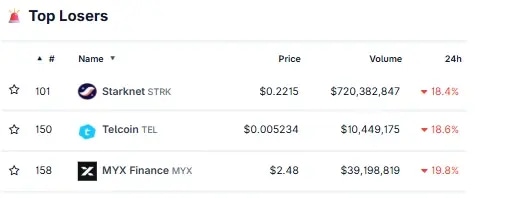

Top Crypto Losers: Starknet, Telcoin and MYX Finance extend losses as Bitcoin dips below $86,000

Starknet (STRK), Telcoin (TEL) and MYX Finance (MYX) continued to face selling pressure on Friday as Bitcoin (BTC) slipped below $86,000, dragging smaller cryptocurrencies down. According to the CoinGecko data, STRK, TEL, and MYX have corrected by more than 18% over the last 24 hours. The technical outlook for these altcoins suggests further losses as the broader bearish sentiment dominates the crypto market.

Author

FXStreet Team

FXStreet