Cryptocurrencies Price Prediction: Bitcoin, Ethereum & OmiseGo – American Wrap 23 September

88,000 Bitcoin options are set to expire this Friday: What does it mean for BTC

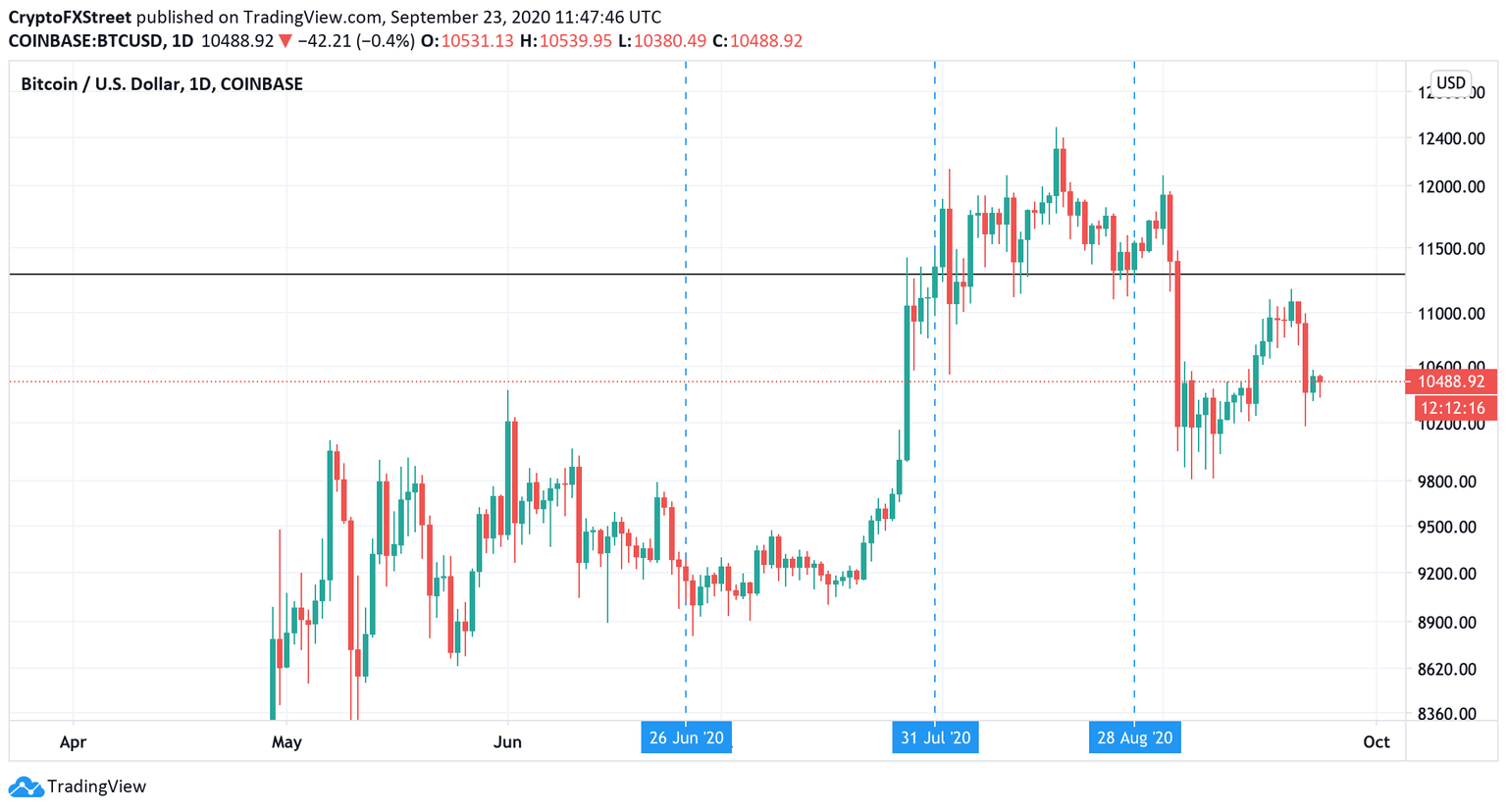

The volatile start of that week that saw Bitcoins sell-off from nearly $11,000 to $10,000 in a matter of hours may have an even more turbulent ending. According to the Skew, provider of data for Bitcoin and Ether derivative, 88,000 Bitcoin options contracts are set to expire on Friday, September 25.

Ethereum closer than ever to ETH 2.0 with Spadina Launchpad live on September 29

The main idea behind the Eth2 upgrade is the shift towards a PoS consensus algorithm as the current Proof-of-Work algorithm is energy-intensive and not sustainable in the long-run. Additionally, ETH's current speed limitation, which can only handle around 15 transactions per second, is simply not enough considering Visa can process more than 1,500.

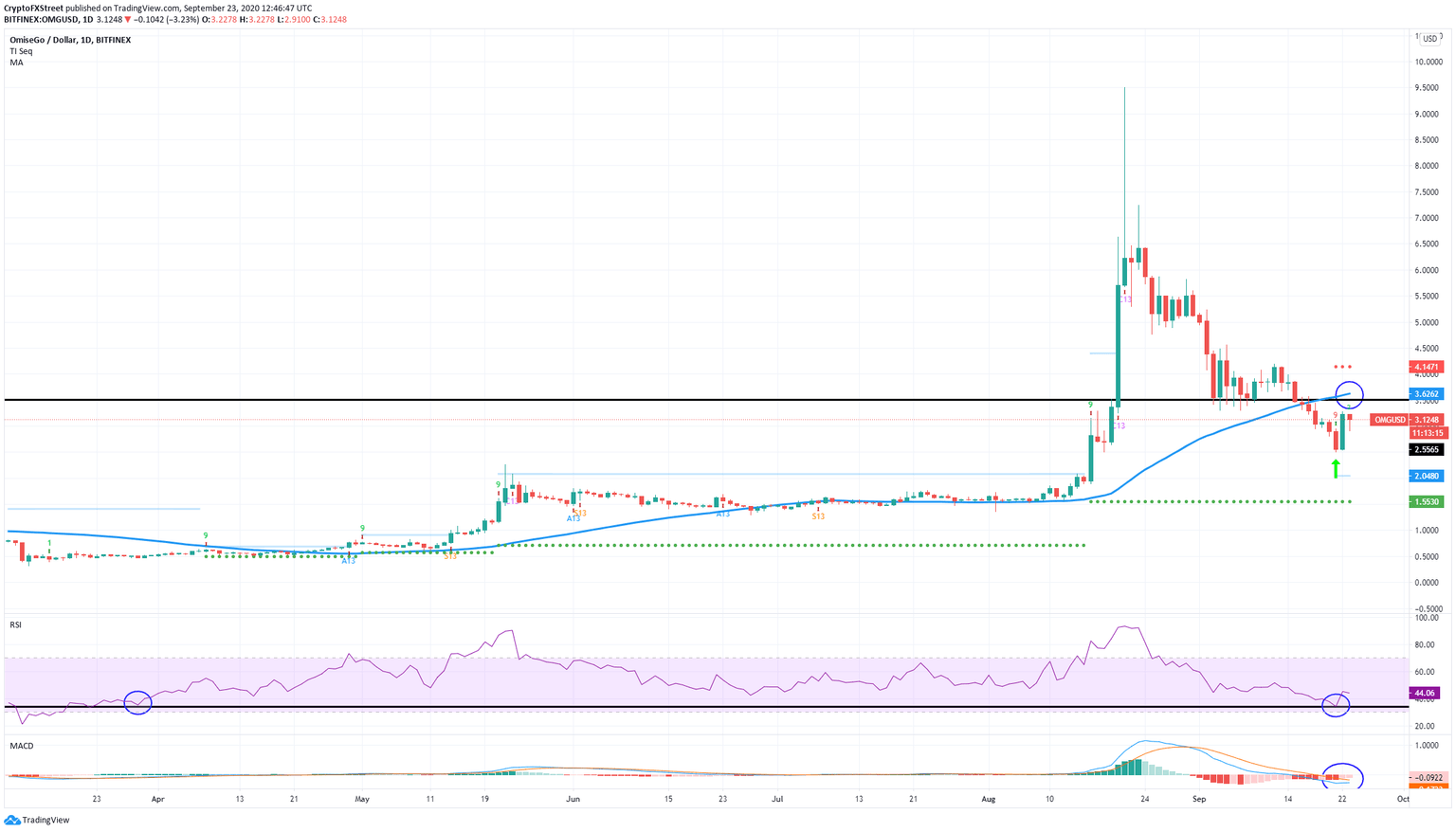

OmiseGo Price Prediction: OMG price surges 30% and it’s looking for more

OMG is down more than 50% since its two-year high at around $7 was established in August 2020. Bulls are finally seeing a bounce for the digital asset and look forward to more price action in the short-term as several indicators are flashing buy signals.

Author

FXStreet Team

FXStreet

-637364709940390866-637364804380329373.png&w=1536&q=95)