Cryptocurrencies Price Prediction: Bitcoin, Cryptos & Memecoins – American Wrap 25 February

Crypto market turns risk-off: Where are Bitcoin and meme coins headed?

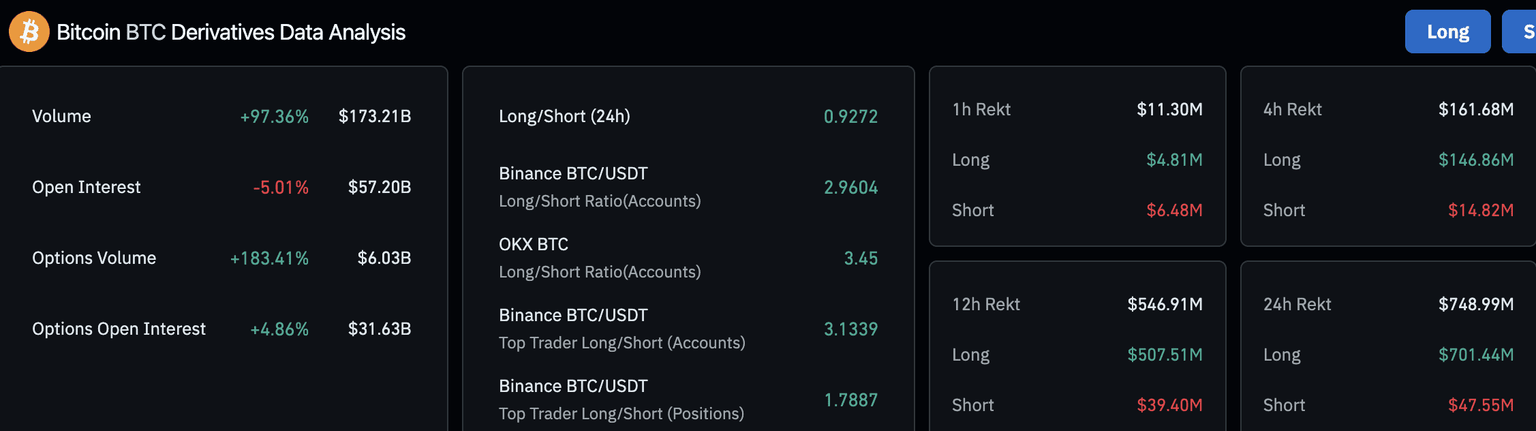

Bitcoin (BTC) traders faced over $746 million in liquidations in the past 24 hours, according to Coinglass data. Meme coins led the market crash last week, with developments surrounding LIBRA and MELANIA and the $1.4 billion Bybit hack, where stolen funds were laundered through Solana meme coins.

Crypto bloodbath: $325 billion market cap vanishes amid selling pressure

The Kobeissi Letter reports on Tuesday a $325 billion wipeout in the crypto market capitalization since Friday. Additionally, Bloomberg reports that Citadel Securities is exploring a role as a Bitcoin and crypto liquidity provider. Amid the turmoil, former FTX CEO Sam Bankman-Fried reemerged, expressing “sympathy for government employees.”

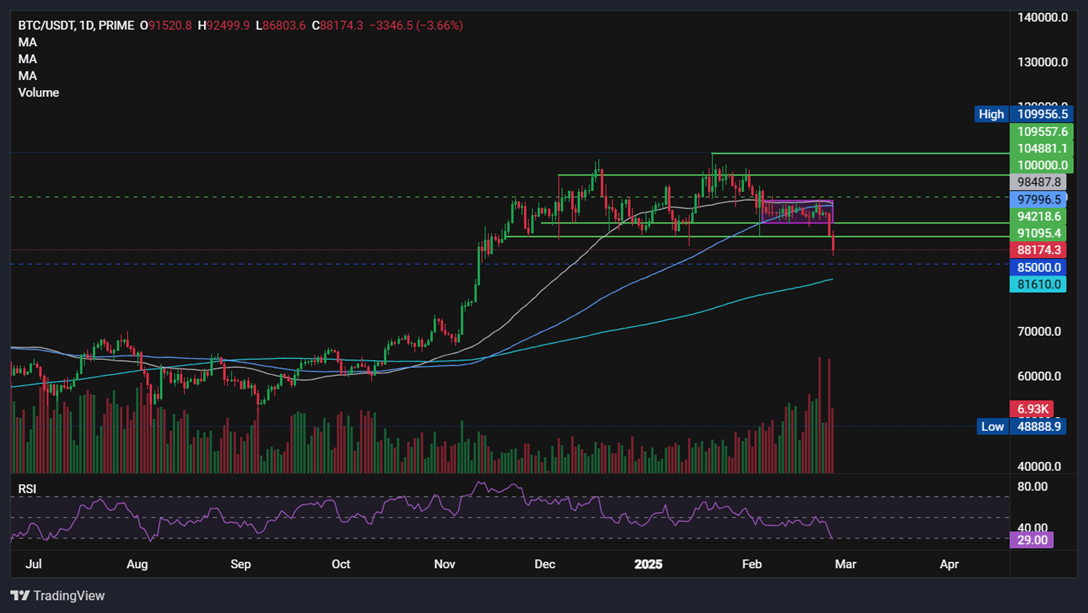

Bitcoin breaks down after weeks of consolidation – What’s going on?

Bitcoin has broken out of its familiar trading range for the past three weeks, sinking to its lowest level in three months. Renewed global trade tensions and a hack at a major cryptocurrency exchange have unnerved investors, triggering a sell-off, resulting in $1.33 billion in long liquidations over the past 24 hours.

Author

FXStreet Team

FXStreet