Crypto bloodbath: $325 billion market cap vanishes amid selling pressure

- The Kobeissi letter highlights how the crypto market erased $325 billion since Friday.

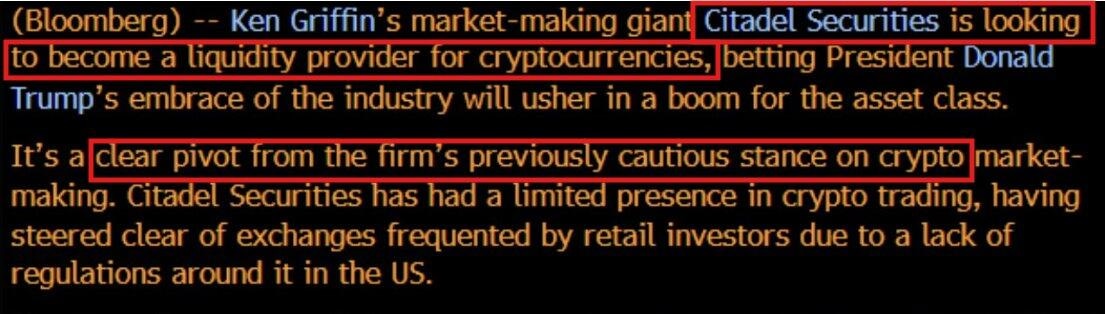

- Bloomberg reported that Citadel Securities is looking to become a liquidity provider for Bitcoin and crypto.

- Amid the crypto crash, Sam Bankman-Fried states he has “a lot of sympathy for government employees.”

The Kobeissi Letter reports on Tuesday a $325 billion wipeout in the crypto market capitalization since Friday. Additionally, Bloomberg reports that Citadel Securities is exploring a role as a Bitcoin and crypto liquidity provider. Amid the turmoil, former FTX CEO Sam Bankman-Fried reemerged, expressing “sympathy for government employees.”

Bloodbath in the crypto market

On Tuesday, the Kobeissi Letter posted on its social media platform X that crypto markets had erased -$325 billion of market capitalization since Friday morning. Among them, at 10:00 GMT alone, crypto lost $100 billion in one hour without any major headlines.

Crypto total market capitalization chart. Source: Kobeissi Letter

Kobeissi’s report explains that over the last 24 hours, the crypto market has recorded $150 billion liquidated. “Selling has broadened with just about all crypto assets falling sharply.”

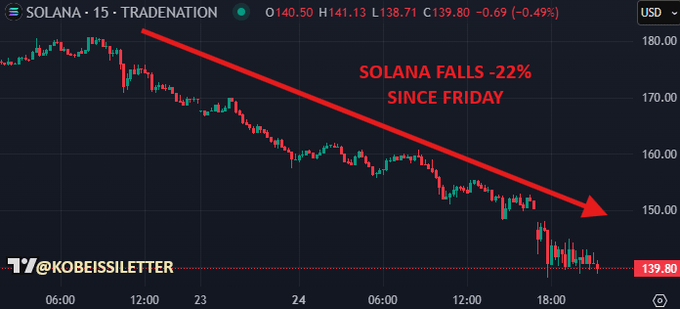

The memecoin market has suffered a sharp liquidity drain, with analysts attributing the downturn to Solana’s decline, which has dropped 22% since Friday. Initially, Solana exhibited strong relative performance during the memecoin frenzy, but as the hype faded, so did its momentum.

The recent news about the LIBRA memecoin and FTX repayments adds bearish credence.

Solana chart. Source: Kobeissi letter

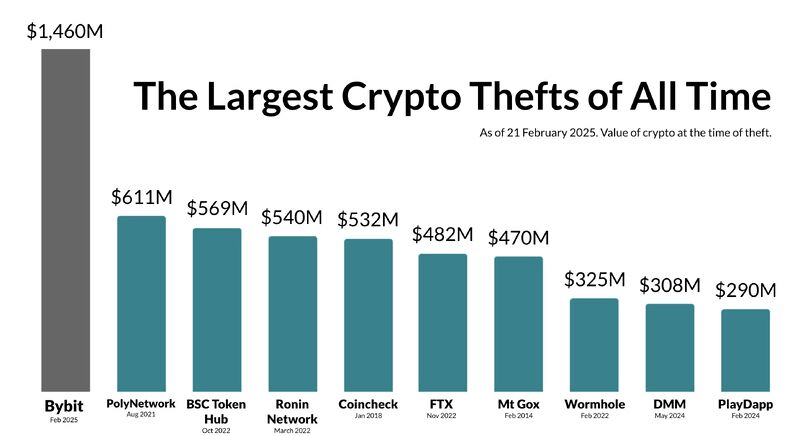

This downturn in the overall crypto market was mainly due to the news that the Bybit cryptocurrency exchange was compromised, and funds worth $1.4 billion were stolen on Friday. The Bybit hack was twice the second largest crypto hack in history, which was PolyNetwork’s $611 million hack in August 2021, as shown in the graph below and further eroding market confidence.

Crypto thefts chart. Source: Kobeissi letter

Bloomberg announced on Tuesday that Ken Griffin’s market-making company, Citadel Securities, is looking to become a liquidity provider for Bitcoin and crypto. Markets took this as a “sell the news” event, as Bitcoin dipped below $90,000, reaching a low of $86,888 on Tuesday.

Amid the crypto crash, Sam Bankman-Fried, former CEO of defunded crypto exchange FTX, said he has “a lot of sympathy for government employees.” This comes as DOGE and Elon Musk prepare for more mass layoffs in the federal government.

1) I have a lot of sympathy for gov’t employees: I, too, have not checked my email for the past few (hundred) days

— SBF (@SBF_FTX) February 25, 2025

And I can confirm that being unemployed is a lot less relaxing than it looks

As volatility resurfaces in equity markets, risk assets like Bitcoin retreat, reflecting a decline in the historic risk appetite in 2024 and early 2025. This shift signals reduced liquidity in crypto markets — a pattern played out in previous cycles.

Author

Manish Chhetri

FXStreet

Manish Chhetri is a crypto specialist with over four years of experience in the cryptocurrency industry.