Cryptocurrencies Price Prediction: Bitcoin, Chainlink & Ripple — Asian Wrap 22 June

Bitcoin ETF summer, Valkyrie investment firm joins BlackRock, WisdomTree, and Invesco in spot BTC application

Bitcoin Exchange Traded Fund (ETF) is the current theme in the crypto market as institutional investors move to provide users with regulated options to participate in the BTC market. The trend has intensified so much that experts say it is the main driver behind the current Bitcoin (BTC) rally.

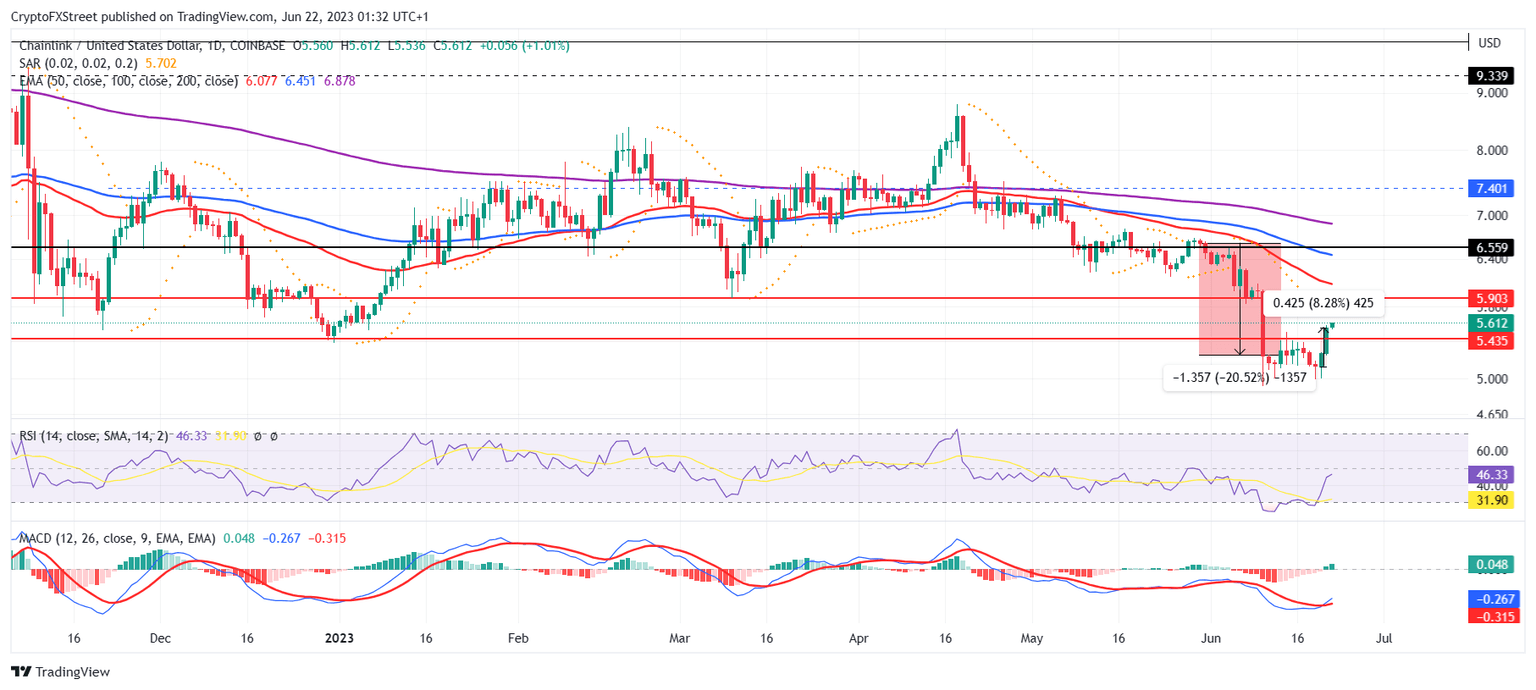

Over 70k LINK holders await Chainlink price to rally by 20% in order to gain profits

Chainlink price is slow in its recovery, which is impacting its investors as well, whose sentiment is turning more and more negative to the point where they chose to sell at a loss. Even now, for a chunk of the LINK holders to gain profits, they might have to wait for a while longer as a significant rally is required for it to occur.

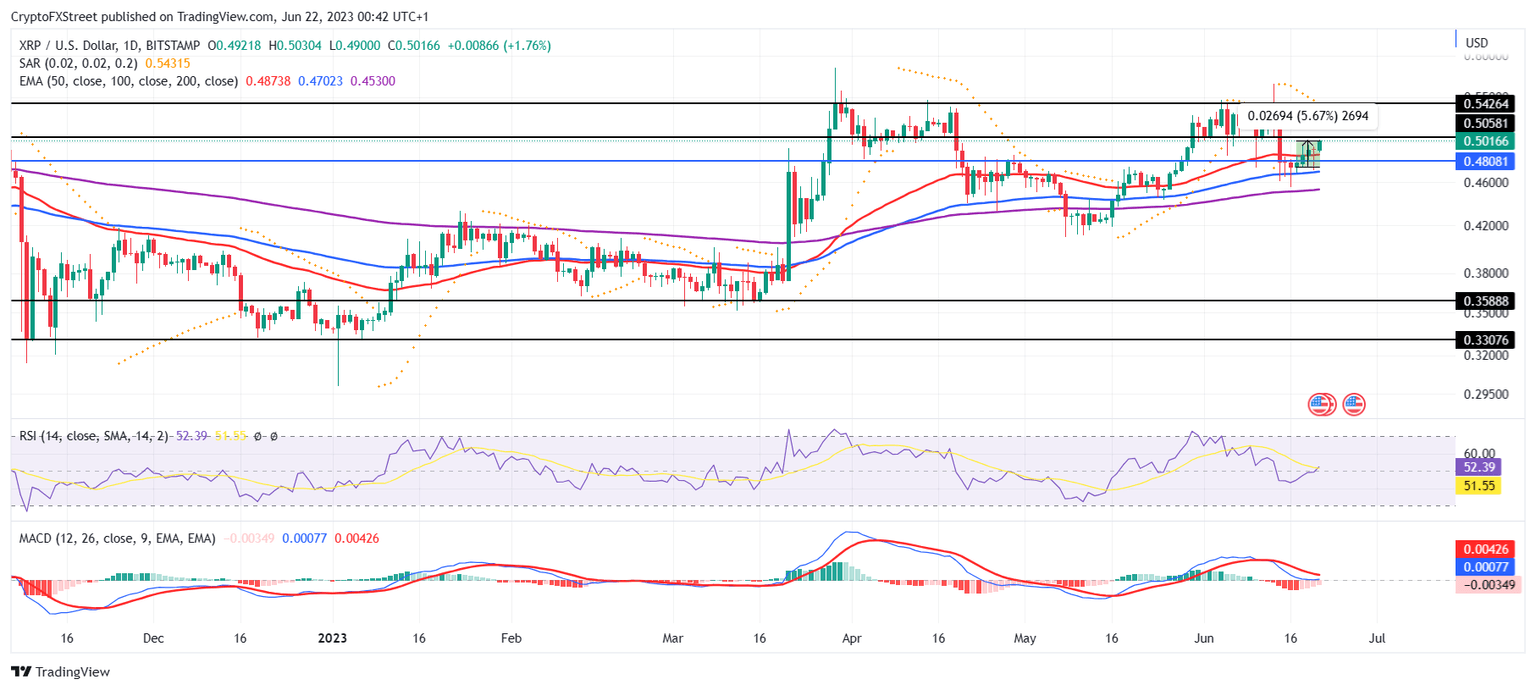

XRP price could mark new 2023 highs on the back of institutional investors' interest

XRP price has had a slow recovery in comparison to many of the top cryptocurrencies, even as Bitcoin broke above the $30,000 mark. However, while the Ripple token is lagging in price rise, it's making up for it in terms of gaining institutions' interest. That might be the key to pushing the altcoin to new highs.

Author

FXStreet Team

FXStreet