Cryptocurrencies Price Prediction: Bitcoin, Binance Coin & Chainlink — Asian Wrap 29 December

“Bitcoin is so back” says Messari, as Inscriptions account for 21% of total fees in 2023

Bitcoin is heading into one of the most important years in its history as two major events are expected to skyrocket the digital asset. Ahead of the same, crypto market intelligence data provider Messari has provided its take on what 2024 can bring for Bitcoin and by the looks of it, Inscriptions might lead the year.

Binance Coin price might face correction despite Binance releasing bullish 2023 overview

One would say that Binance might have had a rough year, given its founder Chengpang Zhao's exit and the company being pursued by enforcement action. Binance Coin price, amidst all this, remained largely correlated to the broader market cues, which is likely changing now.

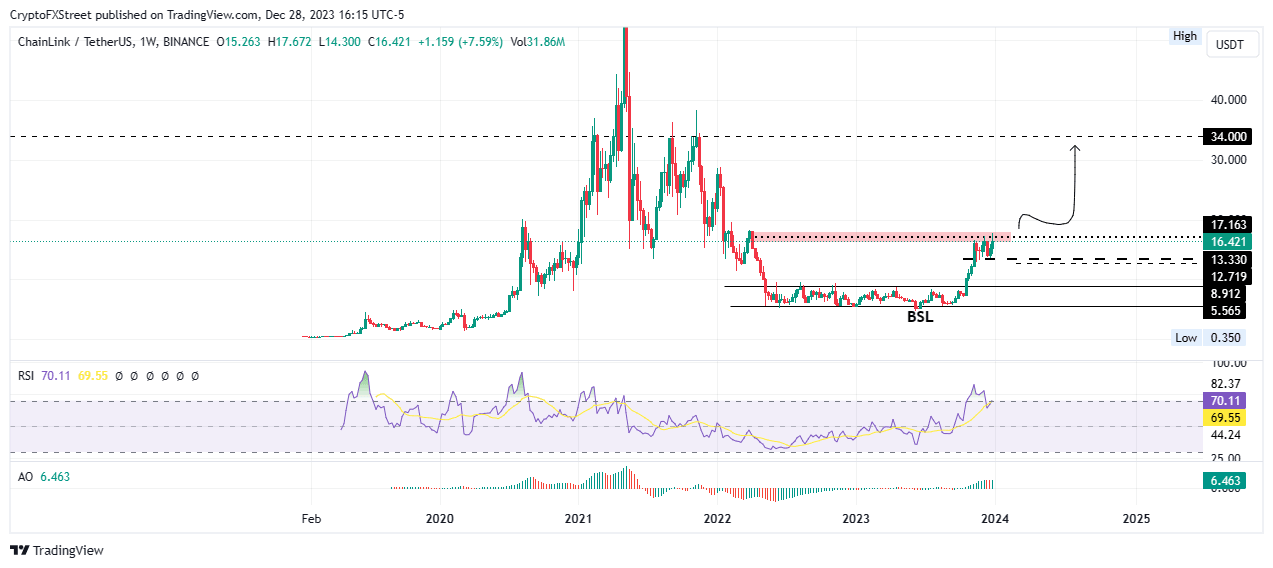

Chainlink Price Prediction: LINK could double its market value if it overcomes this weekly barrier

Chainlink (LINK) price remains trapped within a weekly supply barrier for almost two full months, confronting a critical barrier that will play a pivotal role in the next directional bias for the cryptocurrency.

Author

FXStreet Team

FXStreet