Cryptocurrencies losing ground

During the last 24 hours, cryptocurrencies took the southern path. EOS (-5.21%), TRX(-5.5%), Algo (-6.9%) and ATOM(-15.67%) were the worst performers. Bitcoin(-1.66%) and XRP(-1.62%) did minor retracements. Notably, Bitcoin SV gained 5.5%. Ethereum tokes also took the red side, with LINK (-8.77%), BAT (-6,6%), and ZRX (-5.3%) as the worst performers among the main tokens. The top gainers among Ethereum tokens were ODE (+19) and EKT (+5.13%).

The market cap of the crypto sector went down 2.32% to $221.8 billion, among an 18% increase in the 24H volume ($26.4 billion). The Dominance of the Bitcoin is now 64.66%

Hot news

Malware by North Korean hacking group, Lazarous APT, reveals something of what happens during a hacking attack. To make the attack more authentic, the group created a fake company called Celas Trade Pro with a convincing website and GitHub account to make their software more credible.

Libra Association is ready to address regulatory concerns, according to a statement by David Marcus, board member of Calibra. " We are working really hard together to address all of the legitimate concerns that were raised by regulators..."

Bitcoins 18 millionth coin will be mined this week, according to a beincrypto article. So, by the end of this week, the volume of new bitcoin tokens available for miners will shrink to less than three million.

Technical Analysis

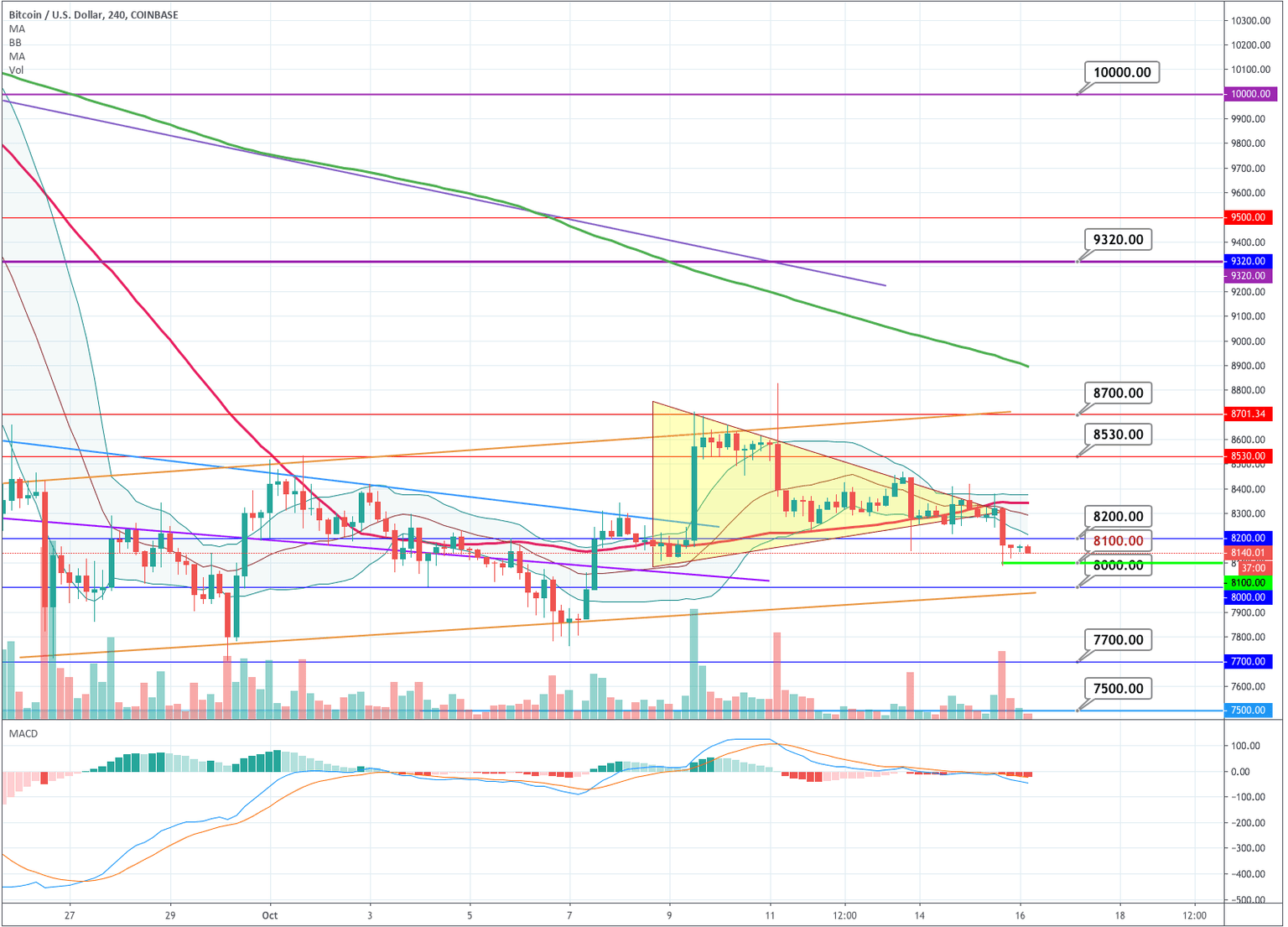

Bitcoin

The triangular pattern of the bitcoin was resolved to the downside. Yesterday the cryptocurrency price produced a large candle with high volume that moved the price from $8,322 to $8,085. Subsequently, BTC buyers made a timid bounce to $8,150.

The MACD and the price moving below the -1SD Bollinger bands suggest a bearish continuation.

The key levels to observe are 8,100, as a possible breakdown level, 8,000 as major support. To the upper side, a break above 8,200 and 8,300 might attract buyers again. Although, if we look at what is happening, again and again, that could be more an opportunity to unload than a real reversal. For a reversal, at least the 8,500 level should be broken.

Ripple

Ripple is quite bullish. Buyers seem to perceive Facebook Libra's difficulties as an opportunity to buy it. After the rejection of the $0.3 level, XRP has tested the 0.2854 level, bouncing off of it and currently moving to test it again, close to the Bollinger mean line. Also, the MACD has turned to a bearish phase. Overall, XRP is still in a consolidation phase. The potential supports for the price besides the Bollinger mean it is its 50-period MA, which matches the levels of the bullish trendline.

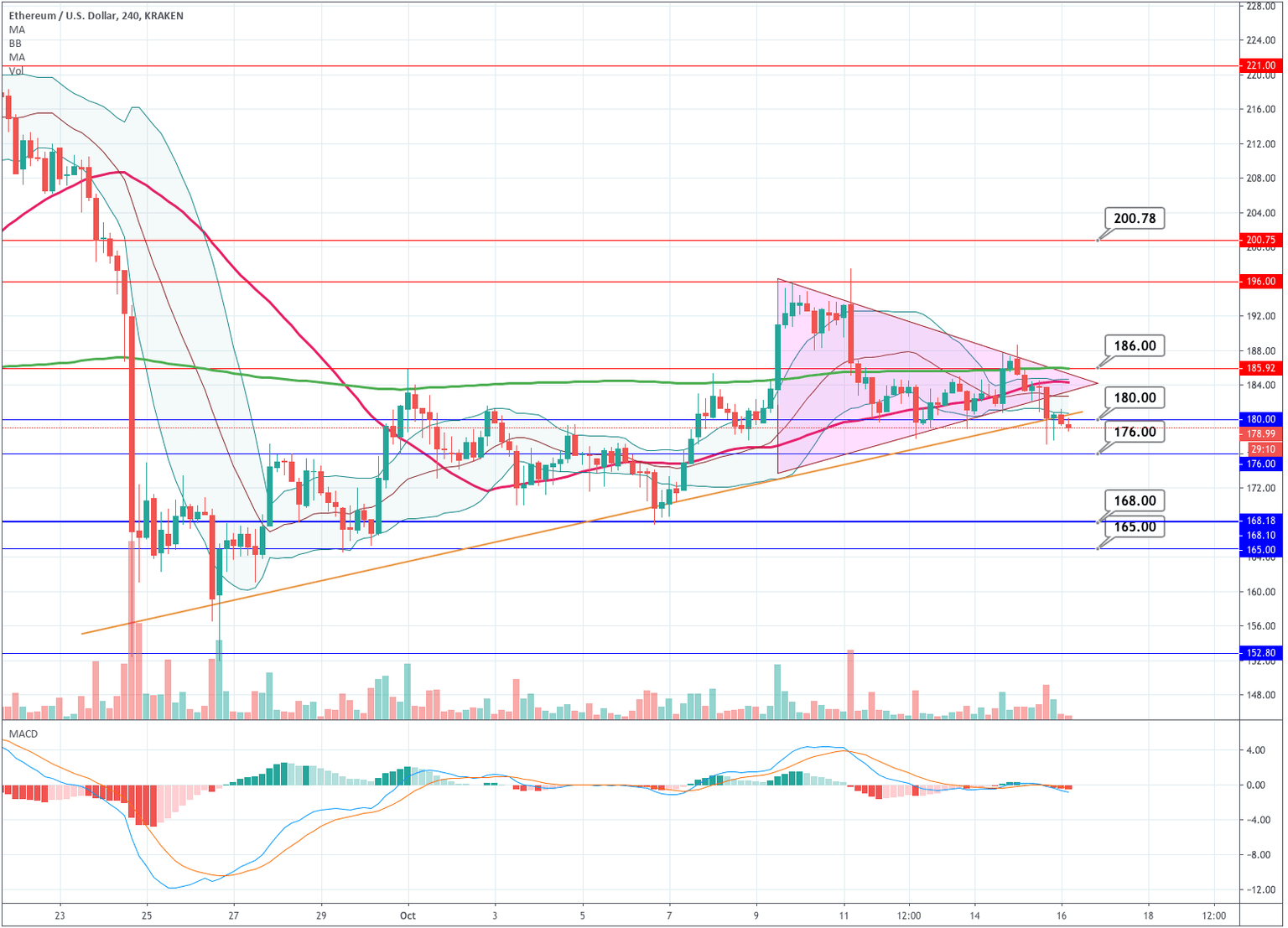

Ethereum

Ethereum also broke a triangular formation to the downside. The price also cut through its 200 and 50-period moving averages and went below the upward trendline and the $180 support level. That was done with increasing volume. MACD also turned bearish. That may signal a bearish continuation. The key levels to follow are:

Supports: $176 and $168

Resistances: $180, $186, and $196

Author

EagleFX Team

EagleFX

EagleFX Team is an international group of market analysts with skills in fundamental and technical analysis, applying several methods to assess the state and likelihood of price movements on Forex, Commodities, Indices, Metals and