Crypto.com Price Analysis: CRO prepares for an upswing

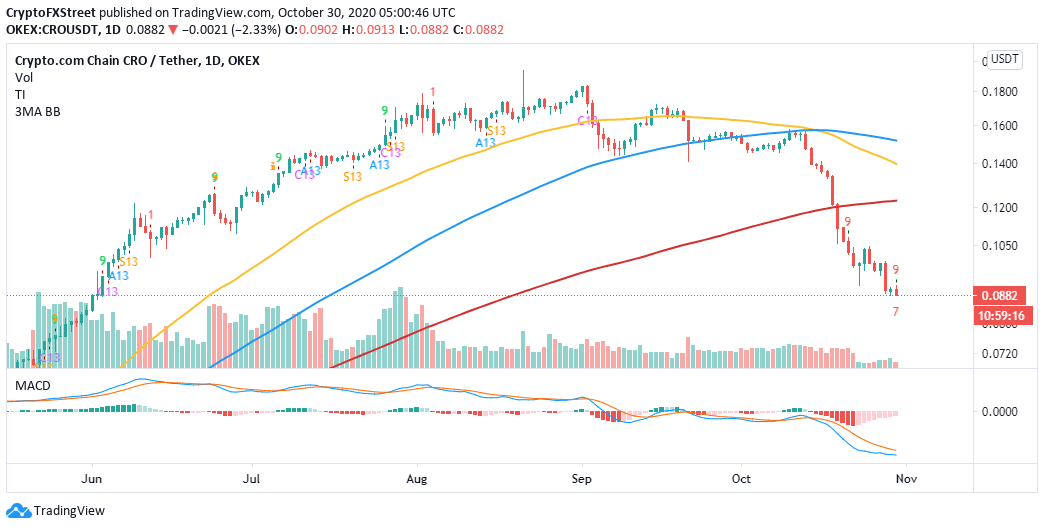

- A buy signal by the TD Sequential indicator shines a light on Crypto.com Coin's potential recovery.

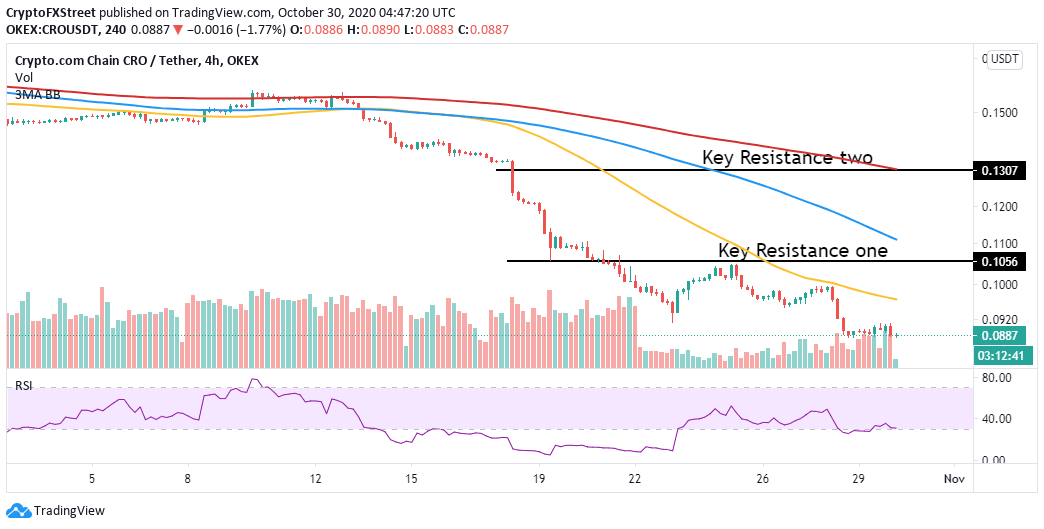

- CRO/USD must close above the 50 SMA in the 4-hour range to confirm and sustain an uptrend.

Crypto.com has corrected by more than 50% from its all-time high traded in September's latter days. The breakdown was unstoppable, especially with most of the tentative support levels caving into the intense selling pressure. October has been a devastating month for CRO investors considering the sharp fall from $0.16 (monthly high) to the prevailing market value of $0.089.

CRO/USD is holding onto a newly established support at $0.088. Buyers in the market are considering buying the dip but are not entirely sure, perhaps waiting for a confirmed breakout. If a bullish trend can emanate from the mentioned buyer congestion zone, a significant recovery will likely occur.

Crypto.com has to close the day above the 50 Simple Moving Average in the 4-hour timeframe to guarantee an uptrend. Besides, it will confirm to the buyers waiting on the sidelines that a breakout is in the offing, hence time to buy the dip.

CRO/USD 4-hour chart

It is also essential to keep in mind the resistance at $0.106 (marginally below the 100 SMA) and the second crucial hurdle highlighted by the 200 SMA around $0.131. In the meantime, consolidation could be coming into the picture before the breakout, as shown by the leveling Relative Strength Index (RSI).

The bullish outlook is validated by the TD Sequential Indicator's buy signal presented in the form of a red nine candlestick. Although the Moving Average Convergence Divergence is still in the negative region, a possible, sideways motion reinforces the consolidation before a breakout.

CRO/USD 12-hour chart

According to Santiment, a leading provider of on-chain data, whales are currently increasing their holdings in CRO. For instance, the number of addresses holding between 100,000 and 1 million CRO shot up from 153 on October 16 to 162 on October 30.

The increase in the number of large investors behind Crypto.com may seem insignificant at first. However, the massive volume moved by these whales is sufficient to add significant buying pressure to kick start a reversal.

Crypto.com Coin holder distribution chart

Looking at the other side of the fence

It is worth mentioning that the buy signal will be invalidated if CRO/USD breaks down below the support at $0.088. Moreover, bearish pressure could increase as long as the price fails to close above the 50 SMA in the 4-hour range.

Note that the MACD in the 12-hour range is still in the negative region, emphasizing sellers' presence in the market. Continued losses from the current price level could revisit the tentative support at $0.065.

Author

John Isige

FXStreet

John Isige is a seasoned cryptocurrency journalist and markets analyst committed to delivering high-quality, actionable insights tailored to traders, investors, and crypto enthusiasts. He enjoys deep dives into emerging Web3 tren

%20%5B08.11.43%2C%2030%20Oct%2C%202020%5D-637396330553629556.png&w=1536&q=95)