Crypto Today: Bitcoin gets less interest from traders, Ethereum ETF could attract $5 billion inflows

- Bitcoin market sees a decline in volatility per on-chain data from Crypto Quant.

- Bitcoin ETFs saw a net inflow of $129 million on July 1; on-chain analysts predict a relief rally in BTC.

- Gemini predicts that Spot Ethereum ETFs could attract up to $5 billion in inflows, per a recent report.

- Ethereum sustained above $3,400 on Tuesday, adding nearly 3% to its value in the past week.

Bitcoin, Ethereum, XRP update

- Bitcoin trades at $62,787 under the $63,000 level early on Tuesday. The largest asset by market capitalization noted an inflow of $129 million to Spot Exchanged Traded Funds (ETFs), per Spotonchain data.

Bitcoin holds above $61,000 as Daily Active Addresses is highest since mid-April

- Ethereum trades at $3,449, with the altcoin sustaining above key support at $3,400 ahead of the likely ETF approval, expected as early as Thursday, July 4.

Ethereum's expected July rise threatened by outflows and whale exchange deposit

- XRP trades at $0.4863 after key developments like Ripple ruling being accepted as a precedent in SEC vs. Binance lawsuit. While the Judge allowed most of the charges to proceed, the charge that the secondary market sales of native token BNB being considered as a security was dismissed.

Ripple escrow timelocks expired on Monday, one billion XRP unlocked as altcoin ranges above $0.47

Chart of the day

BONK/USDT daily chart

BONK is likely to extend gains and rally towards the 50% Fibonacci retracement level of the decline from the March 4 top of $0.000048 to the April 13 low of $0.000012. BONK could climb 13.6% to $0.000036.

The green histogram bars above the neutral line in the Moving Average Convergence Divergence (MACD) support the bullish thesis.

BONK could find support at the June 30 low of $0.00002147.

Market updates

- Pendle Finance, a leading DeFi project, noted a 40% decline in its Total Value Locked (TVL) in the past week. PENDLE trades at $4.828 early on Tuesday.

- Paxos received approval from Singapore's central bank to issue stablecoins and announced a partnership with DBS Bank.

- Bitcoin active addresses crossed 900,000 on July 1, hitting levels previously seen only in mid-April 2024, per IntoTheBlock data.

Bitcoin daily active addresses

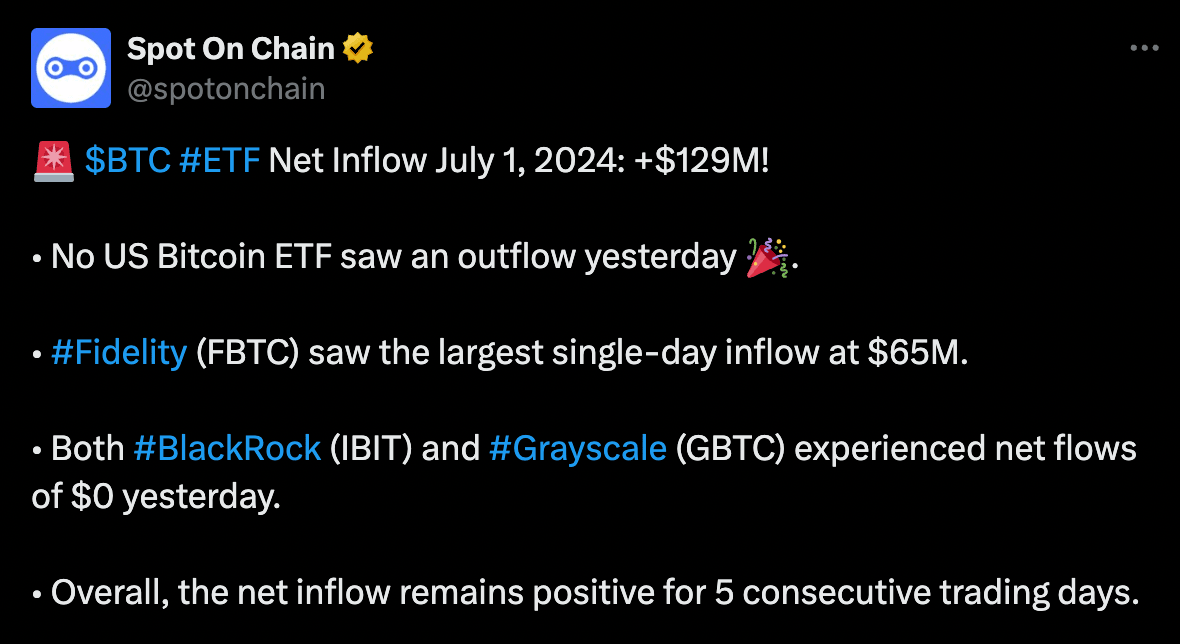

- Spotonchain data shows Bitcoin ETFs noted $129 million in inflows.

Spotonchain Bitcoin ETF flows

Industry updates

- Kronos Advanced Technologies is the first public company to accept Shiba Inu (SHIB) for payments.

Shib announcement

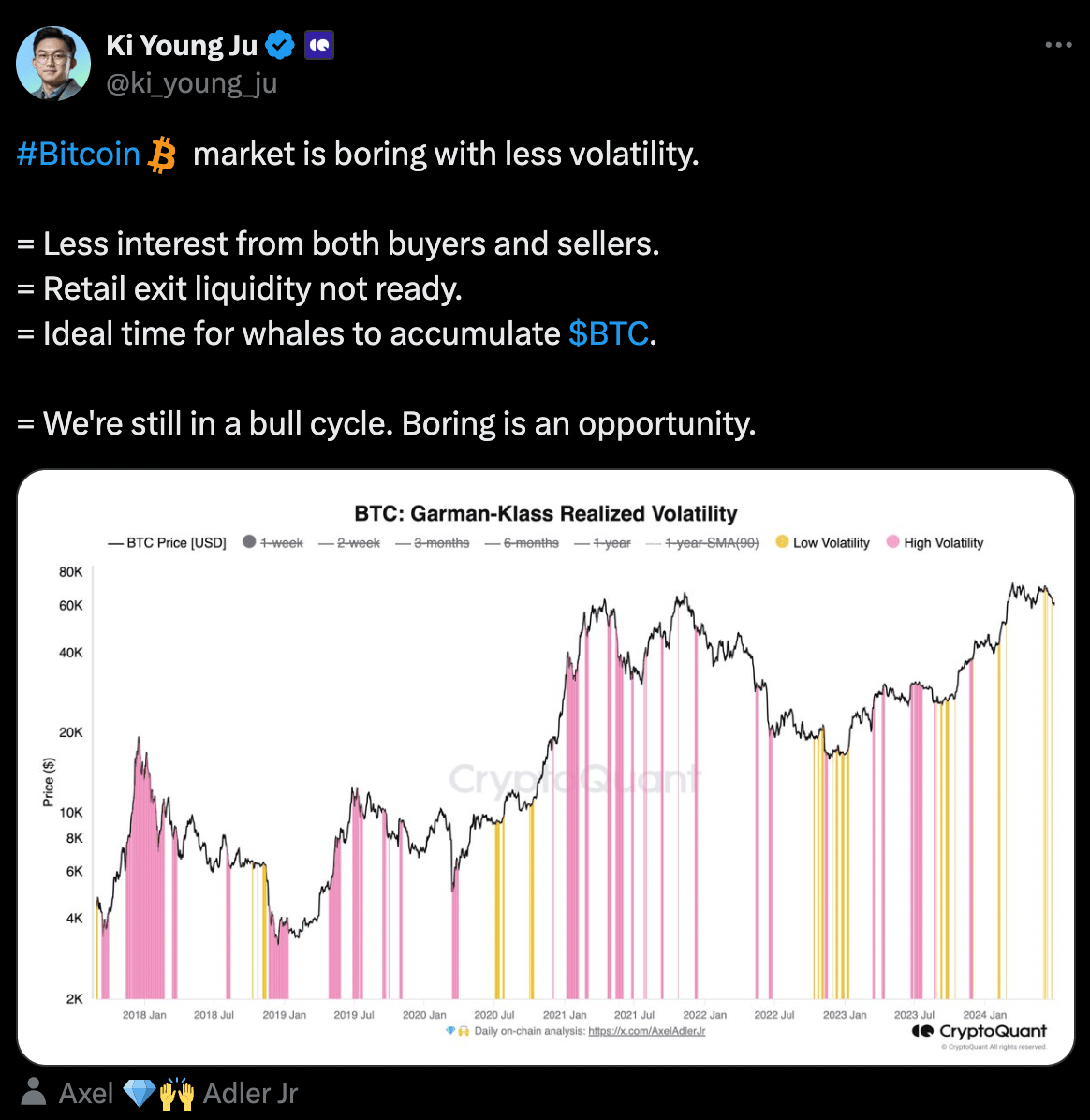

- Bitcoin has noted less interest from both buyers and sellers. An analyst at CryptoQuant notes that it is the ideal time for whales to accumulate Bitcoin, per on-chain data.

BTC tweet by CryptoQuant analyst

- ZKsync unveiled the Elastic Chain, a network of ZK rollups that is useful for new protocols and developers, per an official announcement.

ZkSync announcement

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.