Crypto Today: Bitcoin, Ethereum and XRP erase recent gains, traders focus on meme coins

- Bitcoin, Ethereum and XRP dip under key support levels at $60,000, $2,600 and $0.60 respectively.

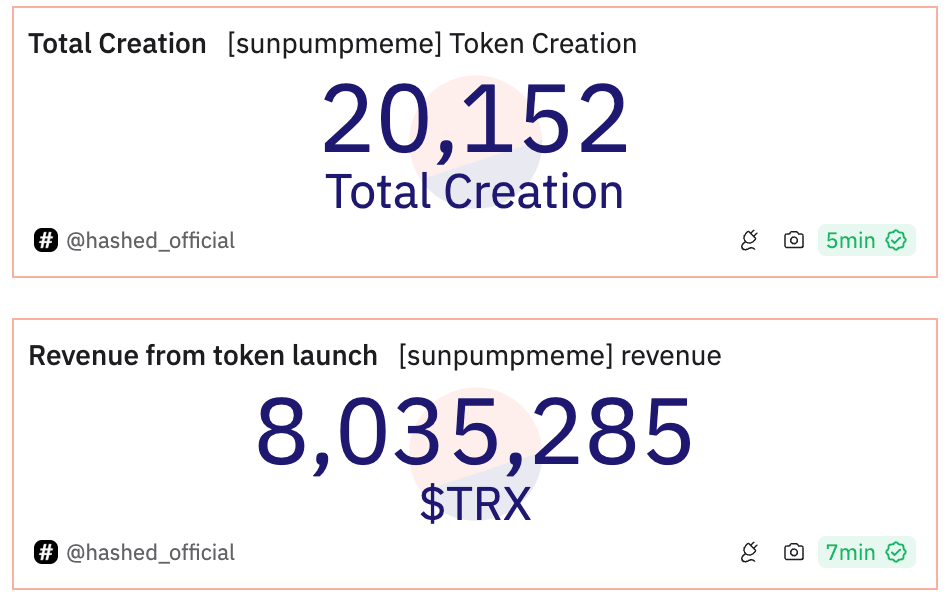

- Tron ecosystem’s meme launchpad SunPump generates over $1.1 million in revenue within twelve days of its launch.

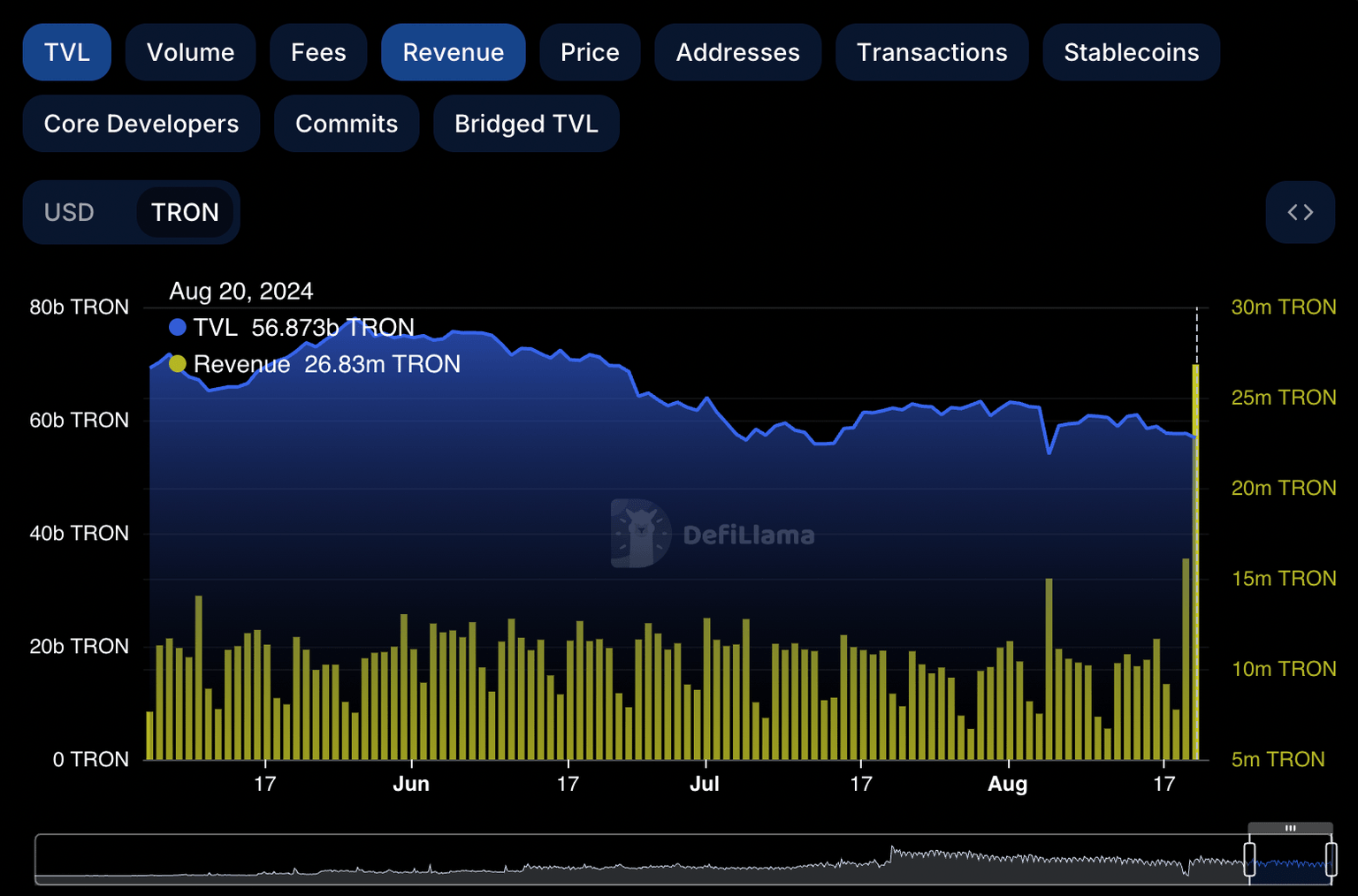

- Tron network daily revenue reached a record high of $26.83 million on Tuesday, per DeFiLlama data.

Bitcoin, Ethereum and XRP updates

- Bitcoin, Ethereum and XRP are trading under important support levels at $60,000, $2,600 and $0.60 early on Wednesday.

- The three cryptocurrencies erased gains from the start of the week as traders shift their attention to other categories of crypto like Artificial Intelligence (AI) and Tron’s ecosystem meme coins launched on the SunPump.

- Sunpump generated over $1.31 million in revenue within twelve days of its launch, according to data from Dune Analytics.

Sunpump revenue from token launch

- The Tron network hit a key milestone with record high daily revenue of $26.83 million on Tuesday. This can be attributed to the on-chain activity coming from the SunPump launchpad.

Tron protocol revenue

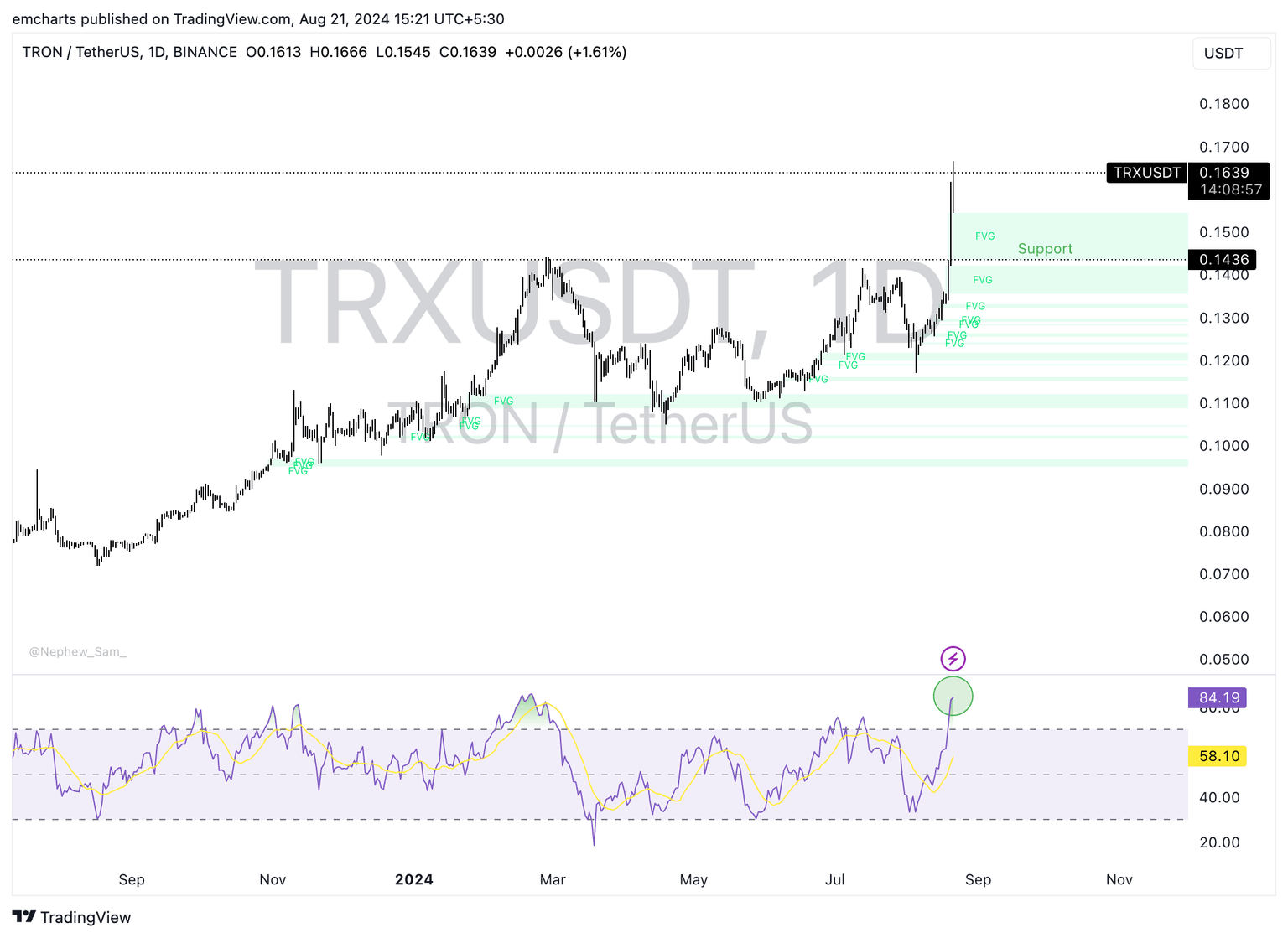

Chart of the day

TRX/USDT daily chart

TRON (TRX) trades at $0.1639 at the time of writing. The token rallied nearly 1.36% on Wednesday, alongside a rise in on-chain activity, extending the gains seen earlier this week. The Relative Strength Index (RSI) reads 84.19 at the time of writing, well in the overbought region, generating a sell signal as there are increasing chances of a pullback.

If a correction occurs, TRX could find support at $0.1436.

Market updates

- K33 Research data shows that, since the beginning of the year, Pump users have launched 1,829,747 meme coins.

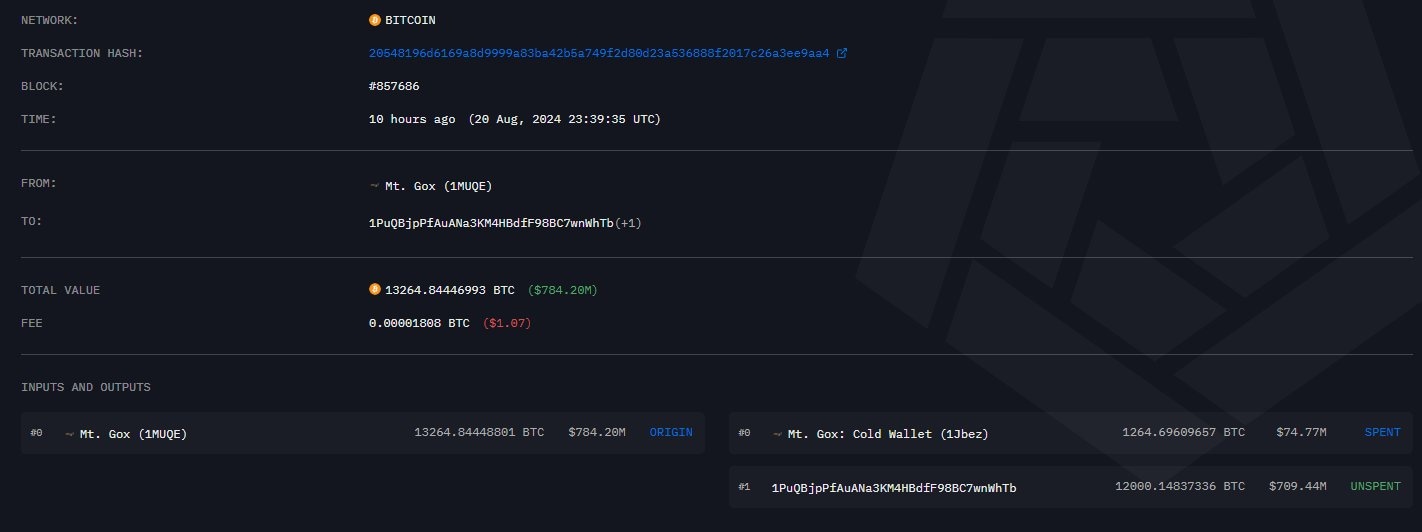

- Mt.Gox transferred 12,000 Bitcoin (worth approximately $710 million) to a new wallet address, according to on-chain data.

Mt.Gox BTC transfer

- A SUNDOG (newly launched meme coin on Sunpump) trader turned $1,690 investment of 104.33 million tokens to $20 million within six days, per Arkham Intel data.

This trader turned $1.69K of SUNDOG into $20 MILLION in 6 days

— Arkham (@ArkhamIntel) August 20, 2024

TT4S5 was one of the earliest SUNDOG buyers & purchased 104.33M tokens for $1.69K.

They currently hold $19.52M of SUNDOG across 7 addresses, and also sent $1.08M SUNDOG to exchanges - for a total profit of $20.60M. pic.twitter.com/ny9HW7qP8R

Industry updates

- Tether launched USD Tether on Layer 1 Aptos blockchain to improve crypto access and reduce transaction costs for users.

- Bankrupt crypto firm Terraform Labs’ Chapter 11 bankruptcy hearing has been scheduled for September 19.

- Tether announces plan to develop UAE Dirham-pegged stablecoin.

Tether to Develop UAE Dirham-Pegged Stablecoin

— Tether (@Tether_to) August 21, 2024

Read more:https://t.co/dkiDAI0y15

Bitcoin, altcoins, stablecoins FAQs

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.