Crypto stocks tumbling at year-end was a ‘healthy’ pullback: Analyst

Major crypto and Bitcoin mining-related stocks, which tumbled as much as 17% on the last day of trading in 2023, were simply part of a “healthy pull back,” says a Bitcoin analyst.

According to Google Finance, Bitcoin mining firms were hit the hardest during the day. Shares in Marathon Digital Holdings (MARA) tumbled 16.6% to $23.5 on Dec. 29 while Riot Platforms (RIOT) fell 12.1% to $15.5.

Hut 8 Corp (HUT) and Hive Digital Technologies (HIVE) also fell 17.3% and 15.1%.

HUT share price on Dec. 29, 202. Source: Google Finance

MicroStrategy (MSTR), a business intelligence firm viewed as a proxy for Bitcoin, fell 5.4% to $631.6.

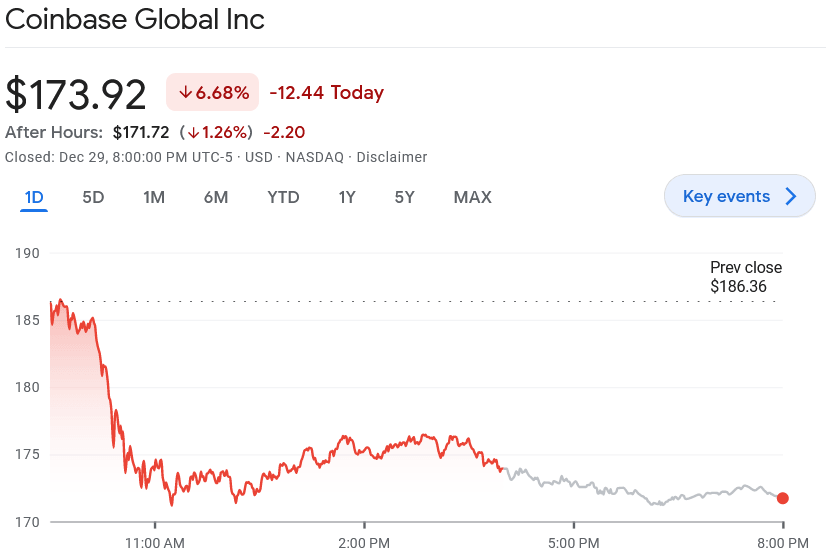

Shares in crypto exchange Coinbase (COIN) — which increased over 400% in 2023 — fell 6.6% to $173.9 and fell another 1.25% to $171.7 in after-hours trading.

COIN share price on Dec. 29, 2023. Source: Google Finance

However, the market dip was described as a “healthy pull back” by Mitchell Askew, head analyst at Bitcoin mining firm Blockware Solutions, in a note to Cointelegraph.

“[Bitcoin mining firms] were over extended beyond their previous 2023 highs despite BTC being flat at 43k for the month of December,” Askew added.

Related: Marathon, Riot among most overvalued Bitcoin mining stocks: Report

Markus Thielen, head of research at cryptocurrency financial services firm Matrixport, shared a similar view:

[We] warned [to investors] that their stock prices had reached fair value vs. bitcoin last week or, in some cases, were even overvalued.

The big fall in share prices from Bitcoin mining companies may have also been related to investor concerns that the Bitcoin halving event — which is set to take place in April — will impact its balance sheets, Askew noted.

But he said those concerns were largely “unsubstantiated.”

“Public miners have the most efficient ASICs and lowest power costs, allowing them to survive the halving without any issues,” he said.

Bitcoin increased 152% to $42,325 in 2023 but it was outperformed by at least 15 cryptocurrency-related stocks, according to nsquaredcrypto.

MARA was one of the best cryptocurrency-related stock performers in 2023, increasing nearly 600%.

In 2023 most Bitcoin-related stocks performed better than #Bitcoin itself. pic.twitter.com/fzSojcVQUe

— Timothy Peterson, CFA CAIA (@nsquaredcrypto) December 31, 2023

Author

Cointelegraph Team

Cointelegraph

We are privileged enough to work with the best and brightest in Bitcoin.