Crypto lender BlockFi prepares for potential bankruptcy in the aftermath of FTX collapse

- BlockFi, a crypto lender, claimed to have substantial exposure to the bankrupt cryptocurrency exchange FTX.

- BlockFi’s assets held at FTX.com, a loan owed by Alameda Research and undrawn amounts from the $250 million credit line with FTX were exposed to the crash.

- BlockFi is preparing for a potential bankruptcy after halting withdrawals for users, Wall Street Journal reports.

Cryptocurrency lender BlockFi is preparing to file for bankruptcy. The lender received a $250 million credit line from cryptocurrency exchange FTX in June. BlockFi informed users that FTX exchange’s collapse wiped out their assets and undrawn amount from the $250 million credit line.

Also read: New York Fed and global banking giants kick off a digital dollar pilot

BlockFi prepares for bankruptcy after substantial exposure to FTX exchange

BlockFi, a cryptocurrency lender with close ties to Samuel Bankman-Fried’s (SBF) FTX exchange, is preparing to file for bankruptcy. The lender held its assets at FTX.com, and had undrawn amounts from the $250 million credit line that SBF offered BlockFi in June 2022.

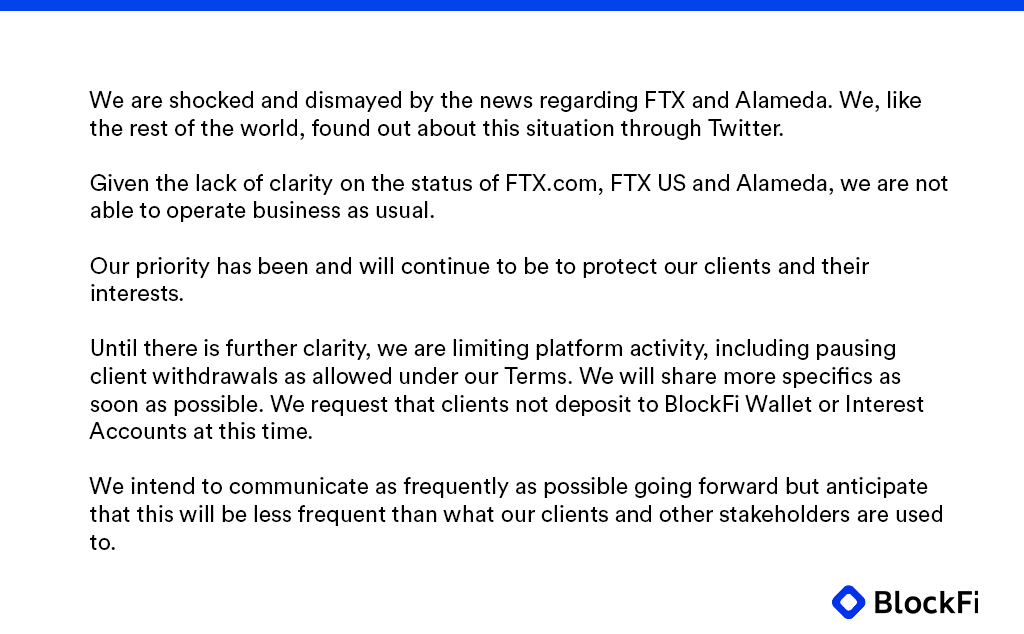

The lender told users on November 11, that they cannot operate business as usual after FTX’s collapse. BlockFi halted client withdrawals and paused deposits to wallets and interest accounts.

BlockFi announcement on November 11

Wall Street Journal reported that BlockFi is preparing for a potential bankruptcy after the biggest blowup in the crypto ecosystem. BlockFi informed investors that not all its assets were locked in custody at FTX, however there was substantial exposure and it warrants that the lender “consider all possibilities.”

The November 14 blog update reveals that BlockFi has retained Haynes and Boone as their primary outside counsel, and BRG – a top-ranked restructuring and bankruptcy advisory firm – has been engaged as their financial advisor.

BlockFi has close ties with FTX exchange

In July 2022, FTX purchased BlockFi amidst turmoil in the cryptocurrency market. The lender was experiencing a severe financial crisis as a result of crypto firm Three Arrows Capital’s collapse. BlockFi was exposed to Three Arrows Capital to the tune of $80 million.

FTX’s acquisition of BlockFi helped the lender initially tackle the liquidity crisis. Immediately after FTX’s collapse, BlockFi declared that it was “fully functional.” However, the situation rapidly changed and the lender has joined the list of crypto firms negatively impacted by Samuel Bankman-Fried’s Chapter 11 bankruptcy filing for FTX exchange. As of 2021, BlockFi held at least $14 billion in customer deposits in different digital assets.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.