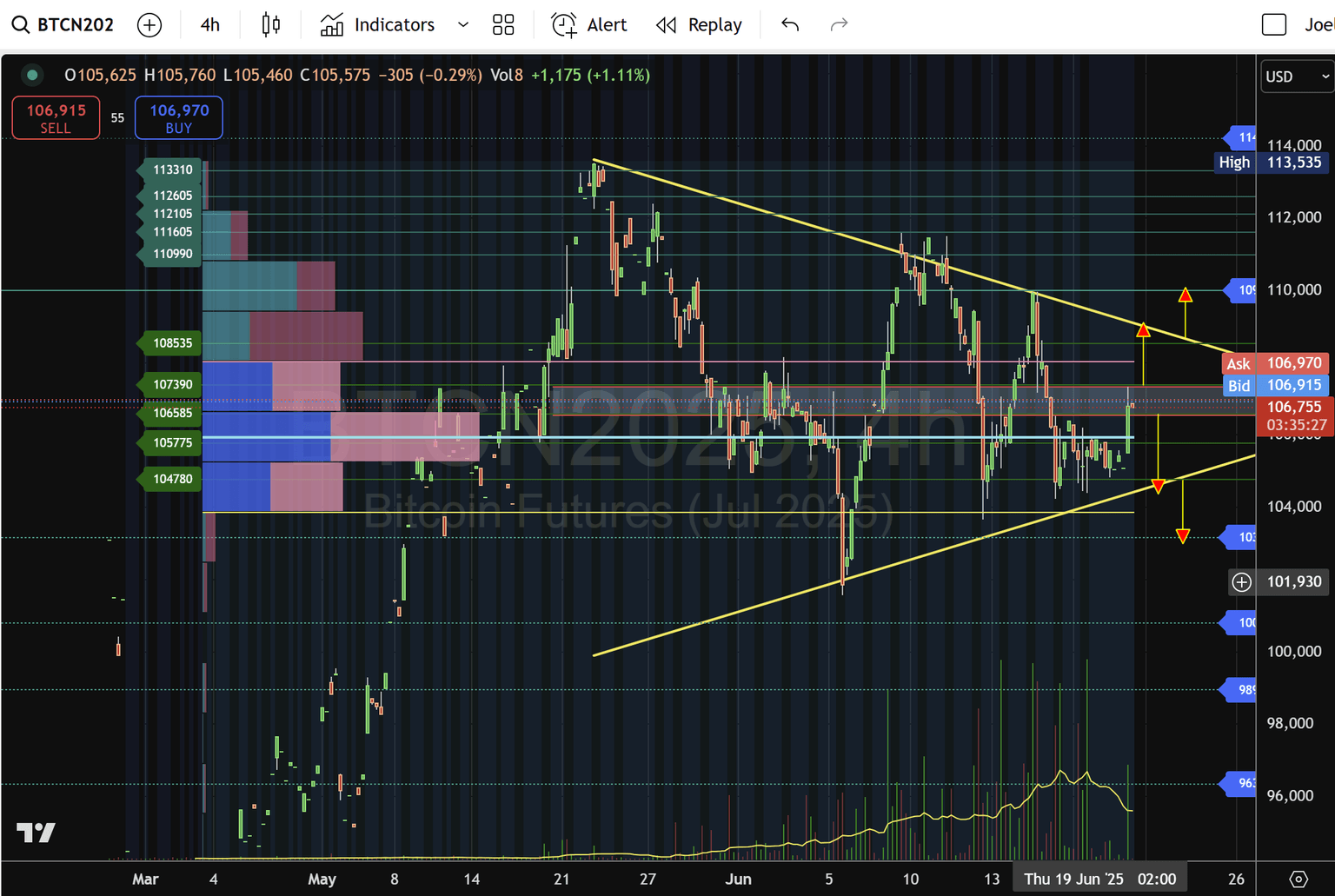

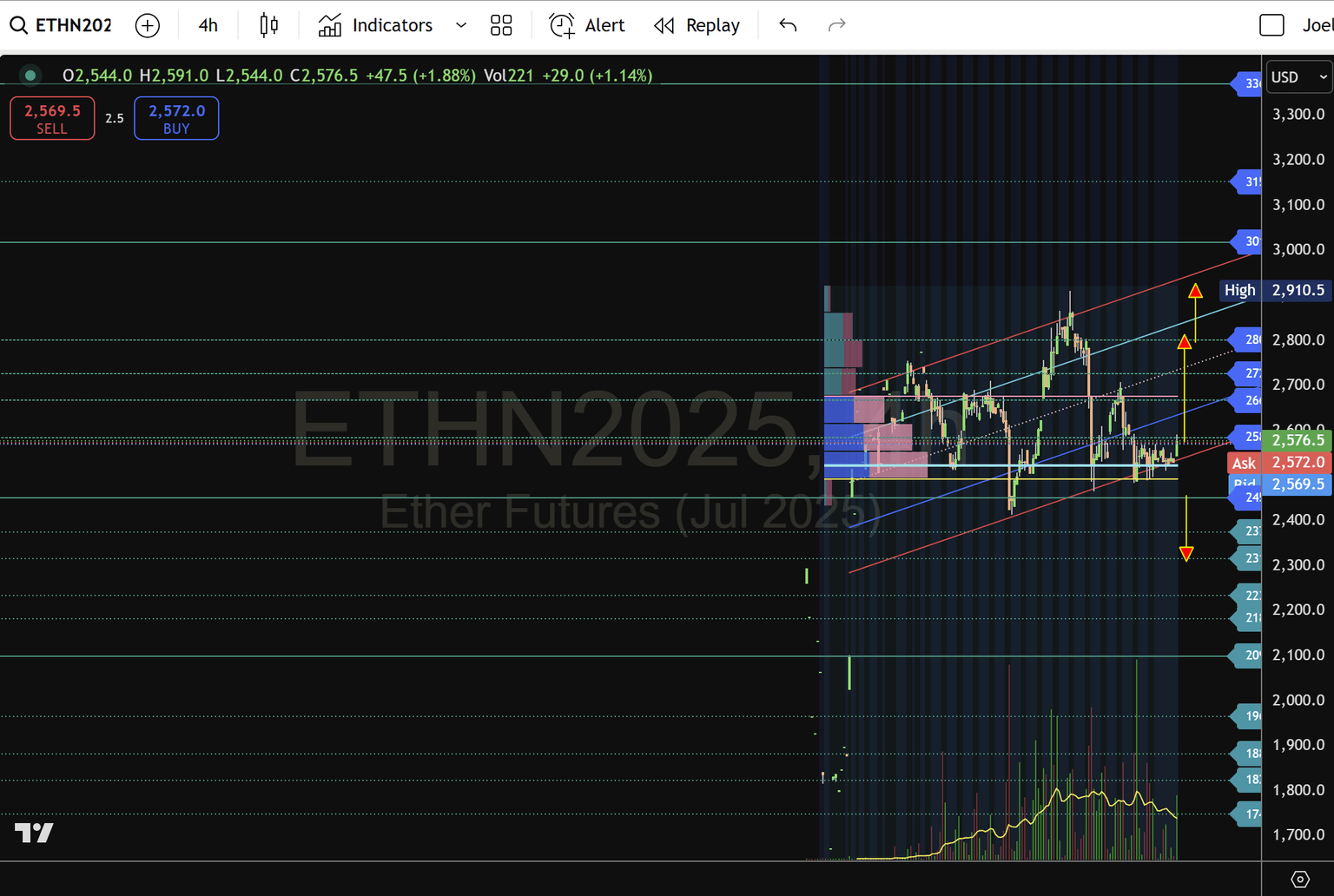

Crypto futures poised for a breakout: Bitcoin on the verge, Ether defends its uptrend

Bitcoin July futures squeeze into a decisive 4-week channel around 107,390–106,585, while Ether holds its 2,450 support in an ascending pitch. Both markets are underpinned by ETF inflows and network upgrades.

As we head into July, cryptocurrency futures are carving out distinct technical narratives. Bitcoin's July contract tightens within a four-week, disjointed channel that could trigger a sharp directional move, while Ether's July futures remain buoyed in an ascending channel off the 2,450 support. Against a backdrop of robust spot ETF flows, easing U.S. inflation, and key Ethereum protocol enhancements, the interplay of these technical setups will likely set the tone for crypto markets in the weeks ahead.

Bitcoin July futures: Poised for a directional break

-

Channel Structure: Over the past month, Bitcoin has oscillated between a descending upper trendline (drawn from mid-May highs) and an ascending lower trendline (originating from early June lows). This tightening "squeeze" centres on the 107,390–106,585 zone.

-

Upside Scenario: A convincing break above 107,390 would clear the mid-channel cap and retest 108,535 (upper band). Beyond there, targets lie at 109,995, with further supply zones at 110,990–111,605, 112,105, 112,605, and 113,310.

-

Downside Scenario: Falling below 106,585 risks a slide back to 105,775 and the lower channel floor at 104,780. A breach under 104,780 could open the door to 103,170 and, in an extended sell-off, 100,805.

-

Volume Profile & Open Interest: Rising open interest and volume accumulation around the mid-channel suggest institutional positioning, which is often a precursor to a breakout.

Ether July futures: Holding an ascending channel

-

Trend Channel: Since rebounding from 2,450, Ether has carved higher highs and higher lows within a parallel channel. The mid-channel point at 2,584 and the Value Area High (VAH) near 2,667 have acted as near-term hurdles.

-

Bullish Case: Maintaining 2,450 support allows for a push above 2,584 and 2,667, targeting 2,726, 2,801, and ultimately the resistance at 2,896. A sustained break above 3,018 (long-term supply) could signal a return to the mid-$3,000s.

-

Bearish Case: A breakdown below 2,450 shifts the channel lower, with successive supports at 2,375, 2,316, 2,233, 2,182, and 2,099.

Fundamental catalysts

-

Spot ETF Flows: June saw record net inflows into Bitcoin spot ETFs, bolstering futures basis and underpinning price support. ETF demand has trickled into Ether via growing interest in ETH-based funds.

-

U.S. Monetary Outlook: Recent U.S. CPI prints have cooled, raising hopes of a Fed pause or pivot. Lower real rates tend to be bullish for risk assets, including crypto futures.

-

Ethereum Network Upgrades: Post-Shanghai improvements and upcoming EIP roadmaps continue to reduce circulating supply via staking burns, improving Ether's supply dynamics. Growth in Layer 2 activity and DeFi TVL adds further tailwinds.

-

Derivatives Metrics: Funding rates on perpetual swaps have normalised, reducing the risk of forced deleveraging and supporting a cleaner breakout/breakdown scenario.

Conclusion and outlook

Cryptocurrency futures are at an inflection point. Bitcoin's decisive move through the 107,390–106,585 channel will likely set the broader risk tone, while Ether's ability to defend 2,450 support underpins its up-channel bias. With institutional ETF flows driving increased liquidity and fundamental upgrades enhancing network potentials, the technical breakouts (or breakdowns) in July could define the next leg of the crypto cycle.

Author

Denis Joeli Fatiaki

Independent Analyst

Denis Joeli Fatiaki possesses over a decade of extensive experience as a multi-asset trader and Market Strategist.