China's crypto holdouts: Bitcoin nodes and OTC desks struggle on

There are still a handful of Bitcoin nodes hanging on in China and OTC trading remains viable, but it may not be for long.

Despite Beijing’s ever-increasing crackdown on the crypto industry, there are still some signs of life in the People’s Republic regarding the Bitcoin network and OTC trading.

China intensified its clampdown on crypto last week in an effort to suppress any remaining activity related to digital assets within its borders. The regime specifically targeted crypto transactions, but as researched by Cointelegraph, this action is nothing new with at least 19 similar crackdowns over the past decade or so.

Despite the latest move, there are still 135 Bitcoin nodes in operation in China according to data from Bitrawr which measures nodes by geographical location. However, this is just 1.21% of the total 11,262 Bitcoin nodes spread across the planet. There may be more if they are operating behind virtual private networks (VPNs) and/or using onion routing with Tor which masks locations

Bitcoin nodes are the software that runs the protocol, containing the full ledger or a segment of it containing a history of the transaction data. Distributed and decentralized systems are specifically designed to be hard to shut down completely so the regime may struggle to extinguish these final few hangers-on or those operating via Tor.

While it's difficult to put figures on the volume due to its opaque nature, over-the-counter (OTC) trading is also maintaining a foothold in China according to various reports as is the local currency pair.

Local media outlet Wu Blockchain reported that the RMB/USDT pair, which is still offered by major exchanges such as OKEx and Huobi, has been trading at a premium. He noted panic selling last week, which has since subsided.

OKEx is currently offering 6.35 yuan for 1 USDT where the actual exchange rate for a greenback is 6.47 according to XE.com.

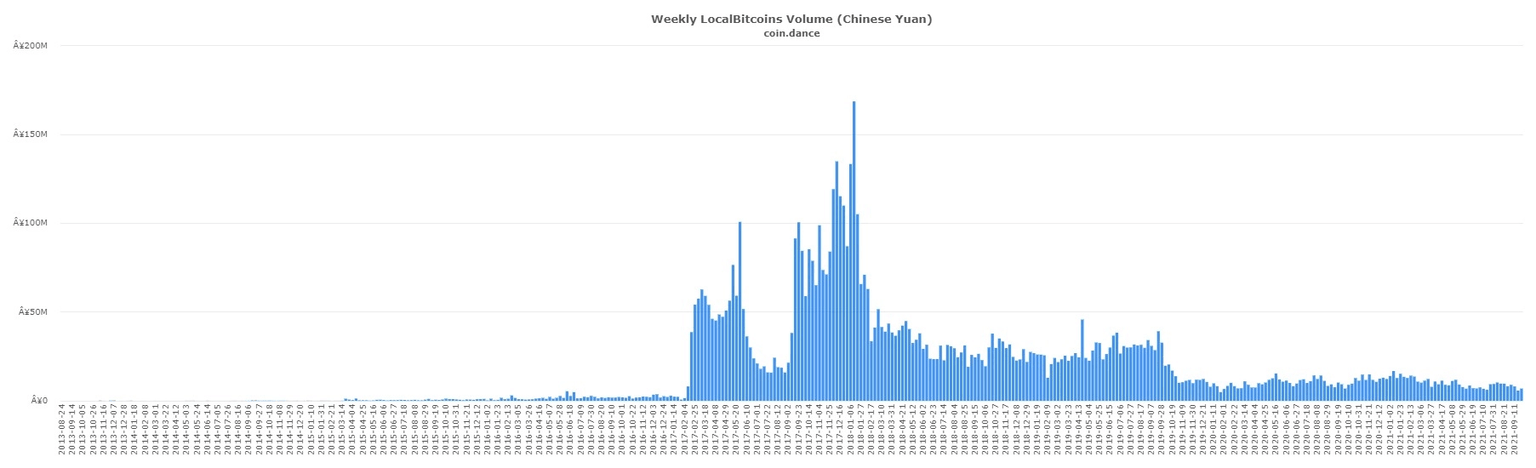

OTC trades are carried out peer-to-peer which circumvents the usage of a bank or the spot markets on centralized exchanges — though many exchanges do have related OTC desks. According to Coindance, volumes in China have been relatively stable since early 2020 with around 7 million Yuan (around $US1 million) being traded per week on P2P platform Localbitcoins.

Former CEO of China’s first crypto exchange BTCC, Bobby Lee, thinks that Beijing will target OTC desks in its next crackdown. Earlier this week, he said that OTC platforms that are operated by the big exchanges will be closed down or forced to exclude Chinese users. Speaking to Bloomberg on Sept. 29, Lee added:

“They really don't want any loopholes where people can use a digital currency as a vehicle to move assets abroad.”

He followed that up with a prediction that BTC markets are due another FOMO rally that could send prices to $200,000.

Author

Cointelegraph Team

Cointelegraph

We are privileged enough to work with the best and brightest in Bitcoin.