Chainlink Price Forecast: LINK breaks below ascending triangle

- Chainlink fell after encountering heavy resistance.

- The bears aim to take LINK down to $11.

-637336005550289133_XtraLarge.jpg)

Chainlink rose from $10.25 on November 5 to $13.45 on November 6 before dropping back to $11.75 the next day. As of writing, LINK is in a pretty precarious position that could define its price action in the days to come.

Chainlink breaks below ascending triangle

Chainlink has been trending in the 4-hour chart since November 7. LINK has been on an upswing, with the buyers aiming for the $13.45 resistance level. However, the bears managed to take control and dip the price below the triangle formation. As per technical analysis, the price target for the sellers is around $11.

LINK/USD 4-hour chart

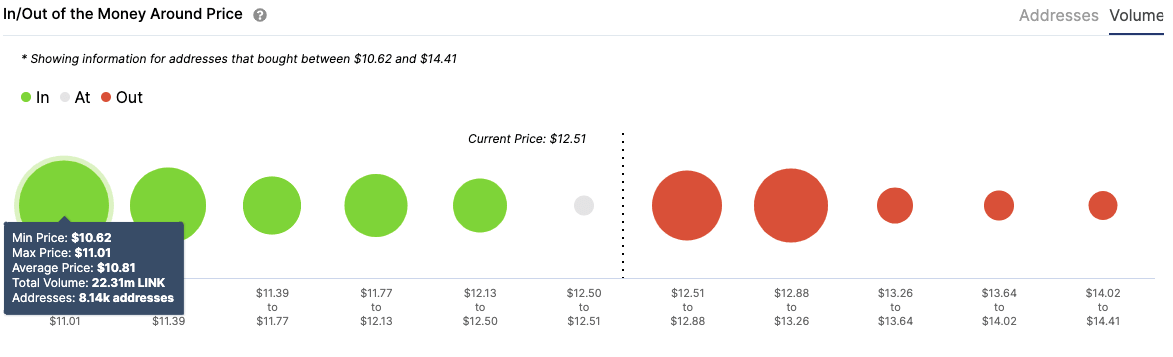

IntoTheBlock’s In/Out of the Money Around Price (IOMAP) helps us visualize strong support and resistance levels. The IOMAP shows us a strong resistance barrier between $12.50 to $13.25. On the downside, the decentralized oracle network has a healthy support wall at $11.25. A break below that takes LINK to $10.85. This validates our predetermined price target of $11.

LINK IOMAP

The number of addresses entering the network over the last month reached a high of 3,080 on November 7. Since then, this number dipped to 2,210, before rising to 2,440. This is a positive sign as it shows that the network is growing.

LINK addresses

If the buyers take back control, they will take the price up to $12.50 before encountering strong resistance. If the bears remain in control, then one can LINK to drop till the $11-mark.

Author

Rajarshi Mitra

Independent Analyst

Rajarshi entered the blockchain space in 2016. He is a blockchain researcher who has worked for Blockgeeks and has done research work for several ICOs. He gets regularly invited to give talks on the blockchain technology and cryptocurrencies.