CFTC pulls ‘actual delivery’ crypto guidance, giving flexibility to exchanges

US Commodity Futures Trading Commission Acting Chairman Caroline Pham has scrapped “outdated guidance” on the delivery of crypto, which has been applauded for offering exchanges more flexibility.

“Eliminating outdated and overly complex guidance that penalizes the crypto industry and stifles innovation is exactly what the Administration has set out to do this year,” Pham said on Thursday.

The guidance, originally finalized in March 2020, related to when the “actual delivery” of crypto happened in a commodity transaction, but the CFTC said in a notice that it had to “reevaluate such guidance in light of further developments during the past 5 years.”

The CFTC under Pham has worked on a more crypto-friendly approach, and Pham said the guidance was withdrawn on recommendations from the president’s crypto working group, which suggested the CFTC release guidance on how crypto may be considered commodities and expand on prior guidance regarding the actual delivery of virtual assets.

More flexibility for exchanges with guidance gone

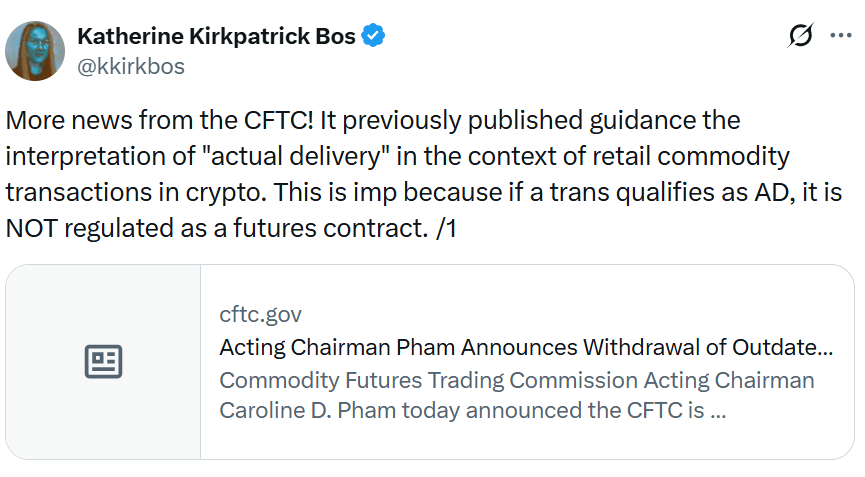

StarkWare general counsel Katherine Kirkpatrick Bos applauded the move, saying the guidance was making it harder for exchanges to offer margin or leverage unless actual delivery occurred within 28 days.

Source: Katherine Kirkpatrick Bos

“This offers way more flexibility for exchanges,” she said. “But PSA — this isn’t law! Just guidance. All of this can be changed again should leadership change.”

The CFTC can issue guidance to clarify its interpretation of legislation and give insight into how it may enforce rules in certain situations; however, it’s not generally legally binding in the same way as formal regulation.

Garry Krugljakow, the head of Bitcoin strategy at the Berlin-based Bitcoin treasury company aifinyo AG, speculated in an X post on Thursday that it’s a “major tell” of what’s to come.

“This move signals two things: cleaner jurisdiction for the CFTC and a regulatory path designed for scale, not hesitation,” he said.

“Actual delivery made sense in 2020. It doesn’t in a world of real custody, collateralization, and Bitcoin-backed credit,” Krugljakow said.

No guidance leaves uncertainty

Meanwhile, Todd Phillips, a fellow at the American think tank the Roosevelt Institute, said the definition of actual delivery is important, “as it decides what exchanges need to register with the CFTC and which don’t.”

Author

Cointelegraph Team

Cointelegraph

We are privileged enough to work with the best and brightest in Bitcoin.