Cardano sees bulls not fleeing the scene just yet as $1.00 still holds

- Cardano price keeps hovering around $1.00.

- With the RSI flatlining, global market tailwinds could be the catalyst to spark an uptrend.

- The first target is set at $1.20, holding 15% gains.

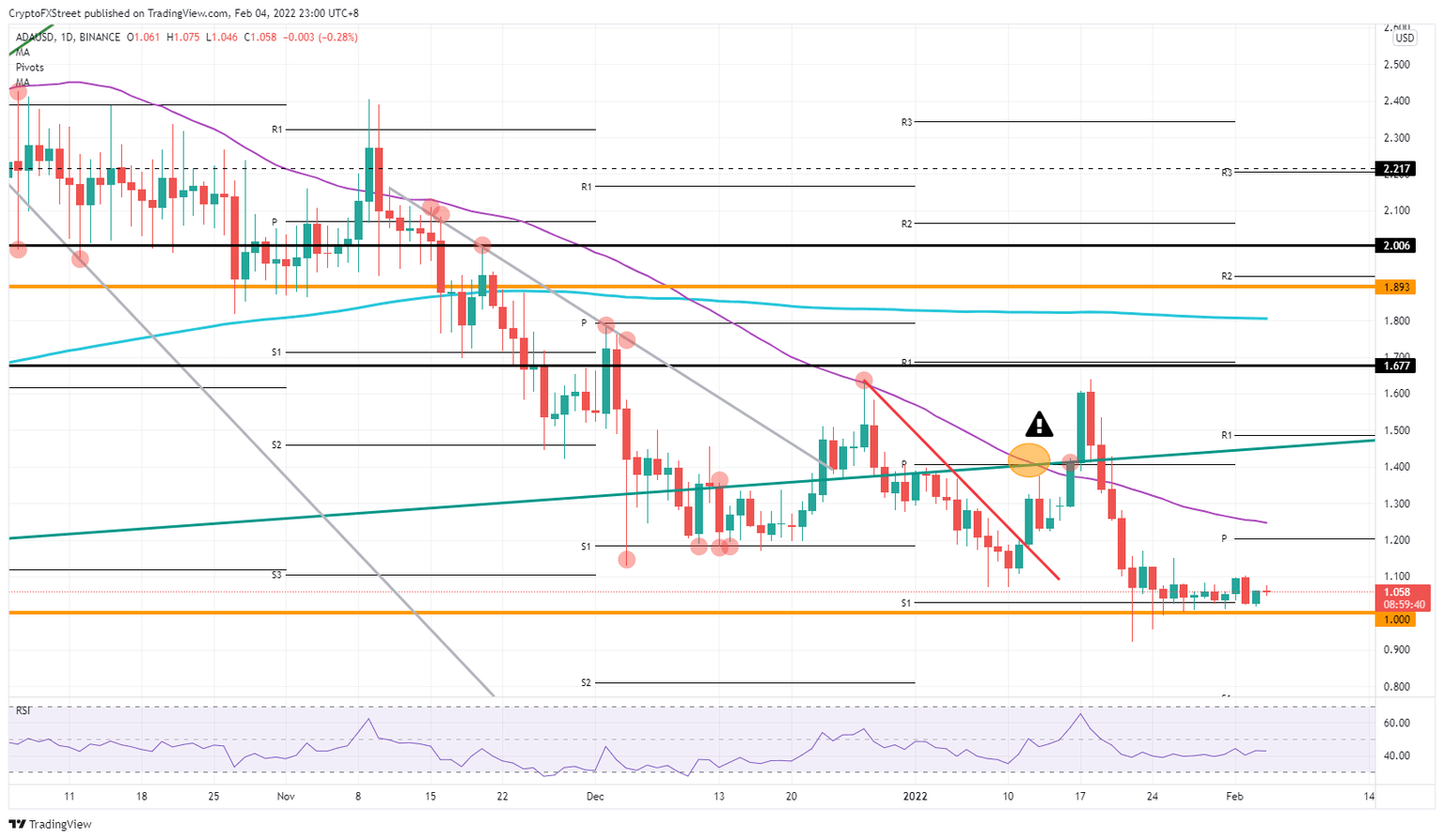

Cardano (ADA) price is staying muted as neither bulls nor bears look ready to give ground on their positions. With global markets on the front foot after Amazon earnings, this could set the scene for a bullish spillover effect, a catalyst that sparks a brief uptrend towards $1.20. At that level, bulls will find the monthly pivot and, in the process, make 15% of gains.

ADA bulls are awaiting a catalyst to spark the fire of a rally

Cardano bulls are trying to keep control of the situation, which is not easy as markets have been choppy these past few days. The first days of February already held more volatility than the whole of January. But the elements do not add up for Cardano, where both bulls and bears are at it with each other and the future direction of Cardano coins lies in the balance.

ADA bulls will want to sit on their hands and wait for the high at $1.10 to be broken. This should trigger some conviction and see bulls adding more to their positions. With that move expect price action to ramp up higher towards the monthly pivot at $1.20, where bulls will want to pause before thinking about breaking the 55-day Simple Moving Average at $1.25.

ADA/USD daily chart

On the downside, things look slightly grimmer with bulls being pushed against the $1.00 level. Reasons for this push and downside pressure could come from global market turmoil or geopolitics. Expect $1.00 to provide robust support, and if not, a short dip towards $0.90 would be the next stop down in case of a break lower.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.