Cardano Price Prediction: ADA eyes a 25% downswing if this bearish pattern confirms

- Cardano is dancing at the extreme edge of a cliff, likely to fall to price levels under $0.1.

- A buy signal could appear on the 4-hour chart in the coming sessions, thereby invalidating the bearish outlook.

Cardano is trading in the red, just like other major cryptocurrencies. The smart contract token recently slumped to $0.13 as precisely predicted. A minor recovery seems to have come into the picture but failed to gain momentum. As technical levels continue to dwindle, ADA seems poised for a further breakdown under $0.1.

Cardano likely to dump some more under $0.1

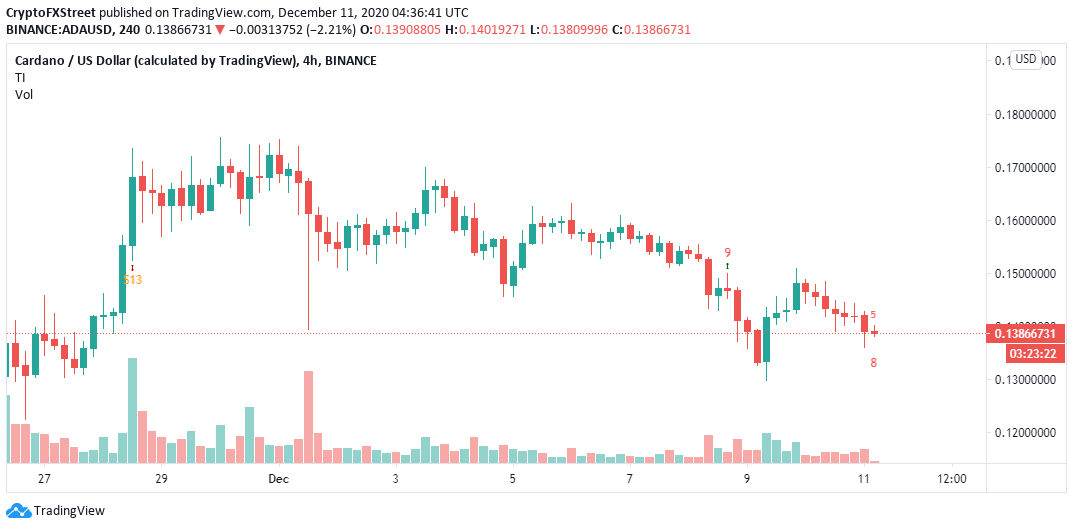

ADA is trading at $0.139 after suffering yet another rejection under the descending trendline. The same upside is also limited by the 50 Simple Moving Average and the 100 SMA on the 4-hour chart.

Marginally under the current price level, Cardano is anchored on the 200 SMA. The buyer congestion at this zone must remain intact to avert potential losses. Besides, the Relative Strength Index downward slope adds credence to the bearish narrative. Note that ADA/USD is also near the apex of a descending triangle pattern.

Descending triangle patterns are bearish and usually lead to massive losses. Traders watch out for breaks under the horizontal line connecting a series of lows. They then enter into short positions, further adding pressure on the asset. The current triangle pattern hints at a 25% downswing to levels slightly under $0.1.

ADA/USD 4-hour chart

The TD Sequential is likely to present a buy signal on the 4-hour chart, which could invalidate the technical breakdown. The call to sell will manifest in a red nine candlestick. If the bearish outlook is confirmed, Cardano could rise in one to four daily candlesticks.

ADA/USD 4-hour chart

Similarly, a bullish picture will appear if ADA holds above the 200 SMA. On the upside, a spike above the trendline could call for more buy orders, creating enough volume for a breakout to $0.18. Note that the 50 SMA and the 100 SMA could delay the recovery process.

Author

John Isige

FXStreet

John Isige is a seasoned cryptocurrency journalist and markets analyst committed to delivering high-quality, actionable insights tailored to traders, investors, and crypto enthusiasts. He enjoys deep dives into emerging Web3 tren

%2520(22)-637432589812685904.png&w=1536&q=95)