Cardano Price Prediction: ADA on the verge of a 30% move ahead of network upgrade

- Cardano team plans a hard fork in December.

- ADA is jammed between strong support and resistance.

Cardano (ADA) sits at the 8th position in the global cryptocurrency market rating. The coin hit the multi-month high at $0.194 on November 24 and has retreated to $0.153 by the time of writing. The coin has stayed mostly unchanged in the past 24 hours and lost over 5% on a week-to-week basis.

Cardano's current market capitalization is registered at $4.8 billion, while its average daily trading volumes settled at $800 million.

Cardano gets ready for a hard fork

IOHK, the development team behind Cardano blockchain, is set to launch a hard fork to introduce several essential features before transitioning to the third phase of the protocol known as "Goguen."

The fork will take place somewhere in December and enable the token-locking mechanism. It will allow users to hold tokens for a fixed period to complete a contract. Cardano team has passed two phases focused on making its protocol decentralized. The third phase is devoted to implementing new features.

ADA price stuck between a rock and a hard place

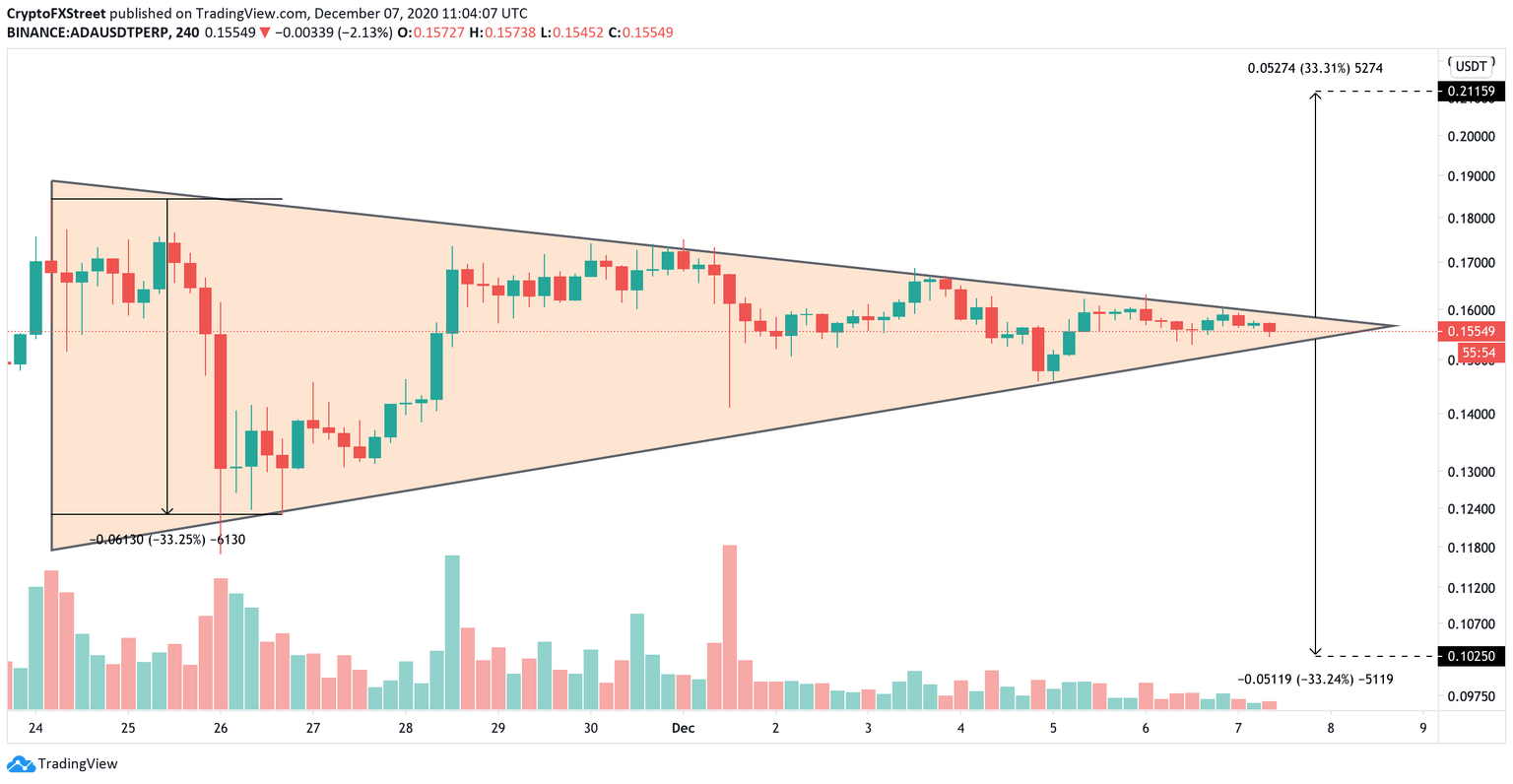

Meanwhile, ADA is stuck in a symmetrical triangle pattern that reflects the high level of market uncertainty. The eventual breakthrough will result in increased volatility and define price momentum for the nearest future.

ADA's 4-hour chart

IntoTheBlock's "In/Out of the Money Around Price" model shows that ADA sits on top of strong support. Over $38,000 Cardano addresses purchased nearly 5 billion coins between $0.145 and $0.14. This barrier coincides with the triangle support. If it is broken, the downside momentum will start snowballing and may result in a 30% sell-off with an estimated target of $0.10.

ETH In/Out of the Money Around Price

On the other hand, over 30,000 addresses purchased about 3 billion ADA tokens around $0.16. This barrier may slow down the recovery as it is also followed by another strong resistance at $0.168. Once it is cleared, the recovery will gain traction with the next target at $0.21, which is an estimated target for the triangle breakup.

Author

Tanya Abrosimova

Independent Analyst