Cardano Price Prediction: ADA eyes 25% upswing after nosedive

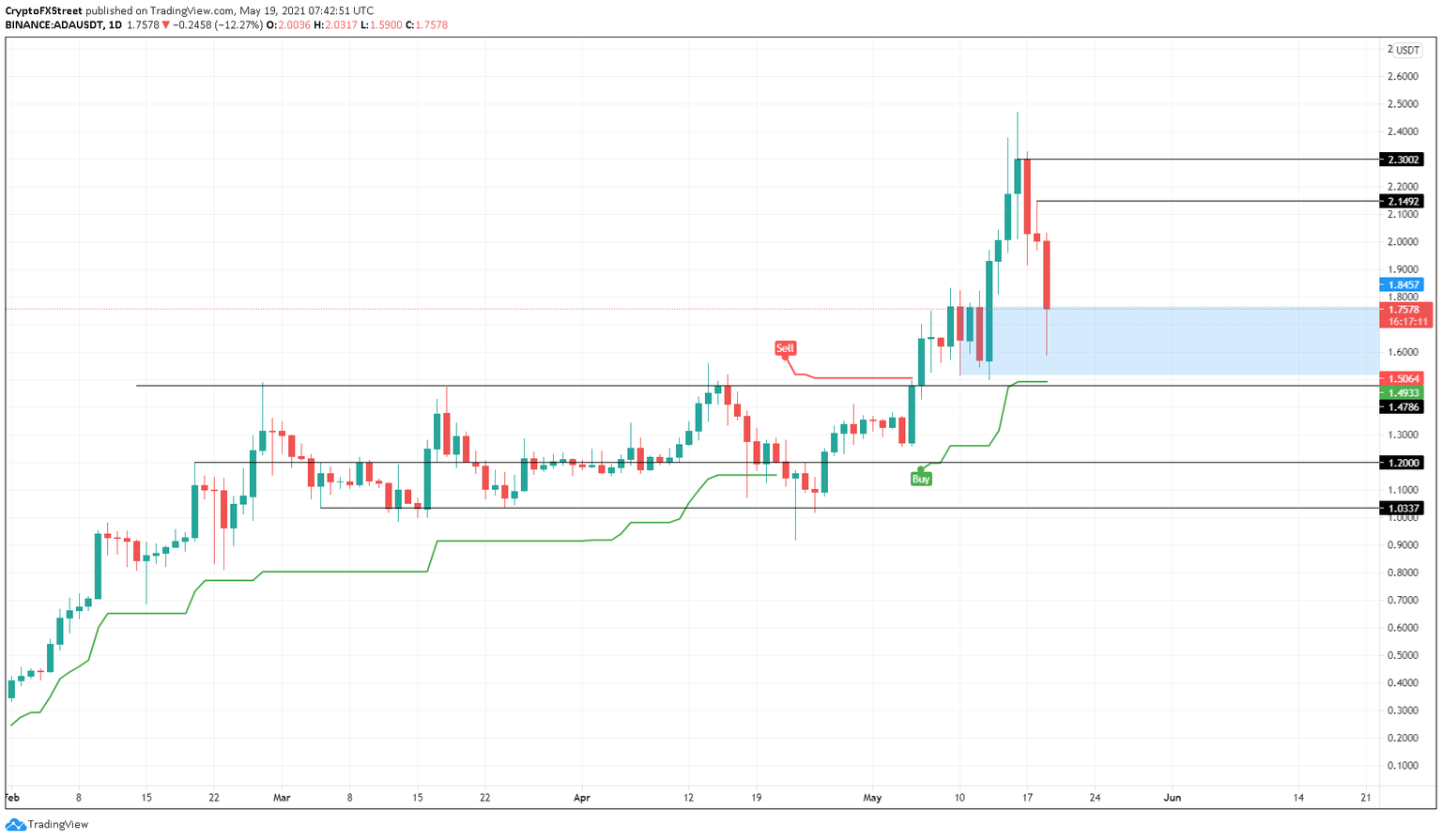

- Cardano price witnessed a 21% crash that has pierced the demand zone, extending from $1.517 to $1.766.

- A spike in buying pressure from this area could propel ADA by 25% toward the recent swing high at $2.149.

- A bearish scenario will come into play if the $1.478 support level is shattered.

Cardano price shows a decline over the three days. Today’s drop has pushed ADA into a demand zone that could trigger an upswing to old highs.

Cardano price nosedives but remains bullish

Cardano price has crashed roughly 31% over the past three days, pushing it into a demand zone that extends from $1.517 to $1.766. This area served as a temporary support level that allowed the buyers to add more to their holdings, leading to a 40% upswing in less than four days.

Therefore, reentry into this barrier will allow investors to add more to their holdings and others, who missed the initial upswing, to jump on the bandwagon this time around. This support area will likely trigger buying pressure that pushes ADA price higher by 25% from its current point ($1.717).

If the bullish momentum continues to rise, Cardano price could quickly retest $2.30 or its recent all-time high at $2.47.

ADA/USDT 1-day chart

While things seem to be down in the dumps for the so-called “Ethereum-killer,” things would get worse if ADA price drops below $1.517. This move would indicate the bearish onslaught.

However, a breakdown of $1.478 will solidify this pessimistic outlook and invalidate the bullish thesis.

Under these conditions, investors can expect Cardano price to fall 14% to $1.365.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.