Cardano Price Prediction: ADA bulls' inability could lead to a 15% drop

- Cardano price rose 47% on May 20 but faced rejection at 50 four-hour SMA at $1.96.

- ADA could continue to free fall until it tests the 200 four-hour SMA at $1.52.

- A decisive close above $1.96 will invalidate the bearish thesis.

Cardano price shows a second bearish attempt to break an uptrend as it dipped into a critical demand area. If the sell orders keep piling up, ADA is likely to retest the confluence of two crucial support levels.

Cardano price may retrace as bulls exhaust

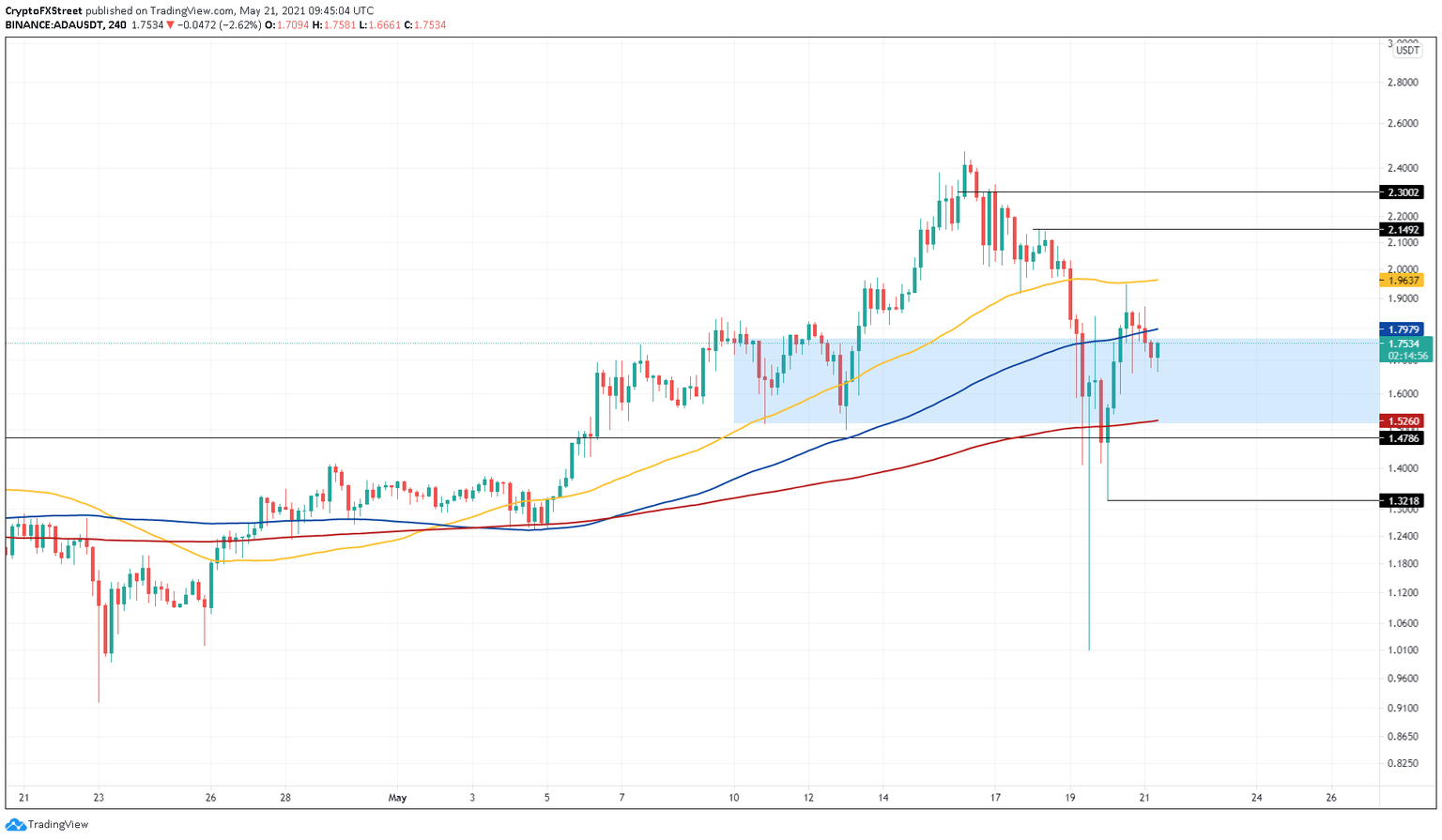

Cardano price surged 92% from its bottom on Wednesday at $1.01. However, this massive rally faced extinction as it encountered the 50 four-hour Simple Moving Average (SMA) at $1.96. Here, the bears took over ADA and pushed it down by 10.84% to where it stands at the time of writing, $1.74.

Due to the presence of the 100 four-hour SMA at $1.79, Cardano price will likely face rejection. In such a case, the so-called “Ethereum Killer” might slide 15% to tag the 200 four-hour SMA at $1.52, coinciding with the base of a demand zone that stretches from $1.76 to $1.52.

This level is a chance for the buyers to rescue ADA. However, a failure to do so will result in a retest of the support barrier at $1.47.

Although unlikely, if Cardano price slices through $1.47, it will result in a 10% sell-off to the swing low created on May 20.

ADA/USDT 4-hour chart

If the buyers manage to slice through the 50-SMA at $1.96, it would invalidate the bearish thesis and trigger more sidelined investors to jump on the bandwagon. Under these circumstances, investors can expect ADA to rally 9% to the immediate resistance level at $2.15.

Breaching this level will allow Cardano price to rise another 7% to $2.30.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.