Cardano Price Forecast: ADA gigantic liftoff to $0.35 faces the ultimate technical challenge

- Cardano skyrockets to $0.35 while the cryptocurrency market value hits a trillion dollars.

- ADA/USD is on the verge of a retreat to $0.30 following a sell signal on the 12-hour chart.

Cardano's 30% growth over the last 24 hours is commendable mainly because it has taken place amid the cryptocurrency market's hype hitting the $1 trillion mark. The flagship cryptocurrency, Bitcoin, also hit a new all-time high at $38,000 and is focused on ascending to $40,000. As for Cardano, the uptrend appears to have lost steam hence the possibility of a retreat.

Cardano's uptrend faces massive obstacles

The daily chart shows that buyers are still in control despite ADA being overbought. The Relative Strength Index is seeking balance within the oversold region after hitting pause at 85. In other words, Cardano may consolidate at the current price level, between $0.325 and $0.35, or retreat to lower levels.

ADA/USD 4-hour chart

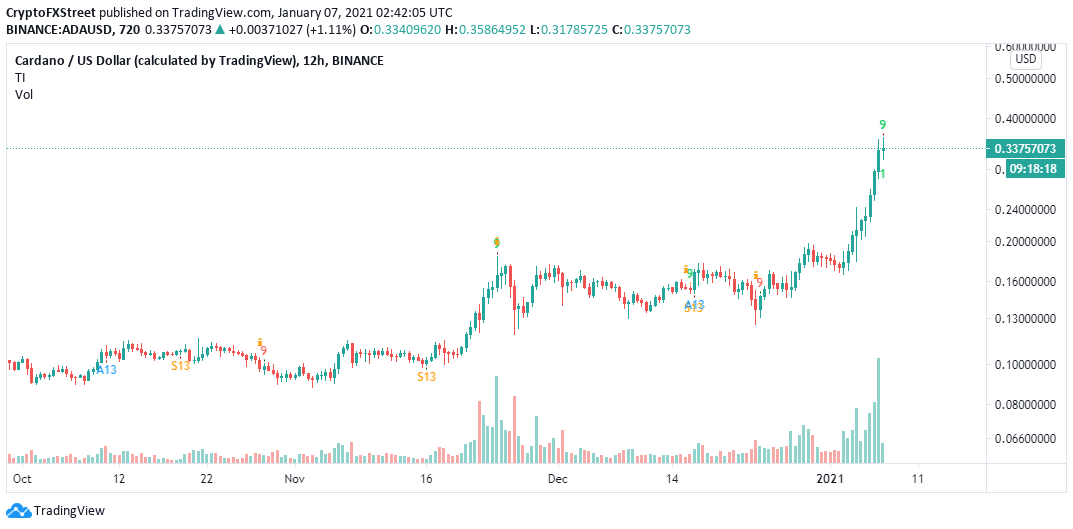

The TD Sequential indicator recently flashed a sell signal on the 12-hour chart, adding credibility to the bearish outlook. The bearish picture formed as a green nine candlestick antedating a one to four three-day candlesticks correction.

A red two candlestick trading below a preceding red one candle could confirm that Cardano is ready to drop further.

ADA/USD 12-hour chart

The IOMAP model by IntoTheBlock reveals that bears have enough room to explore in the near-term. In other words, the closest and most robust support lies between $0.29 and $0.3. Here, nearly 16,400 addresses previously purchased approximately 1.2 billion ADA.

On the upside, if buyers flip the resistance at $0.35 into support, Cardano may embark on another majestic rally aiming for highs above $0.4.

Cardano IOMAP chart

It is worth mentioning that the bearish narrative will be invalidated if the on-chain and technical resistance at $0.35 is flipped into support. Stability and upward price action above this crucial level is likely to pave the way for gains above $0.4, thus ignoring the bearish technical picture.

Author

John Isige

FXStreet

John Isige is a seasoned cryptocurrency journalist and markets analyst committed to delivering high-quality, actionable insights tailored to traders, investors, and crypto enthusiasts. He enjoys deep dives into emerging Web3 tren

%2520(26)-637455858391616505.png&w=1536&q=95)

-637455858604507838.png&w=1536&q=95)