Cardano price did what was expected, after the pressure built up on $0.46 to break

- Cardano price saw bulls clawing back gains after the sucker-punch price received on Tuesday.

- ADA price paired back losses and booked over 3% gains.

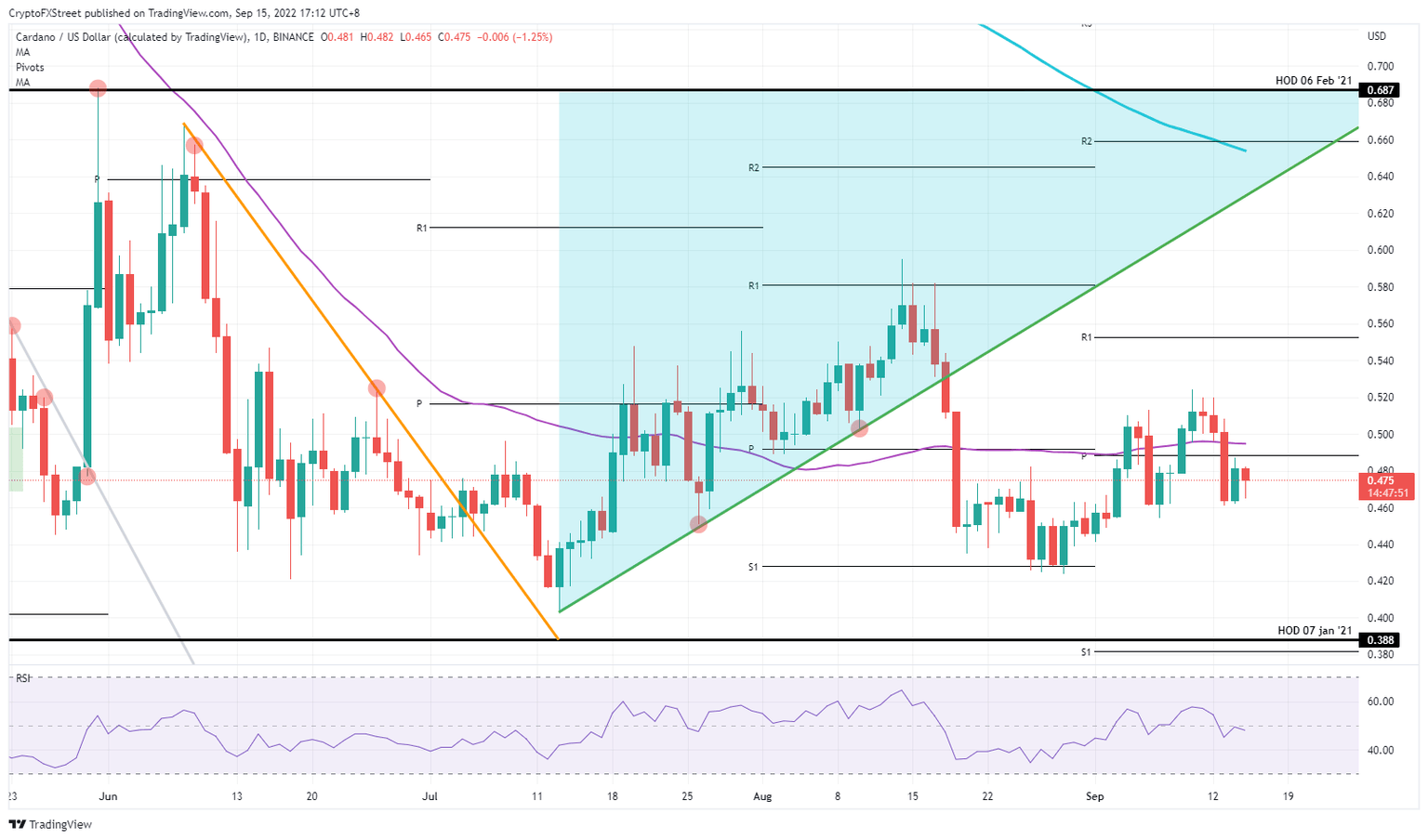

- Expect a drop back to the lower end, with pressure building on the support at $0.46 and a possible leg lower to $0.42.

Cardano price sees investors focusing on retail numbers out of the US today, as markets try to get their heads around a myriad of moving elements – from the EU measures to tackle the energy crisis, to Japan where the central bank is near to intervening in forex markets. The risk for Cardano price is that a rejection from the monthly pivot could trigger a further drop lower.

ADA price could drop 10% if the floor gives way

Cardano price is seeing traders and investors struggle with what to do with the fast-moving components rattling the markets. After the big drop on Tuesday, it was quite normal and expected to see some buying, which triggered a neat recovery, but not a full paring back of the incurred losses. Instead, price action took another leg lower this morning during the ASIA PAC session as Asian traders had difficulties with China’s easing measures, and in the meantime, the BoJ (Bank of Japan) is set to trigger a bulk market intervention to support the falling yen.

ADA price is thus likely to get caught between the monthly pivot at $0.488 and the floor at $0.460, which looks to be the bottom for this week. Risk to the downside comes with equity markets set up for another slide should retail sales remain strong. That would be perceived as a key number as it will count as confirmation that the Fed will step up its game and tighten even more, with the effect on ADA of triggering a drop to $0.4200.

ADA/USD Daily chart

Alternatively, sentiment could start to change as the US session kicks in, as equities are mildly on the front foot and could pull cryptocurrencies up along with them. Again watch out for the 55-day Simple Moving Average and the area around $0.5000 where bulls already burnt their fingers once this week, as a sharp rally would be needed to trade clear enough away from the region to see it in the rear view mirror. Rather look for a close near $0.5200 as confirmation to withstand any fades or pullbacks that might occur by Friday.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.