Cardano price could be on the verge of a breakout to $0.15, bullish metrics suggest

- Cardano price has formed an ascending triangle on the 12-hour chart.

- The digital asset is close to the upper trendline of the pattern and could see a breakout soon.

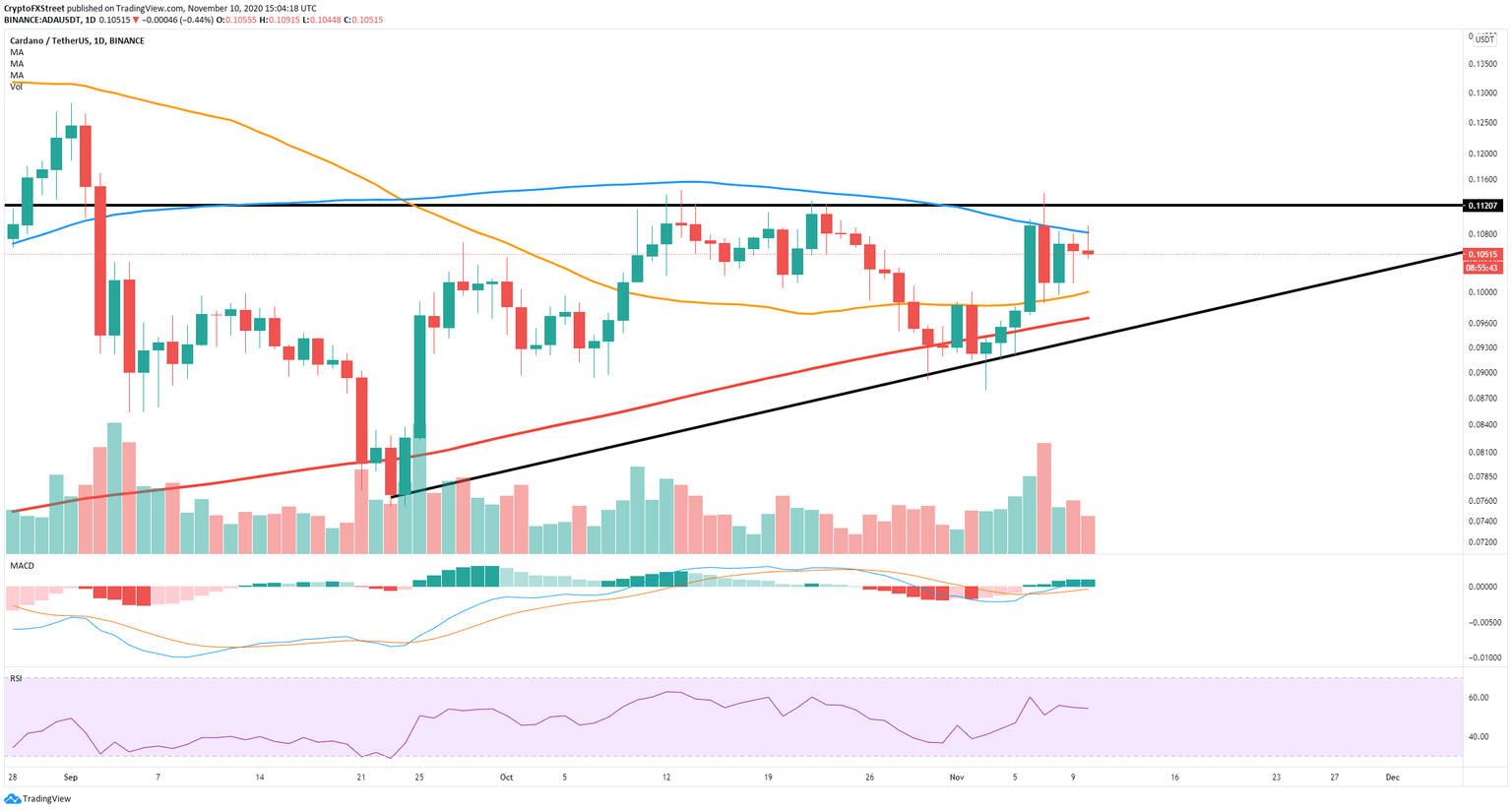

Cardano price has established a robust resistance barrier at $0.112, which is also the upper boundary of a 12-hour ascending triangle. A breakout above this point can easily drive ADA towards $0.13, but rejection would be a notable bearish sign.

Does Cardano price have enough strength to crack $0.112?

Cardano is currently trading at $0.105 and faces the 200-SMA at $0.108 as the closest resistance level on the 12-hour chart. A breakout from this point would push Cardano price towards the upper boundary of the triangle at $0.112.

ADA/USD 12-hour chart

The MACD remains bullish, and the RSI is not overextended, which means Cardano price has a real chance of breaking $0.112, targeting $0.15 as an initial price point, using the height of the ascending triangle as reference.

ADA new addresses chart

Furthermore, the number of new addresses joining the network of Cardano has increased significantly over the past week by 15%. This metric has established an uptrend since October 22, which seems to be gaining even more strength in the past seven days.

ADA/USD daily chart

Nonetheless, Cardano price has been rejected several times on the daily chart from the 100-SMA at $0.108. In the past 24 hours, the price touched $0.109 but got rejected again, which could poise downside risk for ADA. The nearest bearish price target would be the 50-SMA at $0.1, followed by the 200-SMA at $0.096 and, finally, the lower boundary of the ascending triangle at $0.095.

Author

Lorenzo Stroe

Independent Analyst

Lorenzo is an experienced Technical Analyst and Content Writer who has been working in the cryptocurrency industry since 2012. He also has a passion for trading.

-637406176263406799.png&w=1536&q=95)