Cardano price at risk of getting its third strike and losing the game

- Cardano price received two firm rejections in a row on the topside.

- ADA price is being pushed further to the downside.

- The third rejection in a row would scare bulls away and trigger another leg lower in the bear cycle.

Cardano (ADA) price is at risk of closing out the week again with a loss after the two firm rejections the price action underwent these previous weeks. The risk at hand is that Cardano will not be on the bulletin board amongst traders as a possible candidate for a bullish breakout. This could trigger a further breakdown and will be vital for the weekly close, whether it can break the rejection spell.

ADA price is at risk of dropping again below the threshold

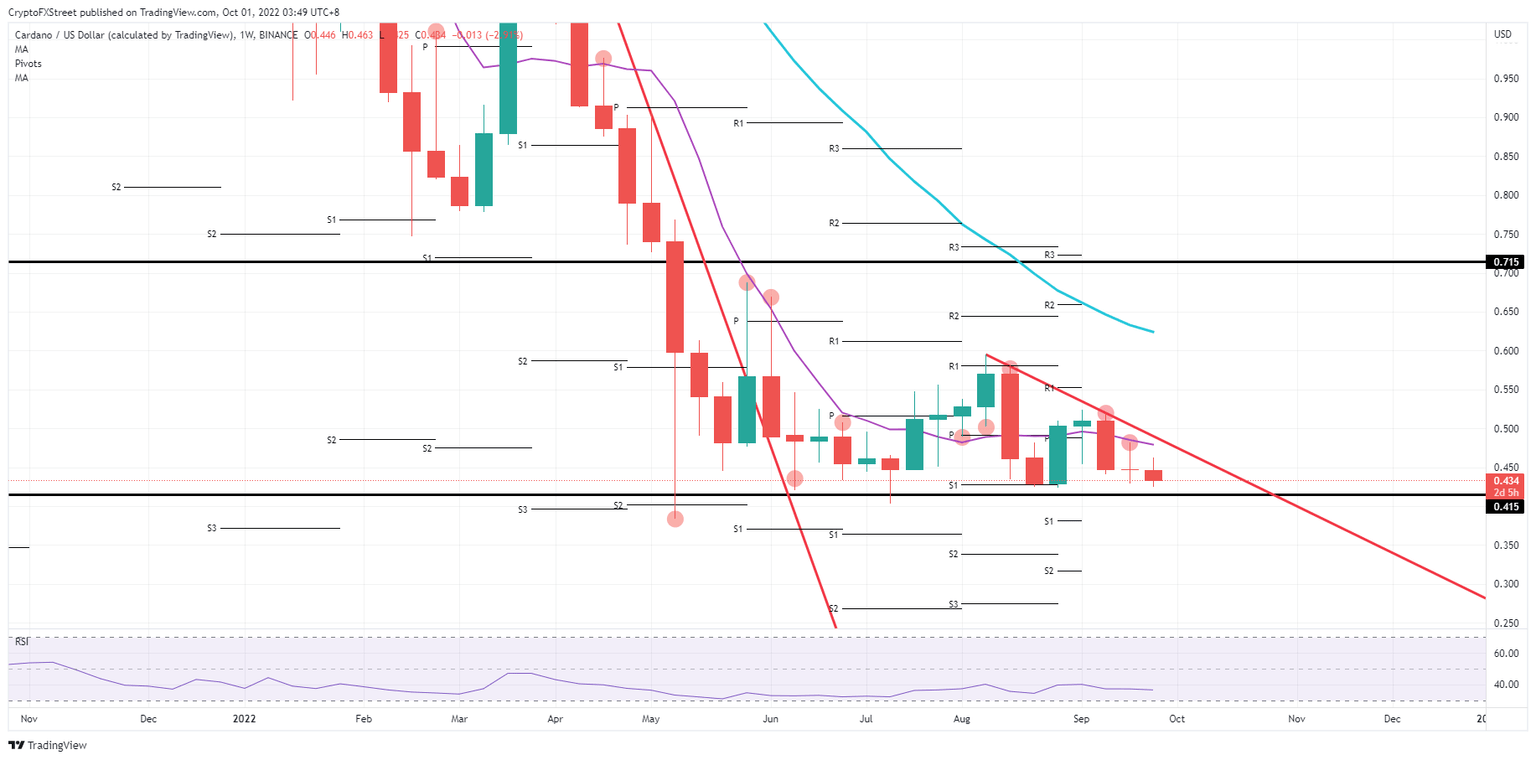

Cardano price has received a few firm rejections on the topside in its weekly performances that could trigger a further exodus of bulls out of its price action. The first strike came two weeks ago against the descending trend line and triggered a sharp decline of over 12%. Last week was good for strike two with bulls trying to break back above that same trend line, but this time got stopped short in its tracks even before it, with the 55-day Simple Moving Average (SMA).

ADA price, thus making up its mind whether it will close above the red descending trend line or add another leg lower to its bear cycle. The low for 2022 is at $0.385 and could be revisited should another rejection trigger a selloff to the downside. Seeing the current market turmoil from this week and the next step in escalation between Europe and Russia, no real incentives are there to boot-start a sharp rally higher.

ADA/USD Weekly chart

Over the weekend, traders can let the dust settle about the eventful week and could already see some prepositioning for a rally into Sunday and in the Asian opening session on Monday. Expect a breakout above the red descending tren line and a close above $0.500 on Sunday night. Expect a small fade to the red descending trend line and a bounce off that line towards $0.584.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.