Cardano inches closer to major price collapse below $1.25

- Cardano price approaches new four-month lows.

- Cardano Relative Strength Index enters bear market conditions.

- Sub-$1.00 conditions are becoming a reality.

Cardano price continues to face weakness against a broader financial market that is increasingly risk-averse. Price action had already been lagging the broader market leaders, but the outlook for a bullish return has slowly retreated.

Cardano price is now under threat of a 30% drop that could exceed below $1.00

Cardano price action has slipped by more than 6% today, in tandem with the broader cryptocurrency market. While not directly related to the cryptocurrency market, the news that China's (and one of the world's) largest real estate companies has officially defaulted has put pressure on risk-on assets – assets that have already been under considerable uncertainty.

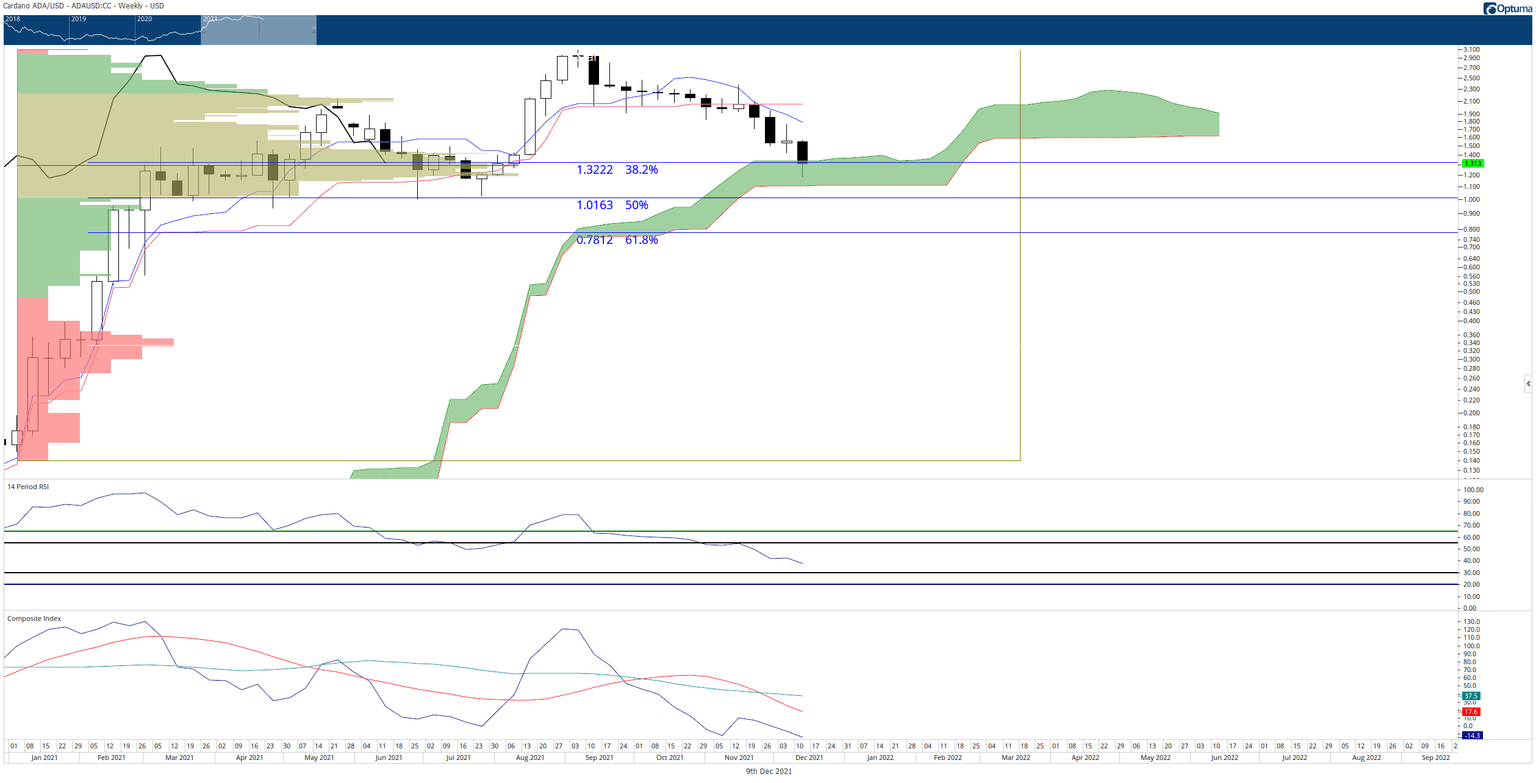

The most substantial combined level of support for Cardano is the $1.33 value area where the 2021 Volume Point Of Control and top of the weekly Cloud exist. Therefore, failure to hold the $1.33 zone would position Cardano at its final primary support level.

Cardano's final support line exists in the price range between $1.04 and $1.10. Senkou Span B, the 50% Fibonacci retracement, and the final thick zone of the volume profile are all that stand in the way of a flash crash down to the $0.40 to $0.50 value area.

Cardano price will fulfill all the requirements for an Ideal Bearish Ichimoku Breakout entry if the weekly or daily candlestick close below $1.07. If that occurs, there is no weekly support within the Ichimoku Kinko Hyo system until the Chikou Span tests the top of the Cloud at $0.13.

ADA/USD Weekly Ichimoku Chart

If buyers are to save Cardano from a violent capitulation move, then holding the $1.33 level won't suffice. Instead, buyers will need to step in and push Cardano to at least a hair above the weekly Tenkan-Sen at $1.81.

Author

Jonathan Morgan

Independent Analyst

Jonathan has been working as an Independent future, forex, and cryptocurrency trader and analyst for 8 years. He also has been writing for the past 5 years.