Canary Capital follows Bitwise in filing for spot XRP ETF

Crypto investment firm Canary Capital has filed to create a spot XRP exchange-traded fund (ETF), the second issuer to bid for an XRP fund in the last seven days.

In an Oct. 8 filing with the Securities and Exchange Commission, Canary Capital said its ETF would give investors access to the XRP (XRP $0.5324) market “through a traditional brokerage account without the potential barriers to entry or risks involved with acquiring and holding XRP directly.”

Canary said its XRP ETF would track XRP’s price using the Chicago Mercantile Exchange (CME) CF Ripple index — a real-time price benchmark product.

The Canary XRP ETF will provide investors with exposure to XRP. Source: SEC

The fund would avoid using any derivatives products in tracking the value of XRP, saying that this could subject their product to “additional counterparty and credit risks.”

[Canary Capital] believes that the design of the Trust will enable certain investors to more effectively and efficiently implement strategic and tactical asset allocation strategies that use XRP by investing in the Shares rather than purchasing, holding, and trading XRP directly.

Canary Capital did not disclose who the custodian of the XRP ETF would be, nor did they clarify what ticker the fund would be listed under.

Canary Capital’s move to file for an XRP ETF comes seven days after crypto asset manager Bitwise filed for an XRP fund with the SEC on Oct. 2.

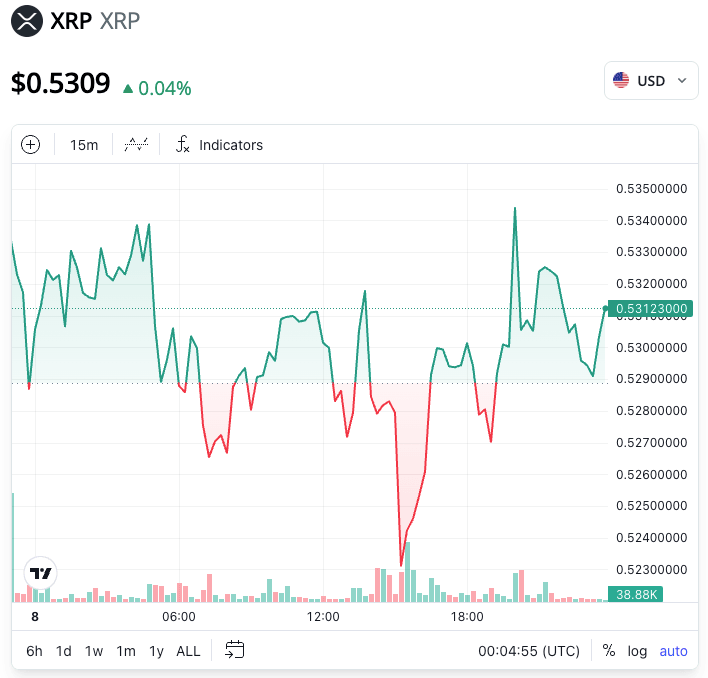

XRP is currently trading for $0.53, up 0.4% on the day and trading flat on the week.

XRP is up 0.4% on the day following the second application for an XRP ETF. Source: Cointelegraph

If Canary Capital’s or Bitwise’s applications are approved by the SEC, it would be the first spot XRP fund to be approved by the regulator.

However, there are likely significant barriers to approval, including the SEC’s appeal of its lawsuit against XRP issuer Ripple, where the regulator claims the token is an unregistered security and accused the company of raising $1.3 billion through offering XRP.

Author

Cointelegraph Team

Cointelegraph

We are privileged enough to work with the best and brightest in Bitcoin.