Buterin tips distributed validators to simplify Ethereum staking

Ethereum co-founder Vitalik Buterin has proposed adding distributed validator technology (DVT) to the blockchain’s staking mechanism, arguing it could simplify the process and the technology backing it.

Buterin pitched “native DVT” in a post to the Ethereum Research forum on Wednesday, which he said would allow Ether stakers “to stake without fully relying on one single node.”

Currently, Ethereum validators can only run one node to work to secure the blockchain, which can incur penalties if it goes down.

Using DVT would mean a validator could use their key across several nodes to help the network, reducing the chances of penalties.

“The key is secret-shared across a few nodes, and all signatures are threshold signed,” he explained, adding the node is “guaranteed to work correctly” as long as more than two out of three of them “are honest.”

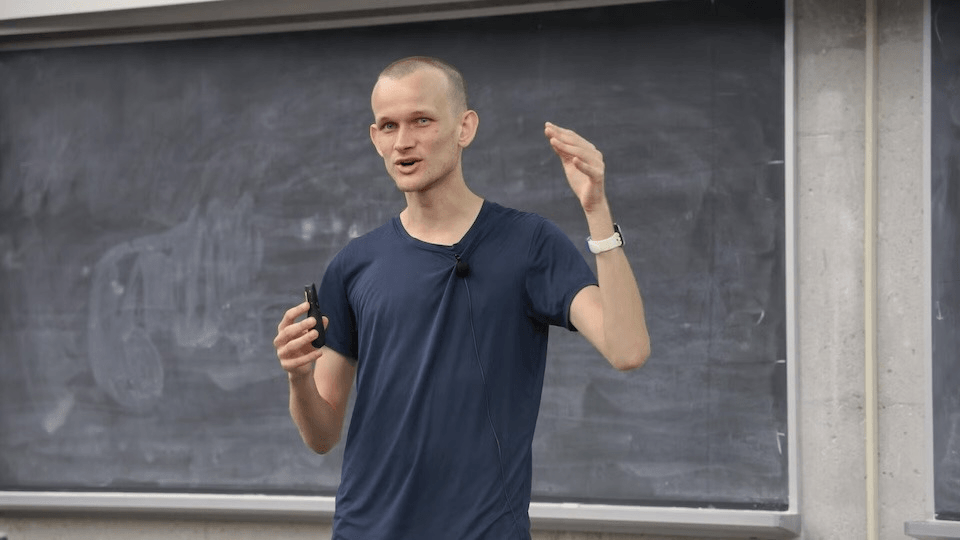

Vitalik Buterin making a point about distributed validator technology at an event in 2024. Source: University of Waterloo

Buterin said that several protocols use DVT, which he noted “do not do full-on consensus inside each validator, so they offer slightly worse guarantees, but they are quite a bit simpler.”

DVT should be implemented in protocol: Buterin

Buterin said that while DVT solutions require complicated setups, he pitched a “surprisingly simple alternative: we enshrine DVT into the protocol.”

Buterin’s design involved a validator being allowed to create a maximum of 16 keys, or “virtual identities,” that act independently but are considered as one by the blockchain.

This so-called “group identity,” Buterin said, is treated as taking an action, like making a block, only if a minimum number of the “virtual identities” signed off on it and are rewarded or penalized based on the actions of the majority.

“This design is extremely simple from the perspective of a user,” he said, as DVT staking becomes running copies of a standard client node.

Buterin added that it would also help security-conscious stakers with significant amounts of ETH to stake in a more secure setup instead of relying on a single node. Stakers could more easily stake their own tokens instead of using a provider, increasing the decentralization of staking.

Buterin’s proposal comes as the co-founder has floated other ideas to make Ethereum easier to use, and his latest pitch requires more debate before it can be added to the network.

Author

Cointelegraph Team

Cointelegraph

We are privileged enough to work with the best and brightest in Bitcoin.