BTC/USD outlook: Overbought studies suggest that limited correction would precede fresh push higher

BTC/USD

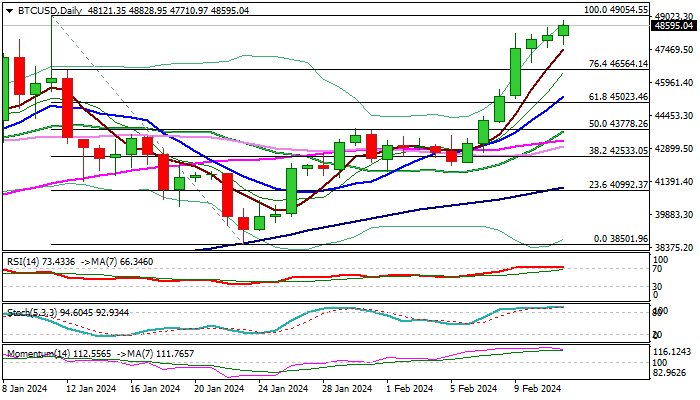

Bitcoin keeps firm tone and holds near one-month high on Monday, after advancing 12.5% last week (the biggest weekly gains since mid-Oct 2021) however, narrower ranges in past three days suggest that bulls might be running out of steam on approach to key barrier at 49054 (Jan 11 peak, the highest since late Dec 2021).

Overbought conditions and fading bullish momentum on daily chart contribute to initial warning of stall and may spark partial profit-taking.

However, overall firm bullish stance (as 49054/38501 corrective phase has been almost fully retraced) suggests that dips should be limited and offer better levels to re-enter bullish market for sustained break of 49054 pivot and acceleration towards psychological 50000 barrier.

Broken Fibo 76.4% barrier (46564) reverted to solid support which should ideally contain corrective dips and keep larger bullish structure intact.

Res: 48828; 49054; 49500; 50000.

Sup: 47515; 46882; 46564; 45300.

Author

Slobodan Drvenica

Windsor Brokers

Industry veteran with over 22 years’ experience, Slobodan Drvenica joined Windsor Brokers in 1995 when he was an active trader for more than 10 years, managing the trading desk and own account departments.