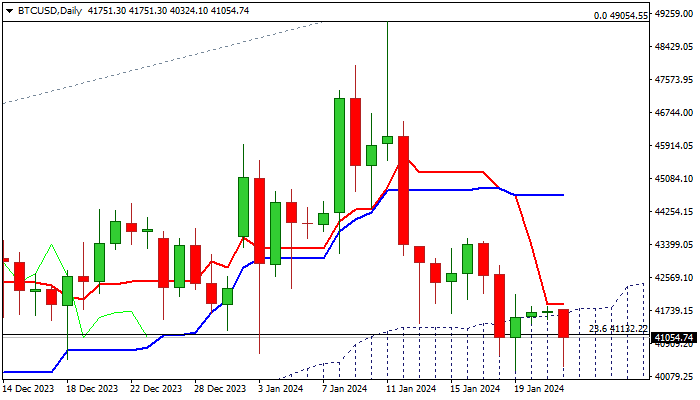

BTC/USD outlook: Key supports at 40000 zone under increased pressure

Bitcoin

Bitcoin lost ground on Monday and fell over 3%, reversing the most of a mild recovery in past three days.

Fresh weakness increases pressure on critical 40000 zone (short-term range floor/daily cloud base), loss of which would generate strong reversal signal and open way for deeper correction of a larger uptrend from Nov 2022 low (15437).

Bears came to play after strong upside rejection at 49000 zone and a bull-trap at 48484 Fibo barrier and regained full control after two consecutive weeks of losses.

Also, strong bearish signal is developing on monthly chart, as bitcoin is on track to register a monthly loss after four months of continuous gains and leave bearish monthly candle stick with long upper shadow.

Technical structure on daily chart is weakening as daily Tenkan-sen and Kijun-sen are diverging after forming a bear-cross and south-heading 14-d momentum is falling deep into negative territory.

However, bears are expected to face very strong headwinds as 40000 support zone is very significant, which may keep the price in prolonged sideways mode.

Immediate downside risk, however, is expected to remain while the action is capped by daily Tenkan-sen (41890), with extended upticks to stall under 43600 zone (Jan 16/17 lower platform / Fibo 38.2% of 49054/40224 downleg) to keep bears in play and offer better selling opportunities.

Res: 41890; 42146; 42308; 42874.

Sup: 40324; 40224; 40000; 39427.

Author

Slobodan Drvenica

Windsor Brokers

Industry veteran with over 22 years’ experience, Slobodan Drvenica joined Windsor Brokers in 1995 when he was an active trader for more than 10 years, managing the trading desk and own account departments.