BTC/USD appears poised for further outperformance

It was another positive week for BTC/USD, which was up +1.9% as of London’s close on Friday despite finishing considerably off its best levels.

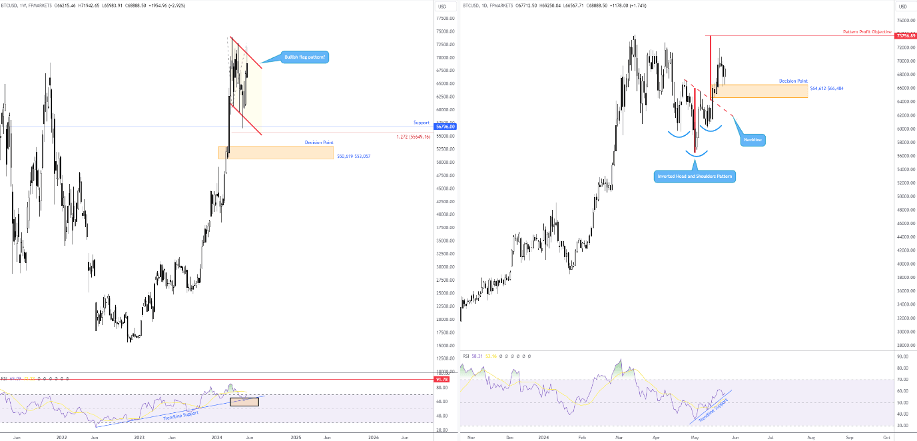

Price movement on the weekly timeframe has been working between the limits of a potential bullish flag pattern since forming the all-time high of $73,845 in March. Even though the unit faded the upper edge of the aforementioned pattern last week, the daily timeframe suggests there is scope to navigate higher terrain.

All-time highs in reach

The Research Team recently communicated that BTC/USD bulls had made a comeback since forming a low of $56,478 and completed a daily inverted head and shoulders pattern (left shoulder: $59,559; head: $56,478; right shoulder: $60,165). The advance sent the unit through the pattern’s neckline, a descending line extended from the high of $67,273, and permitted traders to pencil in the pattern’s profit objective – taken from the value between the head and the neckline and extended from the breakout point – which shares chart space with the all-time high of $73,845 at $73,756.

Bolstering the possibility of challenging all-time highs this week, the Relative Strength Index (RSI) rebounded from trendline support (taken from the low of 23.71) on the weekly chart and the daily chart’s RSI is treading water ahead of trendline support, extended from the low of 35.47. The RSI also remains above the 50.00 centreline on both charts (positive momentum).

Direction this week?

A daily decision point area at $64,612-$66,484 held ground in the second half of last week, and price has room to move higher this week towards the all-time highs/inverted head and shoulders take-profit objective at around $73,840ish. This, of course, also highlights a possible breakout above the weekly chart’s bullish flag pattern structure.

Author

Aaron Hill

FP Markets

After completing his Bachelor’s degree in English and Creative Writing in the UK, and subsequently spending a handful of years teaching English as a foreign language teacher around Asia, Aaron was introduced to financial trading,