BNB Price Analysis: Binance Coin develops hiccup on Monday as traders shrug off Fed comments

- Binance Coin price jumps over 1% as bulls regain control.

- BNB dips lower after gut-punch comments from two Fed officials.

- Markets ignore the warnings and focus on end of US Fed hiking cycle.

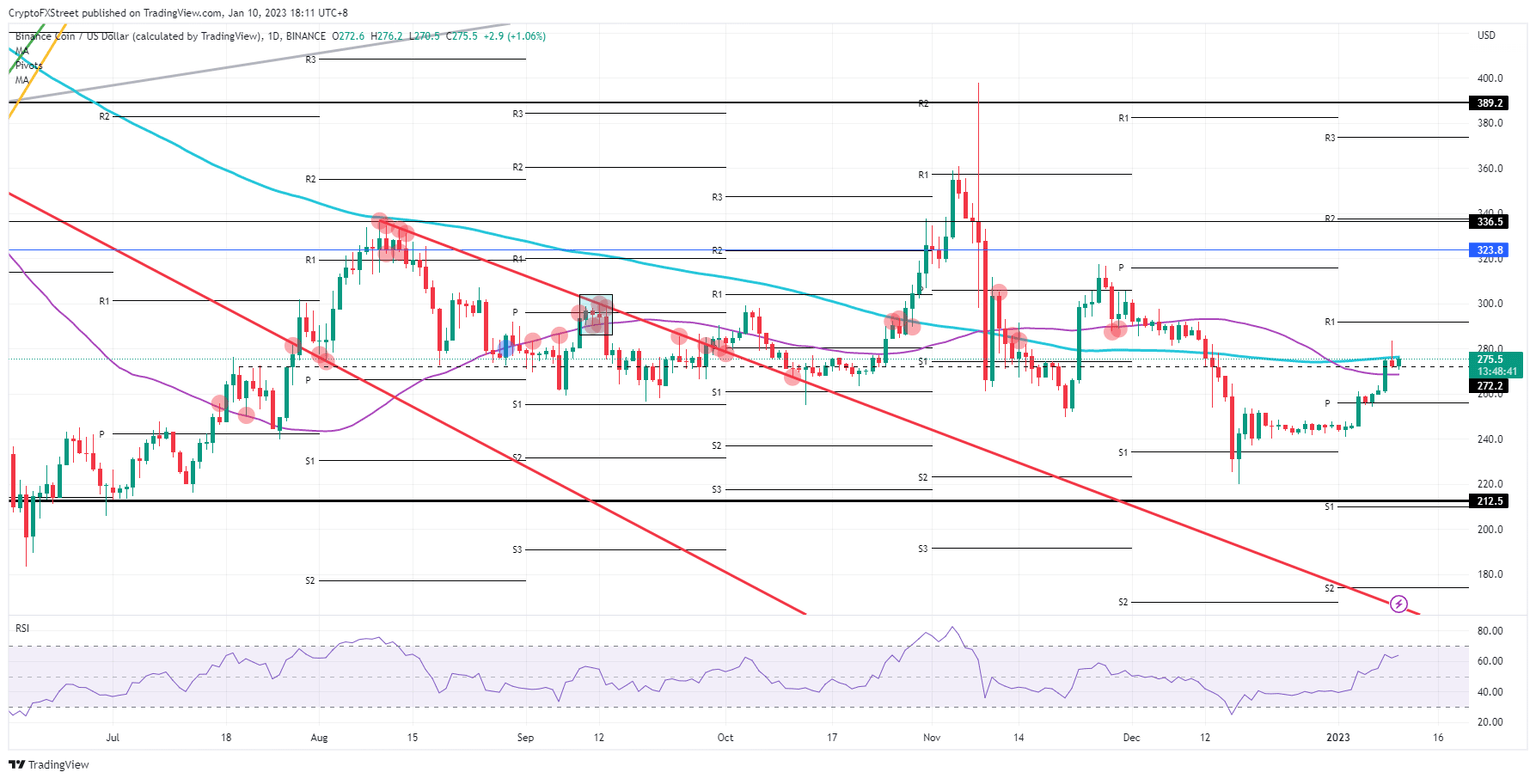

Binance Coin (BNB) price is in a very difficult spot on the chart as price action is caught between the 55-day and the 200-day Simple Moving Average (SMA). Price action tanked in late US session hours on Monday after Federal Reserve members Daly and Bostic warned of broken dreams for traders as they surmise the Fed is nowhere near the end of its hiking cycle. As the dust settles, traders zoomed in on the fact that both are non-voters and thus are now disregarding their warnings. This has led to a a pop higher for BNB and possible break above the 200-day SMA, with a firm target at $300.

BNB price soon to hit $300 if inflation lull gets confirmed

Binance Coin price had a very productive weekend as it was able to pierce through the 55-day SMA and even tested the 200-day SMA but got rejected on that last one. With price action opening on Monday on the higher end of the price fork between the two important technical moving averages, chances look good for another breakdown of the cap element. However, Fed members Daly and Bostic threw a spanner in the works by mentioning that the central bank is nowhere near done with its hiking cycle and they expect more pain to come.

BNB bulls are disregarding the warnings as both members are non-voters in the coming FOMC meeting where interest rate decisions get decided. Meanwhile, equities are paring back the incurred losses and are flirting with green numbers during the European session. This week, $300 should be in the cards with a break above the 200-day SMA and the monthly R1 resistance level, which would mean printing over a 10% weekly gain.

BNB/USD daily chart

Should another close occur this evening below the 200-day SMA, however, bulls could start doubting whether the rally still has any legs or room to move further up. A fade would get underway with pressure on the 55-day SMA that would see a breakdown sub-$200 in search of support. That support would come from the monthly pivot near $256.50, which has already shown its support and relevance in the first trading days of the year.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.