BNB holds steady as Nano Labs acquires 74K BNB for $50 million

- Nano Labs announced it acquired 74,315 BNB for $50 million on Thursday.

- The purchase boosts its digital asset reserve, which comprises Bitcoin and BNB, to $160 million.

- BNB eyes a move above $660 following the announcement.

BNB held steady near $660 on Thursday after Nano Labs revealed it purchased 74,315 BNB for approximately $50 million, boosting its treasury reserve — which includes Bitcoin — to $160 million.

Nano Labs establishes $50 million BNB treasury

Nasdaq-listed Nano Labs (NA) announced that it has acquired 74,315 BNB for $50 million, officially incorporating the cryptocurrency into its digital asset treasury portfolio.

The purchase was made at an average price of $672.45 in an over-the-counter (OTC) transaction. Nano Labs now holds $160 million in its digital asset treasury, which comprises Bitcoin and BNB.

Nano Labs' BNB acquisition comes after the company expressed plans to establish a $1 billion BNB treasury, following a $500 million private placement and convertible notes offering in June. The company intends to hold between 5% and 10% of BNB's total circulating supply in the long run.

BNB is the native token of the Binance Smart Chain and is the fifth-largest cryptocurrency by market capitalization.

Nano Labs isn't the only company establishing a BNB treasury. Former Coral Capital executives Patrick Horsman, Joshua Kruger, and Johnathan Pasch are also leading an initiative to raise $100 million for a BNB treasury through a Nasdaq-listed company, which they plan to rename Build & Build Corporation.

The move to establish a BNB treasury comes as more companies are looking to launch altcoin-focused treasury reserves, mirroring Strategy's (MSTR) Bitcoin playbook. Since the beginning of the year, several publicly listed companies have launched crypto treasuries focused on Ethereum (ETH), Solana (SOL) and Hyperliquid (HYPE).

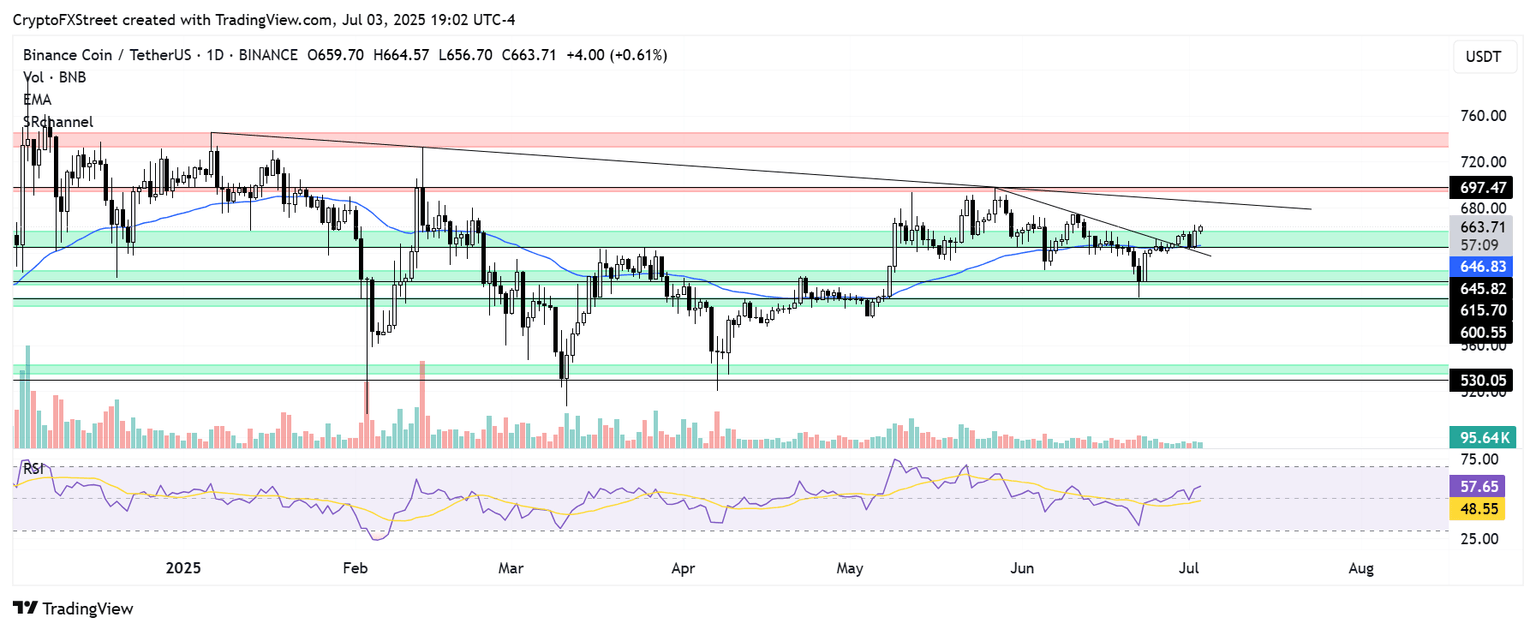

Following the announcement, BNB held the support at $645, strengthened by the 50-day Exponential Moving Average (EMA), and is looking to move above $660. If BNB leaps out of this range, it could test a descending trendline resistance near $680. However, a decline below the $645 support could send its price toward $615.

BNB/USDT daily chart

The Relative Strength Index (RSI) is slightly above its neutral level, indicating a modestly dominant bullish momentum.

Author

Michael Ebiekutan

FXStreet

With a deep passion for web3 technology, he's collaborated with industry-leading brands like Mara, ITAK, and FXStreet in delivering groundbreaking reports on web3's transformative potential across diverse sectors. In addi