BlackRock Bitcoin ETF earns more than its flagship S&P 500 fund

BlackRock, the world’s largest asset manager, is now earning more in annual fees from its spot Bitcoin exchange-traded fund than its flagship S&P 500 fund, according to a recent report.

“IBIT overtaking IVV in annual fee revenue is reflective of both the surging investor demand for Bitcoin and the significant fee compression in core equity exposure,” NovaDius Wealth Management president Nate Geraci told Bloomberg on Wednesday.

Bitcoin has now captured Wall Street’s "undivided attention"

With an expense ratio of 0.25% and around $75 billion in assets under management (AUM), BlackRock’s iShares Bitcoin (BTC $109,373) ETF (IBIT) has generated $187.2 million in annual fees, approximately $100,000 more than its iShares Core S&P 500 ETF (IVV).

The IVV, which launched in 2000, is over eight times larger than the IBIT, with approximately $624 billion in assets, but charges almost nine times less, at just 0.03%.

Several crypto executives were quick to comment on the findings. Crypto entrepreneur Anthony Pompliano said in an X post, “Bitcoin has Wall Street’s full, undivided attention now.” Strive Funds chief financial officer Ben Pham said Bitcoin will be “the death” of active management and passive indexation portfolios.

Source: Rezo

Crypto trader Cade O’Neill said it “says everything about where capital is headed. Institutions aren’t just curious anymore, they’re committed.”

Meanwhile, McKay Research founder James McKay said the news was bullish and “Probably something.”

Since its January 2024 launch, BlackRock’s IBIT has recorded $52.4 billion in inflows, the highest of any US spot Bitcoin ETF, according to Farside data.

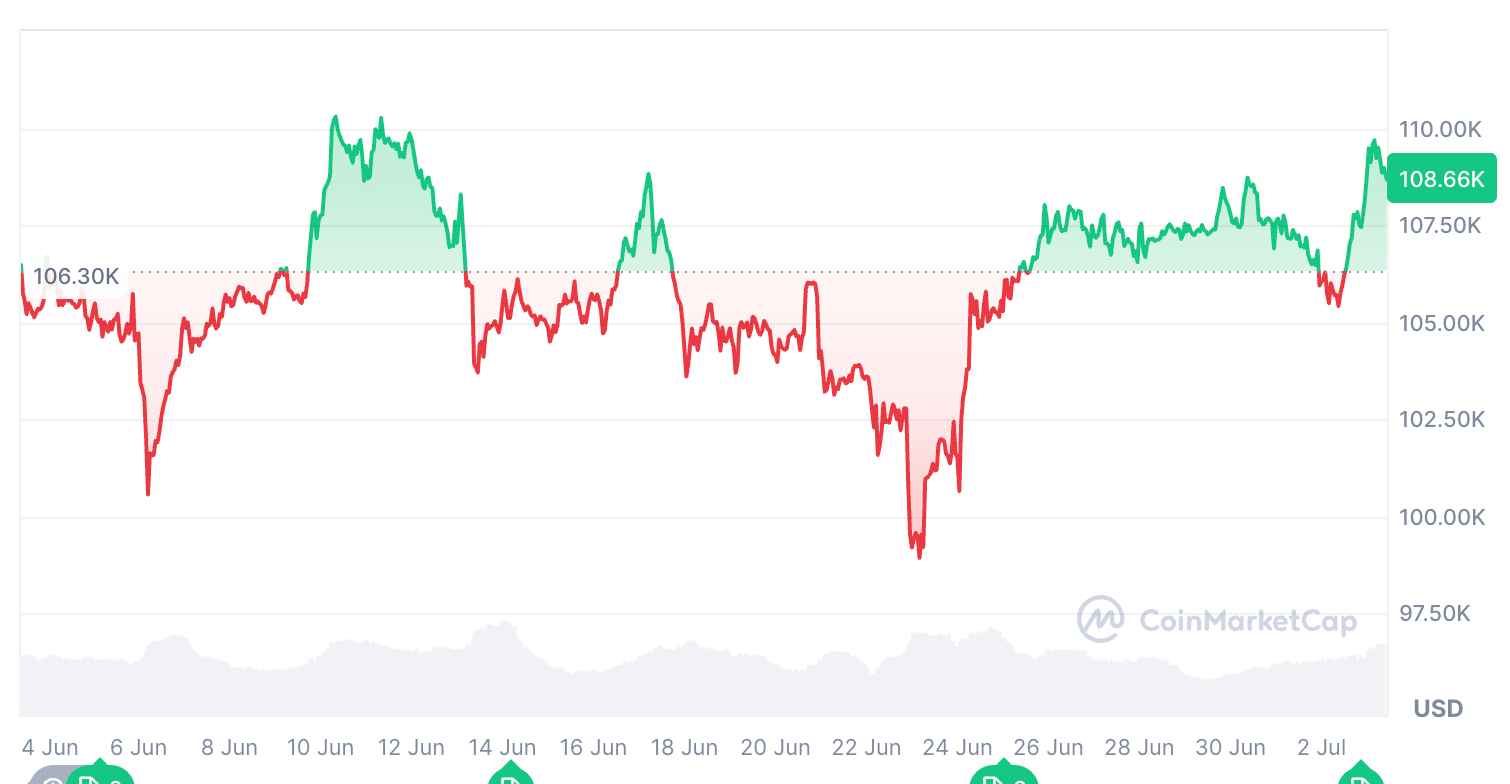

Bitcoin is up 2.37% over the past 30 days. Source: CoinMarketCap

The IBIT closed the trading day on Wednesday at $62.41, up 4.31% across the day, according to Google Finance data. The uptick comes as Bitcoin’s price spiked 2.82% over the same period, which is now trading at $108,660.

Meanwhile, the IVV closed the day at $623.42, up 0.44% over the day.

US-based spot Bitcoin ETFs marked their first net outflow day on Wednesday after 15 consecutive trading days of inflows.

Author

Cointelegraph Team

Cointelegraph

We are privileged enough to work with the best and brightest in Bitcoin.