Bitcoin targets $60,000 next as BTC enters new leg up in bull market

- Bitcoin has been on a tear this week, hand-in-hand with Shiba Inu.

- With a 14% rally, price action in BTC still has some room left to go higher.

- The next price target to the upside for bulls is the high from late May near $60,000.

Bitcoin (BTC) price has been on a solid rally with a very technically built bull run. Buyers stepped in each time on crucial technical levels this week, making it a textbook example of how to trade a rally. Bulls are not done yet as there is still some fuel in the tank, and with global markets acting as additional motivation, the next target will be $60,000.

Bitcoin price bull run nowhere near end as new buyers join rally

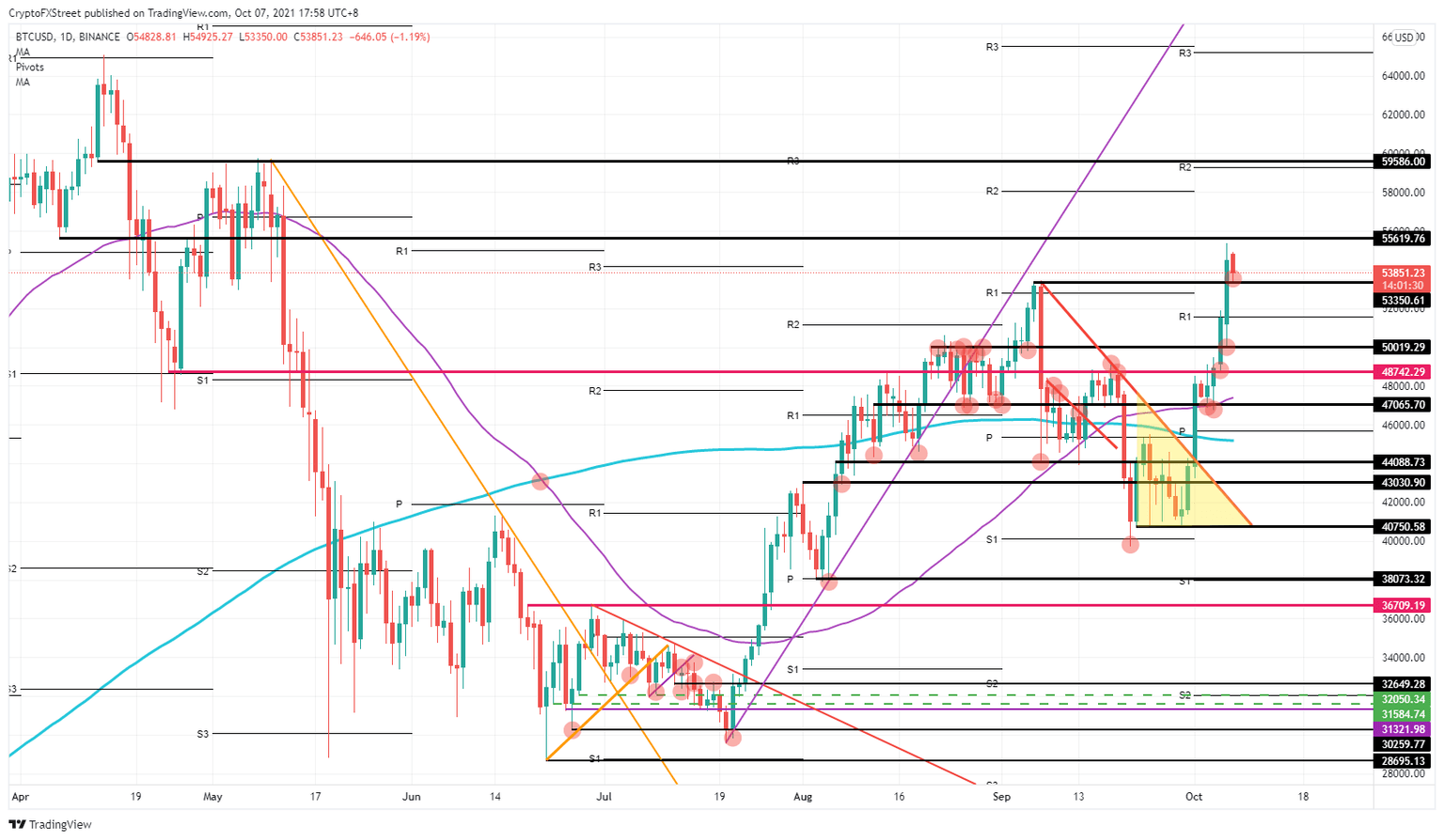

Bitcoin price action has been on the front foot with a solid and technical rally that originated on October 4. Buyers picked up BTC at $47,065 with both a historical level and the 55-day Simple Moving Average (SMA) as two main reasons for an entry. After the break above $50,000, the $50,019 level supported the next stage upward.

BTC price action support at $50,019 originated from August 21 and kept price action in check throughout past months toward either the upside or the downside. As this level turned into support, bulls added to their longs and made price action take out $53,350. With that break, bulls started to fade near $55,619. With the rally now taking a breather, the $53,350 level offers oxygen and the opportunity for buyers to get in again before BTC price action tries to reach $60,000.

BTC/USD daily chart

However, with market sentiment quite choppy these past few days, current sentiment could shift rapidly overnight. Buyers will want to lock in as many gains as possible, which could make Bitcoin price fade back toward lower support levels near $50,019. If there is a dip lower as markets flip back to risk-off, expect a further downturn toward $40,750, paring back all the gains realized in this current bull run.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.