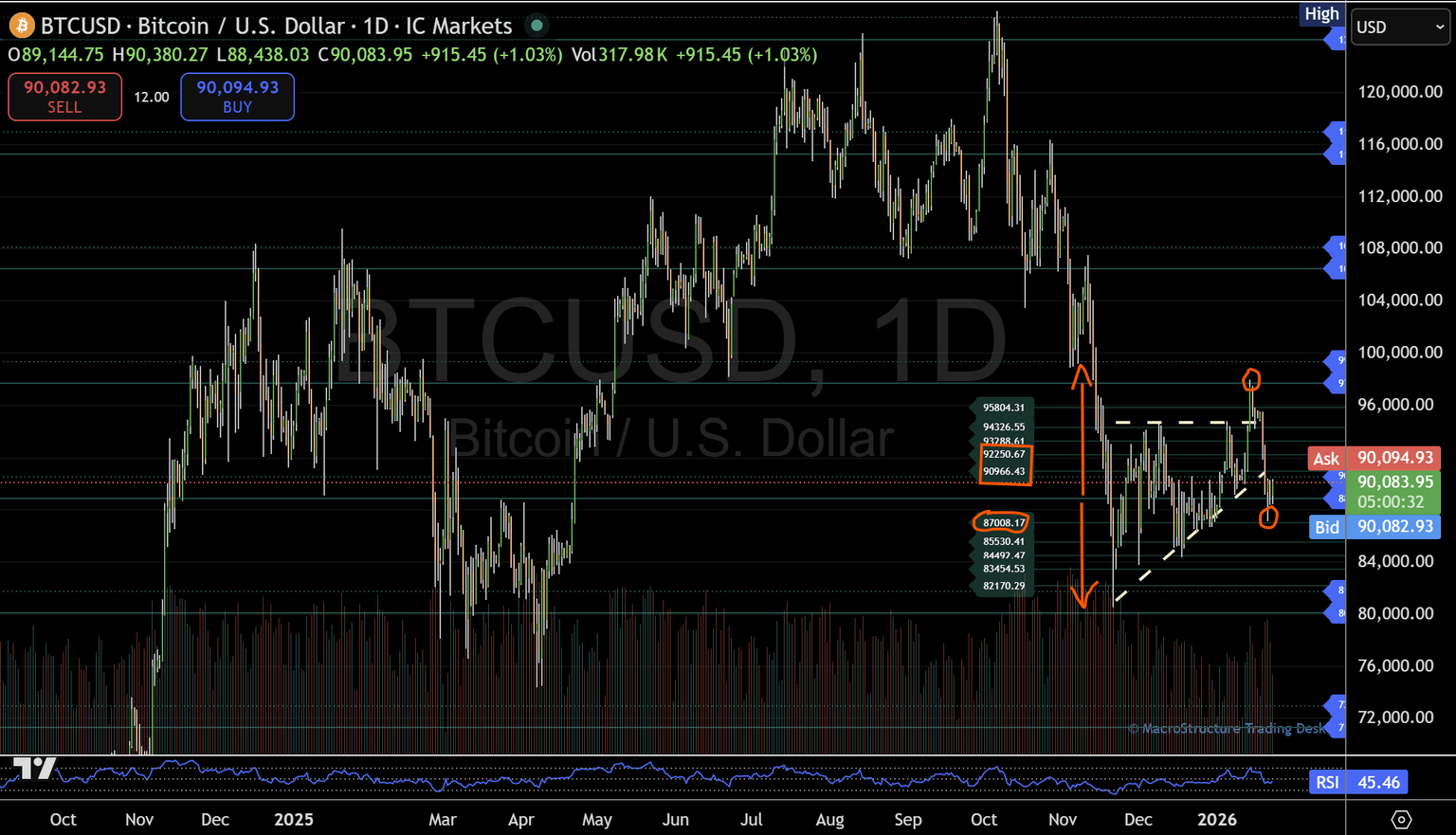

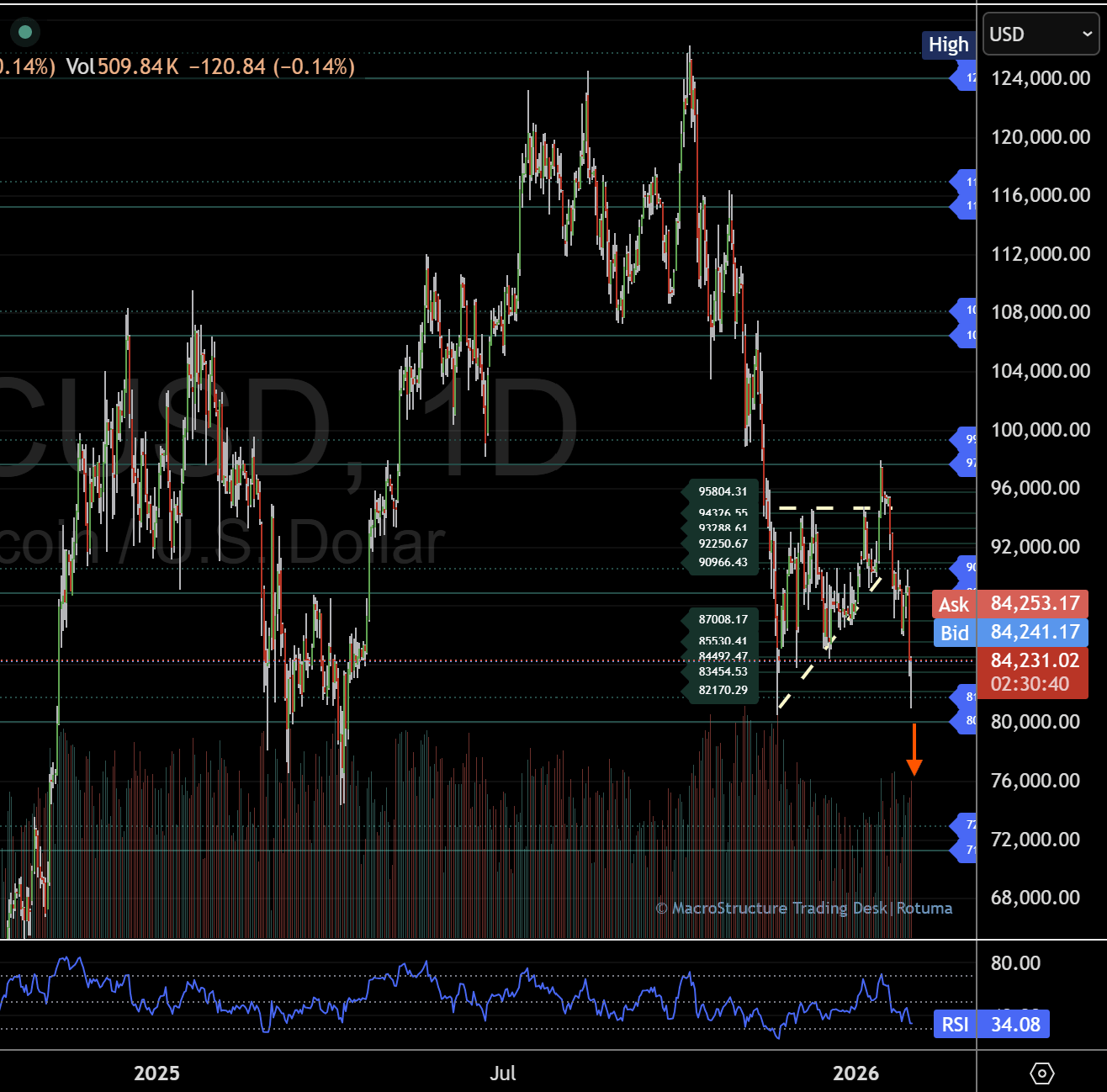

Bitcoin rotates back into lower structure as critical support comes into focus

Failure to reclaim the central pivot keeps the two-way structure intact as Bitcoin tests the lower boundary near 82,000–80,000.

This update is a follow-up to the January 23, 2026, desk report and continues to document how Bitcoin is trading within a clearly defined two-way structure that has been in place since November 2025.

Structure exists first. Price evolves around it until it either holds, fails, or transitions into the next phase.

Bitcoin failed to reclaim the central pivot near 88,900, triggering a rotation back into the lower structure. Price has since moved into the 82,000–80,000 support band, a critical area that underpins the lower boundary of the broader two-way structure observed over recent months.

This lower structure has been referenced consistently across prior desk updates and continues to act as a key decision zone for price behaviour rather than direction.

Key structural levels in focus

- Micro 1–2 support band: 82,170–83,454

Acceptance above this zone would stabilise the lower structure and reopen higher micro references. - Recovery zone above support: 84,492–87,000

A sustained move back into this range would bring the central pivot near 88,900 back into focus. - Failure scenario:

A clean break below the 80,000 level would signal a transition to80,000 the next structural phase lower, extending beyond the current two-way range.

At the time of this update, Bitcoin trades around 83,950, holding just above micro 2 near 83,454. How price behaves around this level will help determine whether the balance is maintained or the structure progresses to its next phase.

As with prior reports, the structure itself remains unchanged. What continues to evolve is price behaviour around these predefined levels.

These desk updates document a structure-first process that observes how price accepts or rejects predefined levels over time. Coverage spans futures, commodities, forex, bonds, crypto, stocks, and indices, with structure providing context before direction.

This observation is for informational purposes only and does not constitute financial advice.

Author

Denis Joeli Fatiaki

Independent Analyst

Denis Joeli Fatiaki possesses over a decade of extensive experience as a multi-asset trader and Market Strategist.