Bitcoin retests support, with trader forecasting BTC price dip to $55K

Bitcoin (BTC) denied bulls their big break on Nov. 4 as sideways action dragged the market ever closer to $60,000.

BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView

BTC hodlers in “buy the dip” mode

Data from Cointelegraph Markets Pro and TradingView showed BTC/USD back below $62,000 at 8 am UTC.

The pair saw a difficult 24 hours after hitting local highs above $64,000, finally bouncing at $60,000 in a brief but significant dip.

While some suggested the price action was a gift to investors looking to add to their BTC stash before further upside, analysts were more focused on longer timeframes.

“BTC retest has been successful for three weeks in a row thus far,” Rekt Capital noted about the strength of the $60,000 mark.

“It’s unfolding exactly as I expected: BTC completed its bounce to 64k and ETH’s cycle reached 4600+,” fellow analyst Crypto Ed, meanwhile, said in a more cautious note on current price moves.

“Pulling back now, has to be seen if we indeed go that deep. When right, BTC to ~55k and ETH 37-3800.”

While unpalatable as an outcome, a trip to the $50,000 range has long been on the table — with Bitcoin still able to keep its overall bullish trajectory as a result.

Altcoin all-time highs keep coming

Altcoins, meanwhile, continued to tag-team to hit new all-time highs in a curious departure from Bitcoin’s uninspiring short-term performance.

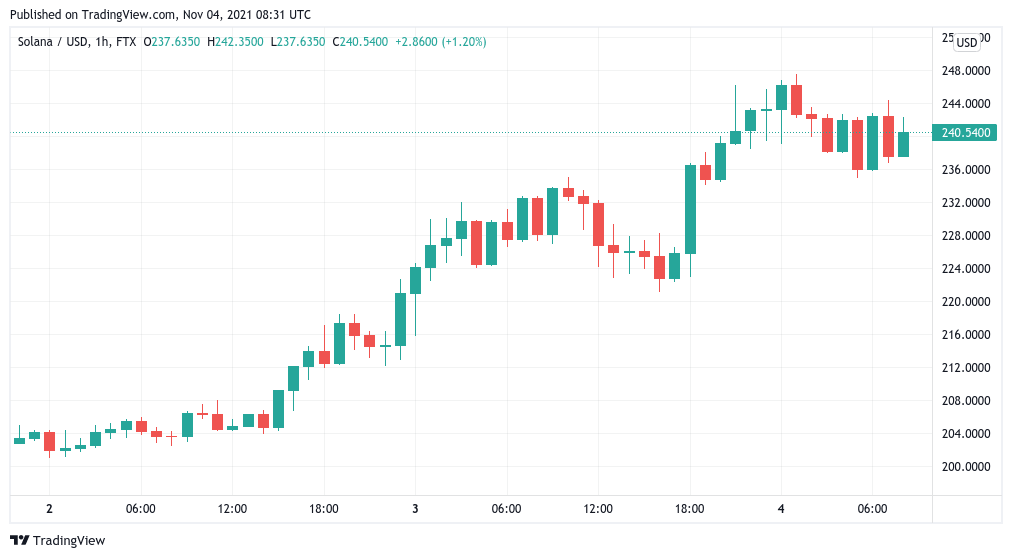

On Thursday, it was the turn of Ether (ETH) to cool from its new peak, while Solana (SOL) surged higher to outperform the rest of the top 10 cryptocurrencies by market capitalization.

SOL/USD 1-hour candle chart (FTX). Source: TradingView

Polkadot (DOT) also returned after consolidation Wednesday, hitting $54.55 to mark a further record of its own.

Author

Cointelegraph Team

Cointelegraph

We are privileged enough to work with the best and brightest in Bitcoin.