Bitcoin Price Prediction: BTC/USD eyes zoom in on $9,779 resistance – Confluence Detector

- Bitcoin price slides under $9,700 (weekend range support) as bears attempt to overpower the bulls.

- BTC/USD could consolidate further according to the MACD and the RSI sideways movements in the 4-hour range.

Bitcoin sideways trading has entered the new week after dominating the weekend session. It has become unviable to attempt a breakout above $10,000 because the last two spikes resulted in extreme dips. For now, Bitcoin has broken the weekend consolidation range at $9,700 and is teetering at $9,674. On the upside, I anticipate resistance at $9,800 and $10,000 respectively.

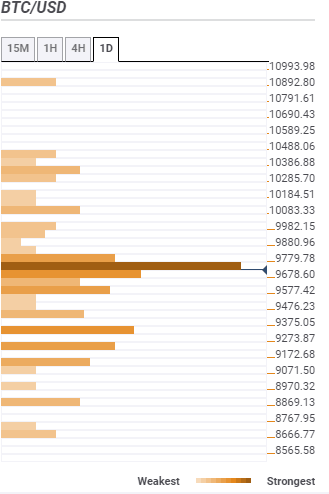

Looking at the confluence levels, Bitcoin buyers must be ready to deal with resistance at $9,799. This zone is home to the SMA five 15-minutes, SMA ten 15-minutes, Bollinger Band 15-minutes middle curve, the previous high 1-hour, and previous high 4-hour. As it appears gain above this zone could result in a smooth ride above $10,000 because the reaming resistance would be mild.

On the flip side, if ongoing breakdown continues, support would be anticipated at $9,577 as highlighted by the Bollinger Band 4-hour upper curve, the Fibo 61.8% one-day and the Fibo 23.6% one week. Other key support areas include $9,375, $9,273 and $9,172.

On the other hand, the 4-hour chart shows that Bitcoin could continue with sideways trading in the near term as seen with the RSI and MACD. If push comes to shove and losses continue, the 50-day SMA will provide support at $9,000, the 100-day SMA, and the 61.8% Fibo at $8,000.

BTC/USD daily chart

Author

John Isige

FXStreet

John Isige is a seasoned cryptocurrency journalist and markets analyst committed to delivering high-quality, actionable insights tailored to traders, investors, and crypto enthusiasts. He enjoys deep dives into emerging Web3 tren

-637272030717725995.png&w=1536&q=95)