Bitcoin Price: How Adam Back's 'hyperbitcoinization' theory could fuel a new wave of accumulation

- Bitcoin firm Blockstream CEO Adam Back says BTC could become out of reach, citing hyperbitcoinization.

- The BTC OG's theory stipulates that Bitcoin price growth would make buying a luxury and something unattainable.

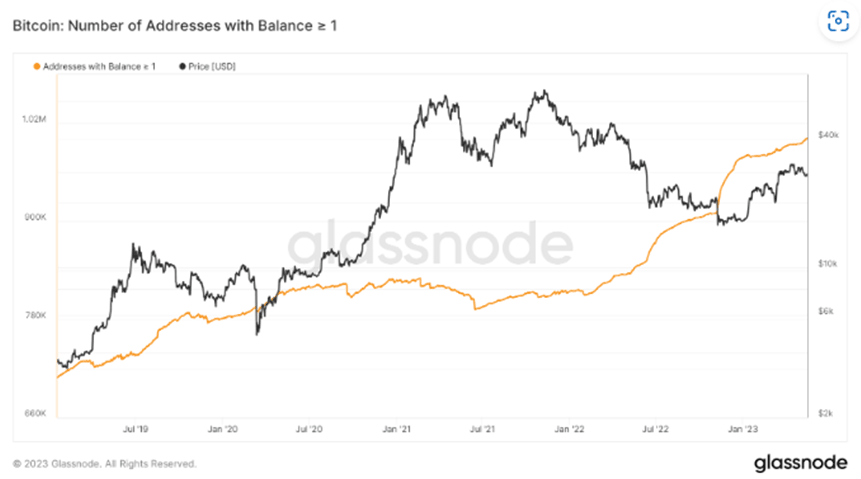

- The comment sprouts from Glassnode data showing over 1 million addresses holding at least 1 BTC as of May 18.

- Adam tells his 0.5 million (+) followers to accumulate their first target while they still can.

Bitcoin (BTC) OG Adam Back has made a case that could prove bullish for the flagship cryptocurrency, arguing "hyperbitcoinization" is near at sight. The narrative comes after a recent report from Glassnode showing that there were over 1 million "wholecoiner" addresses as of May 18.

1 Million Wholecoiner Addresses#Bitcoin pic.twitter.com/4ywupjEfOu

— Rafael Schultze-Kraft (@n3ocortex) May 12, 2023

Notably, wholecoiner refers to an individual or an address hodling 1 BTC, as opposed to the ones with fractions of Bitcoin.

Also Read: Top 3 Price Prediction Bitcoin, Ethereum, Ripple: Dark clouds abound for BTC, XRP takes new focus

Bitcoin has crossed a crucial threshold, Glassnode shows

Bitcoin (BTC) has crossed a significant threshold, with on-chain analytics firm Glassnode showing that over 1 million addresses hold at least 1 BTC as of May 18.

Glassnode data also shows that these wholecoiners have been steadily accruing the BTC since mid-2021, with the northbound trend in 1-BTC wallets showing no reversal. However, the on-chain analytics firm notes that the trend gained momentum in 2022, recording a 20% increase from 814,000 in January to 978,000 wholecoiners in December of the same year.

Bitcoin firm Blockstream CEO responds

Adam Back, the CEO and co-founder of Bitcoin firm Blockstream, says that this "adoption trend lays the path to hyperbitcoinization." A relatable explanation of this term is drawn from his tweet, which notes:

I saw the graph and thought, very cool, now let's go for 10 million whole coiners next! And then it dawns on me: that may not be possible as there are only 21mil bitcoin.

In his opinion, a continuation of this trend could see Bitcoin price growth make purchasing BTC a luxury, or in the dire case, "something unattainable altogether."

The concern comes as existing BTC investors with long-term market participation broadly resist the urge to sell BTC. In fact, some of them kept their reserves across the recent bear market and subsequent price recovery.

Meanwhile, a surge in short-term retail holders in 2023 has inspired speculation of a new Bitcoin bull market on the horizon. This is plausible with Adam appealing to his 518,900 followers to "Accumulate your first target while you can pre-hyperbitcoinization!"

Also Read: Bitcoin trader predicts end of dip within weeks as BTC price adds 3.5%

The role of whales in influencing Bitcoin price

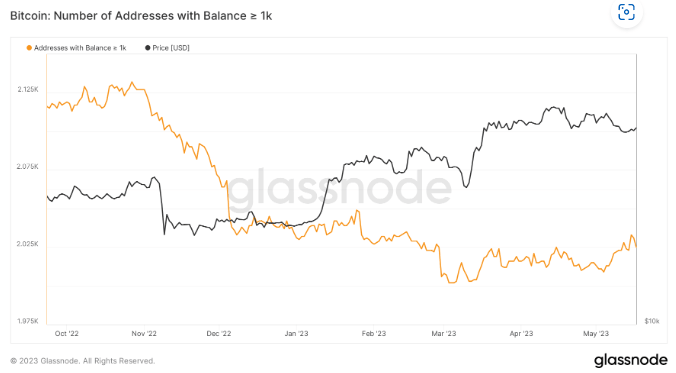

Meanwhile, Glassnode has used another spectrum to show a concerning stagnation among whale wallets. As shown in the chart below, whale addresses with between 1,000 BTC and 9,999 BTC have started to recover after the plunge around June 2022.

Conversely, up to 117 whale addresses with over 10,000 BTC remain stagnant, within the range that started when the FTX exchange imploded under the leadership of Sam Bankman-Fried. It is worth mentioning that the largest classes of whales are the ones who have the most influence on Bitcoin price action because of their trading activities.

Also Read: Chainlink whales begin accumulation as LINK enters opportunity zone

Author

Lockridge Okoth

FXStreet

Lockridge is a believer in the transformative power of crypto and the blockchain industry.