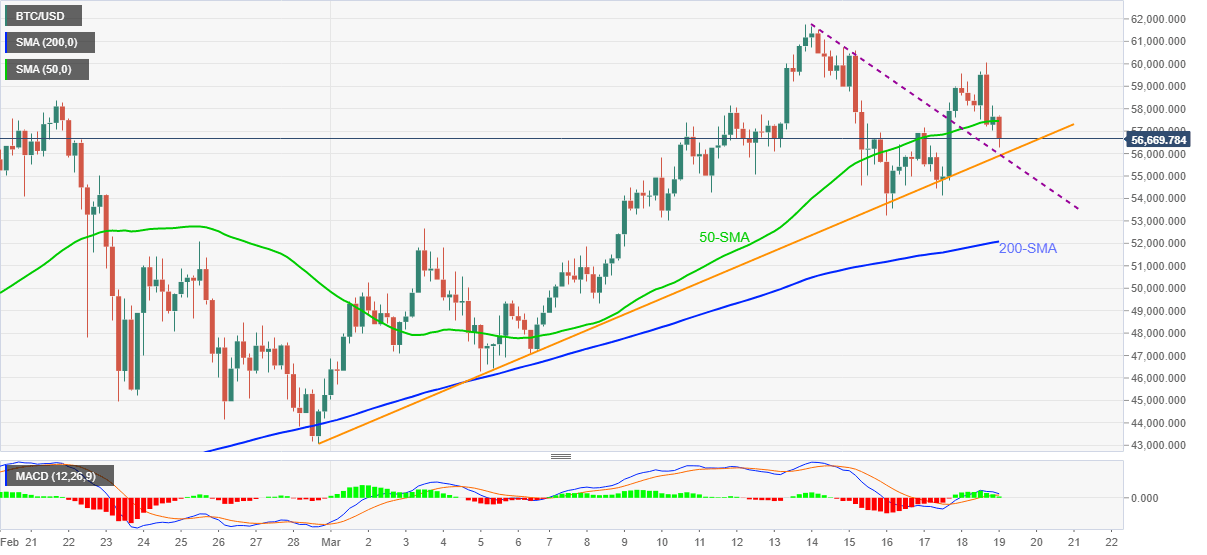

Bitcoin Price Forecast: BTC needs to break $55,900 support to extend bearish impulse

- BTC/USD bounces off intraday low but stays depressed below 50-SMA.

- Convergence of previous resistance line and monthly support restricts downside to 200-SMA.

- Receding bullish bias of MACD, sustained trading below short-term SMA favor sellers.

Bitcoin traders keep the previous day’s bearish bias during early Friday as the quote drops below 50-SMA to $56,930, down 1.20% intraday. The cryptocurrency major recently refreshed the day’s low with a $56,276 level, while extending Thursday’s pullback from $60,079, before the latest corrective pullback.

Given the quote’s failures to stay beyond $60,000, coupled with the downbeat MACD, BTC/USD sellers are likely to remain dominant.

However, a confluence of weekly support line, previous resistance, as well as an ascending trend line from February 28, currently around $55,900, offers a tough nut to break for the BTC/USD bears.

If at all the crypto major drops below $55,900, odds of its plunge to a 200-SMA level of $52,080 can’t be ruled out.

Meanwhile, a corrective pullback beyond the 50-SMA level of $57,450 needs to provide sustained trading beyond the $60,000 threshold to recall the BTC/USD buyers.

To sum up, Bitcoin signals short-term correction amid a broad bullish trend.

BTC/USD four-hour chart

Trend: Pullback expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.