Bitcoin Price Forecast: Five possible drivers that could take BTC to an all-time high in six months

- Bitcoin price has made multiple attempts at a breakout above the ascending parallel channel.

- The intermediate trend remains bullish despite the risk of a correction in the wake of buyer exhaustion.

- BTC could give sidelined investors a buying opportunity before the next leg up.

Bitcoin (BTC) continues to record higher highs, culminating in a strong uptrend. This bullish outlook has one analyst speculating a new all-time high soon, citing five narratives that could steward the king of crypto into a new peak price.

Bitcoin to record new ATH before end of 2024

There is a big chance that Bitcoin price could record a new all-time high soon, according to Lucas Outumuro, head of research at on-chain aggregator tool IntoTheBlock. Specifically, the tool puts the odds at 85% in favor of the king of cryptocurrency recording a new peak in six months, meaning by August.

With bullish momentum surging, @intotheblock forecasts an 85% chance #Bitcoin hits new ATHs in the next 6 months, driven by Halving, ETFs, Easing, Elections, & Treasuries (HEEET). pic.twitter.com/tI3ZEWDxnD

— Satoshi Club (@esatoshiclub) February 16, 2024

IntoTheBlock attributes the expected surge in BTC price to heightened bullish momentum, attributing the ambition to five key themes. These are the halving, exchange-traded funds (ETFs), easing monetary policies, the US elections, and institutional treasuries.

The halving is barely eleven weeks out and will see miner rewards slashed in half. The event is expected to kick off the next bull cycle.

ETFs are the current mania in the market and continue to drive the cryptocurrency market. The investment product continues to record growing demand with over $4 billion in new inflows reported within the first month after the landmark approval and subsequent launch of spot Bitcoin ETF products in the US.

The theme of easing monetary policies by the Federal Reserve comes on the heels of declining inflation rates. In response, there are hopes that the Fed could lower interest rates, which should have the effect of increasing liquidity in the market. This would be beneficial to risk-on assets such as Bitcoin and stocks.

The US will hold the 2024 election in November with the possibility of a Republican administration inspiring the crypto market amid speculation of pro-crypto leaders.

As regards institutional treasuries, regions like Asia and South America continue to enjoy the legitimization of Bitcoin. Corporate treasuries and accessibility to ETFs could see the US market enjoy the same privilege, fostering the growth of the crypto industry.

Bitcoin price outlook

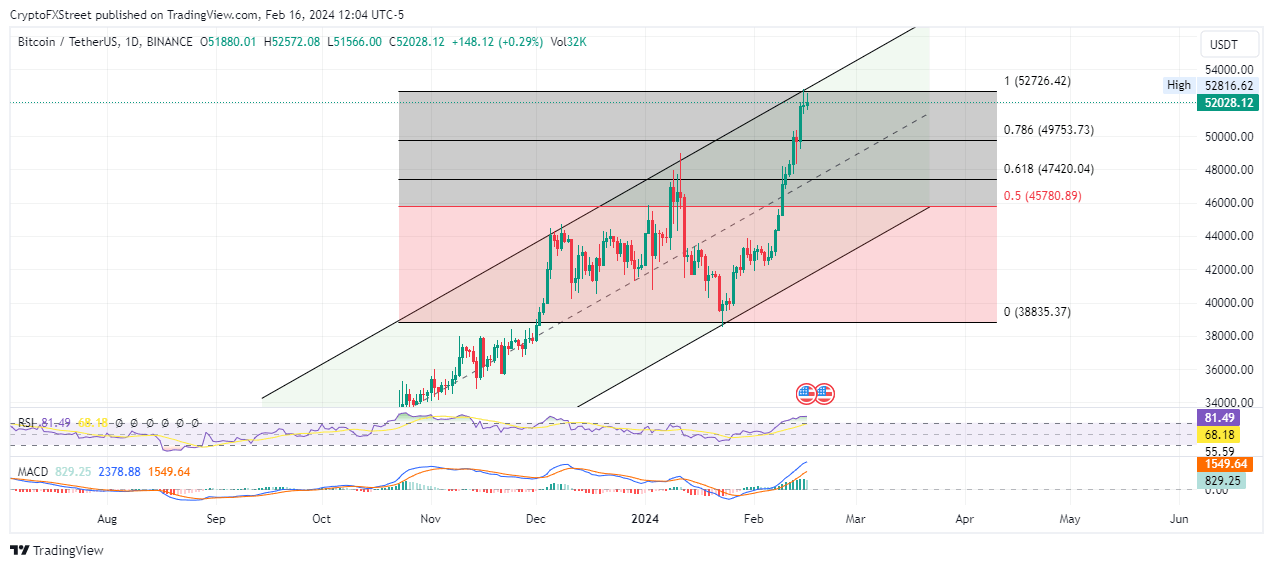

Measured from a market range of between the January 23 low of $38,835 and the February 15 high of $52,816, Bitcoin price is trading above the 78.6% Fibonacci level at $49,753. Chances are BTC could test this retracement level soon in the aftermath of a pullback as BTC is overbought. This is seen in the position of the Relative Strength Index (RSI) at 81.

In a dire case, Bitcoin price could extend the fall to the most critical Fibonacci level of 61.8% at $47,420, or worse, extend a leg down to the 50% Fibonacci level at $45,780.

BTC/USDT 1-day chart

Conversely, considering BTC bulls are still in the market, seen with the green histogram bars in positive territory, Bitcoin price could shatter the upper boundary of the channel. This could open the path for an extension to $55,000, or in a highly bullish cash, foray further to the $60,000 psychological level.

Also Read: Bitcoin Weekly Forecast: BTC eyes $60,000 but correction looms

Cryptocurrency prices FAQs

How do new token launches or listings affect cryptocurrency prices?

Token launches like Arbitrum’s ARB airdrop and Optimism OP influence demand and adoption among market participants. Listings on crypto exchanges deepen the liquidity for an asset and add new participants to an asset’s network. This is typically bullish for a digital asset.

How do hacks affect cryptocurrency prices?

A hack is an event in which an attacker captures a large volume of the asset from a DeFi bridge or hot wallet of an exchange or any other crypto platform via exploits, bugs or other methods. The exploiter then transfers these tokens out of the exchange platforms to ultimately sell or swap the assets for other cryptocurrencies or stablecoins. Such events often involve an en masse panic triggering a sell-off in the affected assets.

How do macroeconomic releases and events affect cryptocurrency prices?

Macroeconomic events like the US Federal Reserve’s decision on interest rates influence risk assets like Bitcoin, mainly through the direct impact they have on the US Dollar. An increase in interest rate typically negatively influences Bitcoin and altcoin prices, and vice versa. If the US Dollar index declines, risk assets and associated leverage for trading gets cheaper, in turn driving crypto prices higher.

How do major crypto upgrades like halvings, hard forks affect cryptocurrency prices?

Halvings are typically considered bullish events as they slash the block reward in half for miners, constricting the supply of the asset. At consistent demand if the supply reduces, the asset’s price climbs. This has been observed in Bitcoin and Litecoin.

Author

Lockridge Okoth

FXStreet

Lockridge is a believer in the transformative power of crypto and the blockchain industry.