Bitcoin Longs Up 45% while its price stalls

During the last 24 hours, it seemed that cryptocurrency markets were beginning to generate strength. However, as has happened lately, the Asian session slowed down this small progression, to sale on strength and pulled down the market. Bitcoin is losing close to 1.7% while on Ethereum (-2.12%) and Ripple(-3.02%) sales accelerated further. ATOM (-5.7%), and TRX (-6.76%) were the most punished among the top capitalized assets.

Ethereum tokens also are suffering from the sale wave. MRK (-5.32%) and MOF (-12.7%) are the most harmed among the top cap tokens, while FST (+9.15%) and LINA (+49%) continued climbing sharply.

Fig 1 - 24H Crypto Market Heat Map

The market capitalization of the sector descended further, to $195.6 billion (-2.12%), while the traded volume dropped to $23.1 billion (-4.51%), and the bitcoin dominance remained stable at 66.22%.

Hot News

The Australian police seized the equivalent of one million US dollars in cryptocurrency in an anti-drug operation.

PlusToken scam operation blamed for the current bearish bias of the crypto market. According to an article by U.today, the biggest crypto scam in history is the leading force in the market, with over one percent of the total BTC in circulation controlled by the scammers. That matches the observation that the latest most significant drops happen during the Asian session.

Kelly Loeffler, Bakkt CEO, may likely become a US Senator next week, picked by Georgia Governor Brian Kemp for a seat in the United States Senate, as reported by the Wall Street Journal.

Technical Analysis- Bitcoin

Chart 1 - Bitcoin 4H Chart

When yesterday, it seemed that bitcoin was beginning to gain strength, sales dragged down its price during the Asian session. Bitcoin broke below $7,300 and currently is struggling at $7160, its short-term minor bottom. We can see that the price broke down after a movement that brought it to touch the Bollinger mean line, and now moves almost touching the -3SD line. This setup makes us think that a test of the $6.880 level is likely.

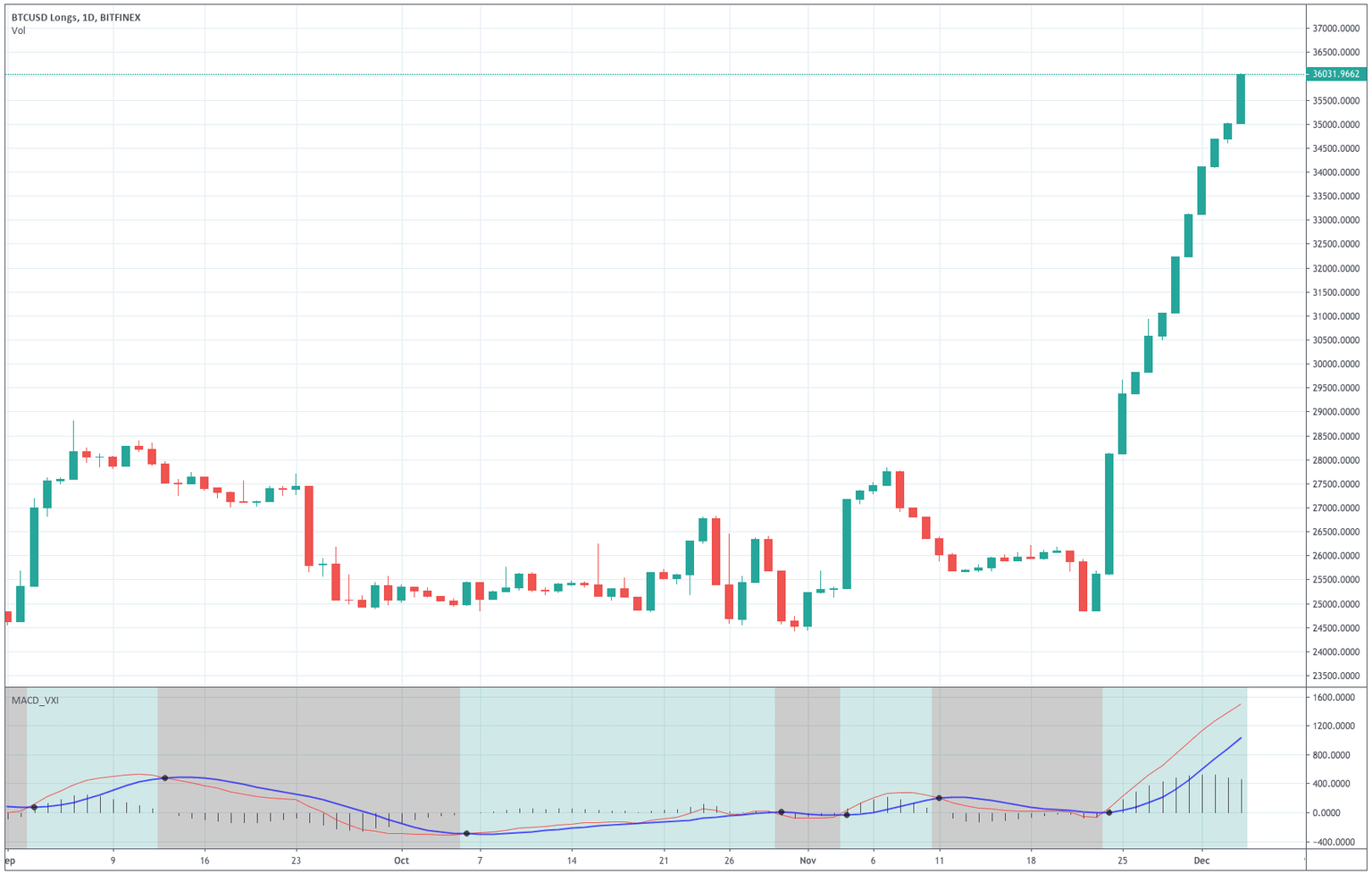

The odd thing about the current bearish sentiment of the Bitcoin is that while the price stalls or move down, the latest sessions have been marked by a 45.54% increase in the long positions if we give credit to the numbers of the Bitfinex exchange. Is this the accumulation activity prior to a sharp bullish movement?

Chart 2 - Bitcoin Longs Daily Chart

|

SUPPORT |

PIVOT POINT |

RESISTANCE |

|

7,160 |

7,300 |

7,400 |

|

7,000 |

7,475 | |

|

6,880 |

7,570 |

Ripple

Chart 3 - Ripple 4H chart

Ripple had a sharp drop this early morning that drove its price from the Bollinger Mean line at about $0.22 down to $0.2124. The asset is now touching the -3SD line, which shows the stent of the bearish momentum for XRP. A target of $0.2065 will create a double bottom if it is respected.

|

SUPPORT |

PIVOT POINT |

RESISTANCE |

|

0.2142 |

0.2220 |

0.2233 |

|

0.2115 |

0.2266 | |

|

0.2090 |

0.2330 |

Ethereum

Chart 4 - Ethereum 4H chart

Ehtereum also broke down after touching the Bollinger mean line, breaking through $146.7. Now it is reaching its support of $143, which seems to be holding. The MACD and the price action position in relation to the Bollinger bands ( the price moving below -1SD is always bearish) points to more drops, though. A recovery above $147 would shift the sentiment to bullish, though. A drop below 143 would mean further sales and a visit to $140 and possibly to $132.

|

SUPPORT |

PIVOT POINT |

RESISTANCE |

|

145.00 |

148.00 |

151.00 |

|

143.40 |

154.00 | |

|

140.00 |

156.00 |

Litecoin

Chart 5 - Litecoin 4H chart

Litecoin was forced to descend in the Asian session, although its drop is being mild. The price moved from near $46.7 down to $44, which has held as support. The MACD has been moving in negative territory, and the Bollinger Bands point down. All these hints show a bearish sentiment in the price. The good news is the price is recovering from its bottoming movement, and $33 holds intact. If the current candlestick closes strong, we could see a short-term recovery in this asset. $45.4 and $44 are the main levels to keep.

|

SUPPORT |

PIVOT POINT |

RESISTANCE |

|

45.40 |

45.40 |

46.10 |

|

44.50 |

46.70 | |

|

42.70 |

48.00 |

Author

EagleFX Team

EagleFX

EagleFX Team is an international group of market analysts with skills in fundamental and technical analysis, applying several methods to assess the state and likelihood of price movements on Forex, Commodities, Indices, Metals and