Bitcoin hits 6-week lows in hours as 24-hour crypto liquidations near $650M

Bitcoin (BTC) shed almost $5,000 in a single day on Nov. 26 as bulls faced fresh disappointment.

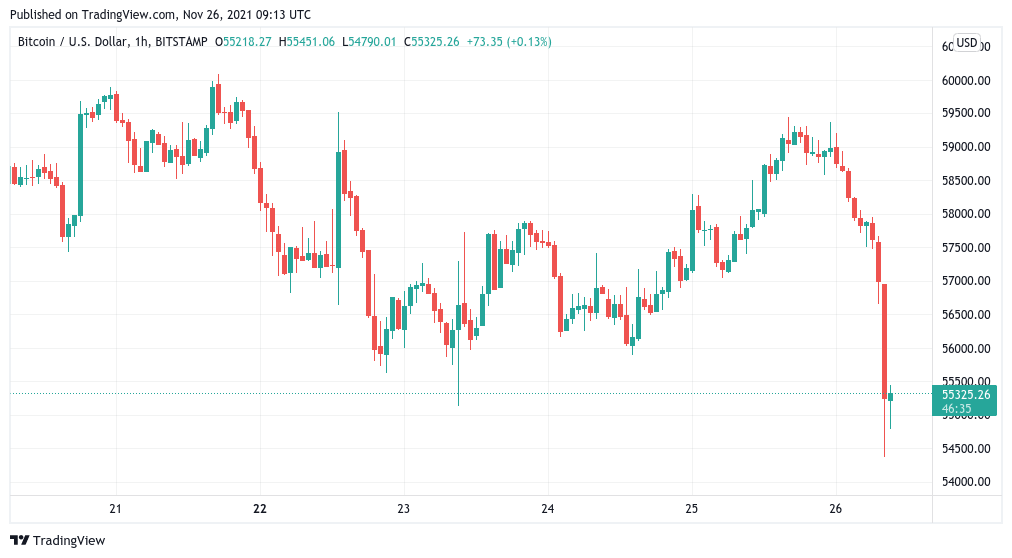

BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView

Bitcoin targets $54,000

Data from Cointelegraph Markets Pro and TradingView followed BTC/USD as it headed toward $54,000 at the time of writing amid intense volatility.

Holders saw major selling pressure after coming within inches of $60,000 late Thursday, the latest attempt to beat resistance nonetheless ending in retreat.

Hours later, Bitcoin was back at its lowest since mid-October, and firmly vindicating those who assumed that the current break from bullish upside was not yet over.

“Not quite there but hopefully soon,” analyst Willy Woo said about one indicator hinting at an incoming — but not immediate — return to form.

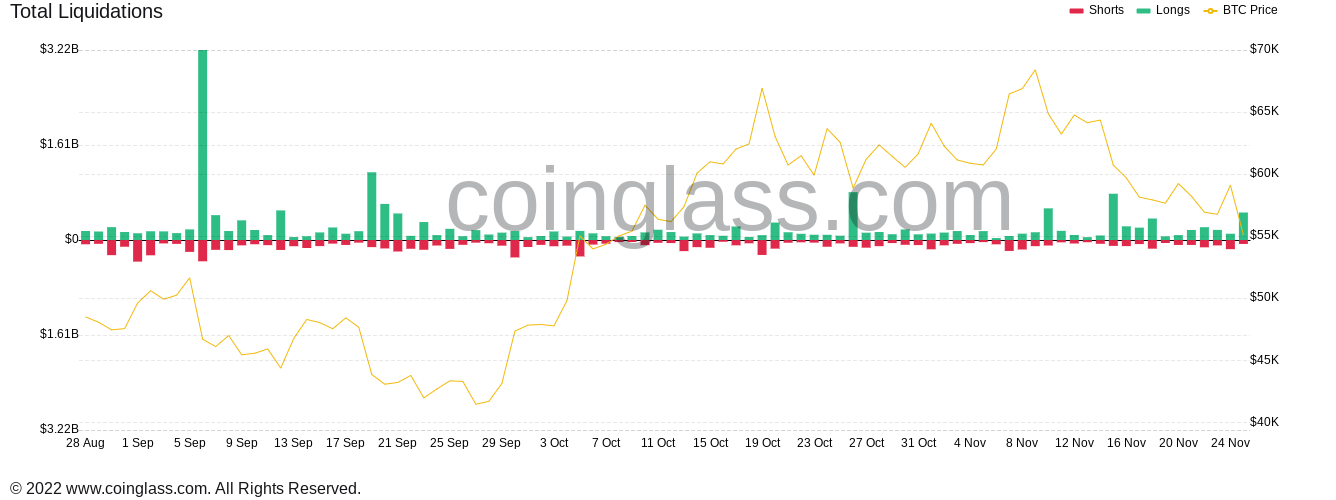

Crypto liquidations chart. Source: Coinglass

Anyone too enthusiastically betting on corrective moves being over was feeling the pain Friday, however, as 24-hour cross-crypto liquidations passed $630 million.

Yet not everyone was surprised or even fazed by the events. Cointelegraph contributor Michaël van de Poppe called current price action “beautiful.”

“Many pumps on markets are getting retraced fully,” he added in Twitter comments ahead of a fresh market update.

US dollar reverses rally

Altcoins did not respond well to Bitcoin’s fall, with many major tokens outperforming BTC against the United States dollar in terms of losses.

Ether (ETH) shed 5.8% compared to Bitcoin’s 4.8%, with others seeing closer to 10% erased from spot price on the day.

Van de Poppe advised traders not to “chase the pump” on altcoins, as markets showed that repeating volatility remains a key characteristic in the short term.

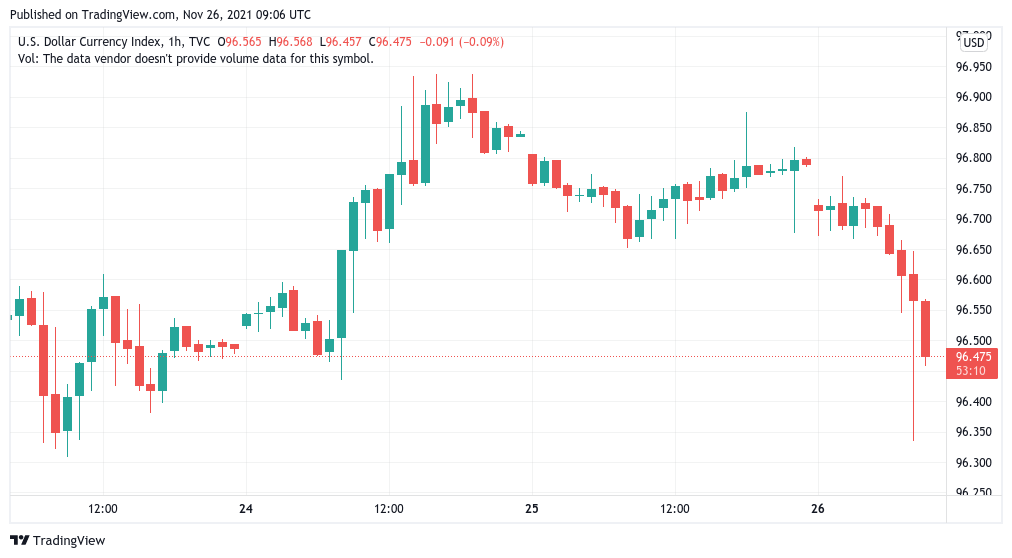

In the background, the U.S. dollar finally began to flag, ending a winning streak that had seen the U.S. dollar currency index (DXY) hit its highest since June 2020.

While traditionally inversely correlated, Bitcoin looked like more of a copycat as DXY targeted 96 for support.

U.S. dollar currency index (DXY) 1-hour candle chart. Source: TradingView

Author

Cointelegraph Team

Cointelegraph

We are privileged enough to work with the best and brightest in Bitcoin.