Bitcoin gains as risk appetite rises on Fed rate cut bets

-

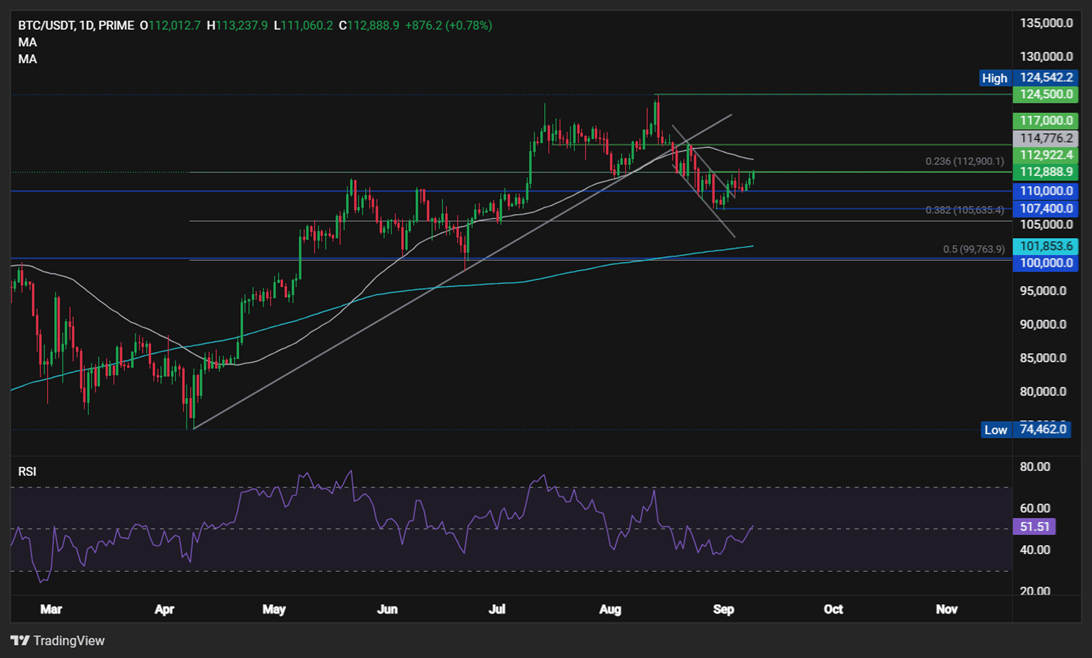

BTC rises to 113k, testing resistance.

-

Fed rate cut expectations rose after the weak NFP report.

-

US employment revisions for year to March 2025 are in focus.

-

Whale selling slows & institutional demand persists.

BTC technical analysis

Bitcoin is on the rise, extending its recovery from the 107.4k September low to 113k at the time of writing. Other cryptocurrencies are also pushing northwards. Ethereum trades 1.4% higher above 4350, and Solana is approaching 220. The total crypto market has risen 1.9% over the past 24 hours, reaching $3.92 trillion.

Bitcoin, along with other risk assets, is rising on expectations that the Federal Reserve will start cutting interest rates again this month after a pause in its rate-cutting cycle. Following Friday's weak-than-expected US nonfarm payroll report, the market is fully pricing in a rate reduction at the September 16-17 meeting.

The Fed fund rates are pricing in a 90% probability of a 25 basis point rate reduction and a 10% chance of an outsized 50 bps cut.

Will US employment revisions fuel outsized Fed rate cut bets?

US macro data remains in the driving seat, with the level of US job growth for the 12 months through to March expected to be slashed by around 800,000 jobs when the government publishes its preliminary payrolls benchmark estimate today. Coming on the heels of Friday's NFP report, which showed that job growth almost stalled in August and the economy shed jobs in June for the first time in 4.5 years, a significant downward revision could suggest that the US jobs market was already struggling before Trump’s tariffs and that the Fed is behind the curve when it comes to supporting maximum employment. This could add to outsized Fed rate cut expectations and lift BTC higher.

The Nasdaq reached a record high on Monday, and Gold has scaled to a fresh record high above 3680 on Tuesday, fueled by Fed rate cut expectations. Investors are now anticipating multiple rate cuts this year. This divergence with US stocks and Gold at record highs could help propel BTC back towards its record level.

Beyond today’s data, attention will be on US CPI figures for further insight into the inflationary impact of Trump’s tariffs. Expectations are for CPI to rise to 2.9% YoY.

Institutional and corporate demand persist

BTC ETFs saw $368.25 million in net inflows yesterday, adding to $246.4 million last week as institutional demand continues to support the price.

Strategy and Metaplanet announced more BTC purchases, adding to their BTC corporate strategy. Metaplanet has executed 10 acquisitions over 10 weeks, diversifying away from yen weakness.

Whale selling slows

Bitcoin whales sold around 100K BTC worth around $12.7 billion over the past month, marking the largest whale selloff since 2022, according to CryptoQuant. This has weighed on the price structure, pushing BTC to 107.4 earlier this month. This aggressive selling appears to have slowed, according to the weekly balance change of large holders. Should this continue, together with persistent institutional support and Fed rate cut optimism, could help BTC break towards 120k.

Bitcoin technical analysis

After hitting a record high of 124.4k BTC/USD, it rebounded lower, finding support at 107.2k, the September low. The price has recovered from this low, rising out of the multi-week downtrend, above 110k and testing 112.5k, the 23.6% Fib retracement of the 74.4k low and 124.4k high. The RSI is pointing higher.

Buyers need a close above 112.5k to expose the 50 SMA at 115k. Above here, 120k and 124.4k pave the way to fresh record highs.

Immediate support is at 110k, the psychological level. A break below here brings 107.4k into play. A move below here could revive the bearish trend towards 105k before exposing the 200 SMA at 102K.

Start trading with PrimeXBT

Start trading with PrimeXBT

Author

PrimeXBT Research Team

PrimeXBT

PrimeXBT is a leading Crypto and CFD broker that offers an all-in-one trading platform to buy, sell and store Cryptocurrencies and trade over 100 popular markets, including Crypto Futures, Copy Trading and CFDs on Crypto, Forex, I