Bitcoin flirts with 92k with US CPI in focus as macro forces drive cross-asset trading

- Crypto meets Tradfi: BTC, Indices & Gold ahead of CPI.

- BTC rises to $92k, US futures are mixed, and Gold holds $4600.

- US CPI is expected to rise 2.7% YoY in December.

- BTC technical analysis.

Bitcoin is rising around 1% over the past 24 hours, with prices testing the $92k level. While the largest cryptocurrency has advanced for three consecutive sessions, it remains confined within the 90k–94k consolidation range. The broader crypto market is also higher by 0.7%, supported by a rebound in U.S. financial markets on Monday and overnight.

TradFi markets are mixed today, with U.S. equity futures hovering near record highs, while gold prices hold steady above $4600 despite a firmer U.S. dollar ahead of key U.S. inflation data.

BTC is defined by macro and geopolitics

So far in 2026, Bitcoin is up 4%, compared with gold’s 6% gain and a 2% rise in the S&P 500. This relatively unified start comes following a mixed performance in 2025 and comes amid a shift in how institutions, investors and professionals are framing cryptocurrency. The traditional four-year cycle is losing relevance, while liquidity conditions, Federal Reserve policy, and institutional flows increasingly drive price action. Geopolitics now sets the tone for risk sentiment rather than speculative excess.

The growing convergence between crypto and traditional finance is becoming more apparent, as traders rotate capital between gold, Bitcoin, equities, and FX in response to macroeconomic signals. Bitcoin is increasingly trading as a macro-sensitive asset alongside traditional markets.

US CPI in focus

Attention now turns to U.S. inflation data, with bond yield reactions likely to be decisive. Headline CPI is expected to hold steady at 2.7% YoY in December, while core CPI is forecast to rise to 2.7% from 2.6%. Markets are pricing a 95% probability that the Fed leaves rates unchanged in January, while still expecting two rate cuts later this year.

A hotter-than-expected CPI print could push Treasury yields and the dollar higher, weighing on Bitcoin, gold, and equities. Conversely, softer inflation may pull yields and the dollar lower, supporting risk assets and precious metals.

BTC/USDT technical analysis

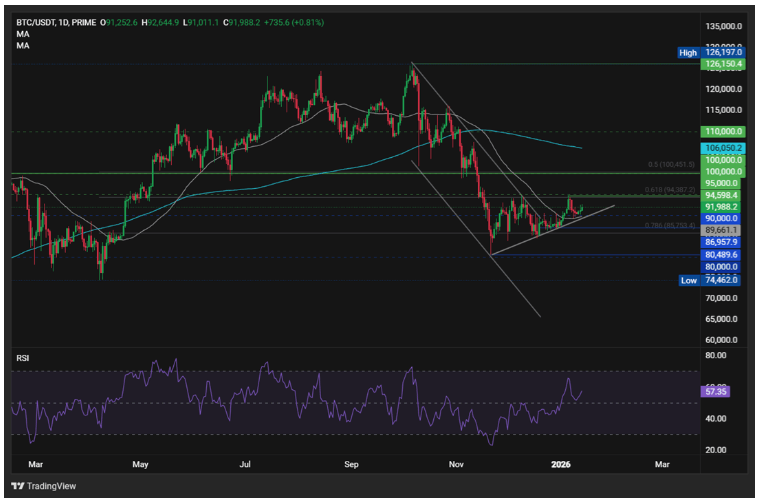

Having recovered from the 87.3k November low, BTC has recorded a series of higher lows. However, the upside has remained capped by 94.5k. The price holds above its rising trendline and its 50 SMA as well as the 90k psychological level. This, combined with an RSI above 50, keeps buyers hopeful of further upside.

Buyers need to push above 94.5k to create a higher high and open the door to 100k, the psychological level, and the 50% fib retracement of the 74.4k low and 126.6k high. Above her, the 200 SMA comes into play at 106k.

Immediate support is at 90k (the round number), 89k (the 50 SMA), and the rising trendline. Below here, 85k comes into focus, the December low, and the 78.6% fib level.

Start trading with PrimeXBT

Author

PrimeXBT Research Team

PrimeXBT

PrimeXBT is a leading Crypto and CFD broker that offers an all-in-one trading platform to buy, sell and store Cryptocurrencies and trade over 100 popular markets, including Crypto Futures, Copy Trading and CFDs on Crypto, Forex, I