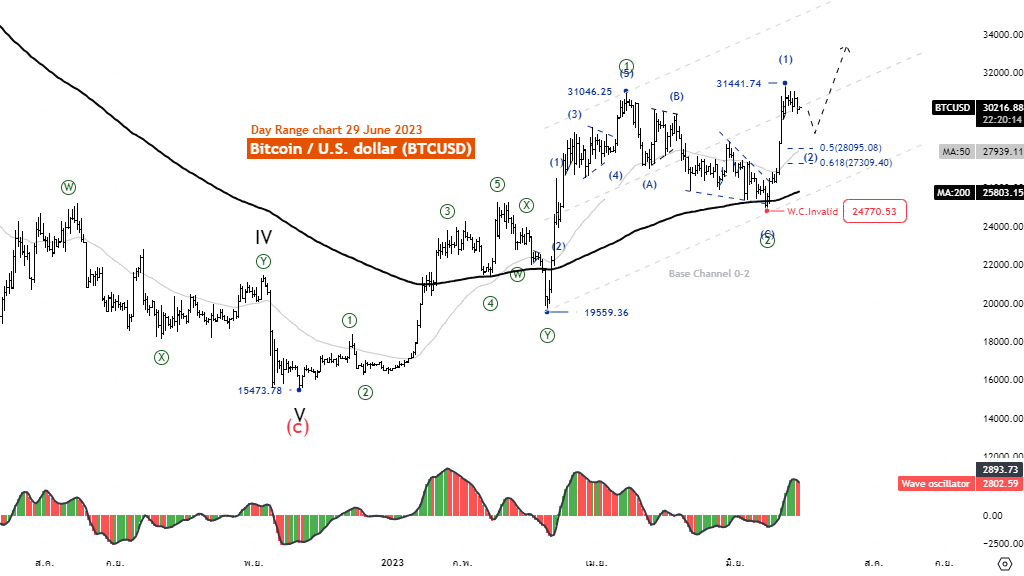

Bitcoin is likely to end wave ((2)) at the 24770.53 level

Elliott Wave Analysis TradingLounge Daily Chart, 29 June 2023,

Bitcoin/U.S.dollar(BTCUSD).

BTCUSD Elliott Wave Technical Analysis.

Function: Reactionary(Counter Trend).

Mode: Corrective.

Structure: Double Corrective.

Position: Wave(Y).

Direction Next higher Degrees: wave ((2)) of Motive.

Details: Wave ((2)) is likely to end at the level of 24770.53 A five-wave rise from this point will support this idea.

Wave Cancel invalid level: 24770.53.

Bitcoin/U.S.dollar (BTCUSD) Trading Strategy: Bitcoin is likely to end Wave ((2)) at the 24770.53 level, which is enough to reverse Wave((2)) in line with a healthy rebound from the MA200 level, giving us a five-wave movement. to support this idea And it could be the start of a new uptrend.

Bitcoin/U.S.dollar (BTCUSD) Technical Indicators: The price is above the MA200 indicating an Uptrend, Wave Oscillator has a Bullish momentum.

Source: tradinglounge com TradingLounge Analyst: Kittiampon Somboonsod, CEWA.

Daily Chart

Elliott Wave Analysis TradingLounge 4H Chart, 29 June 2023,

Bitcoin/U.S.dollar(BTCUSD).

BTCUSD Elliott Wave Technical Analysis.

Function: Counter Trend.

Mode: Corrective.

Structure: Zigzag.

Position: Wave C.

Direction Next higher Degrees: wave (2) of Motive.

Details: Retracement of wave ((2)) usually .50 or .618 x Length wave ((1)).

Wave Cancel invalid level: 24770.53.

Bitcoin/U.S.dollar(BTCUSD)Trading Strategy: Bitcoin is likely to end Wave ((2)) at the level of 24770.53, which is enough to reverse Wave((2)) in line with a retest of the MA200 line. This makes us expect a five-wave movement. to support this idea And it could be the start of a new uptrend.

Bitcoin/U.S.dollar(BTCUSD)Technical Indicators: The price is above the MA200 indicating an Uptrend, Wave Oscillator has a Bearish momentum.

Author

Peter Mathers

TradingLounge

Peter Mathers started actively trading in 1982. He began his career at Hoei and Shoin, a Japanese futures trading company.