Bitcoin dominated crypto fund inflows as institutional investors turn bullish on BTC

- Bitcoin investment funds witnessed a significant increase last week.

- Inflows of BTC-focused products climbed in tandem with the leading cryptocurrency’s rally during the same period.

- Bullish sentiment increased as investors anticipate a Bitcoin ETF being approved by SEC Chair Gary Gensler.

During the Bitcoin price rally last week, cryptocurrency investment funds doubled the amount of inflows in tandem with the bullish sentiment that returned during the same period. A significant increase in BTC-focused funds was witnessed, as inflows reached the highest levels in five months.

Bitcoin witnesses bullish momentum

Last week, cryptocurrency investment products witnessed inflows of $226 million, marking the eighth consecutive week of inflows, resulting in $638 million in total during this period.

Bitcoin investment products made up a significant majority of the total, with inflows adding up to $225 million.

According to a report by CoinShares, the firm believes that there was a turnaround in sentiment toward the leading cryptocurrency following constructive statements from SEC Chairman Gary Gensler to potentially approve a BTC exchange-traded fund in the United States.

Gensler hinted that the securities regulator may be willing to approve an ETF that is linked to Bitcoin futures. He further stated that the United States will not follow in China’s footsteps in banning the new asset class, although the decision would ultimately be up to Congress.

While institutional investors have been increasingly participating in investing in the new asset class, Bitcoin price witnessed a major bull run last week rising to a five-month high. BTC price secured a strong foothold above $50,000.

The last time BTC funds witnessed inflows at these levels was in May, before the Bitcoin price crash from $58,000 to around $29,000 in July.

Ethereum and altcoin fund inflows took a backseat last week, with ETH seeing minor inflows of $14 million, Solana raking in $12.5 million and Cardano with $3 million.

Bitcoin price is ready to pop $60,000

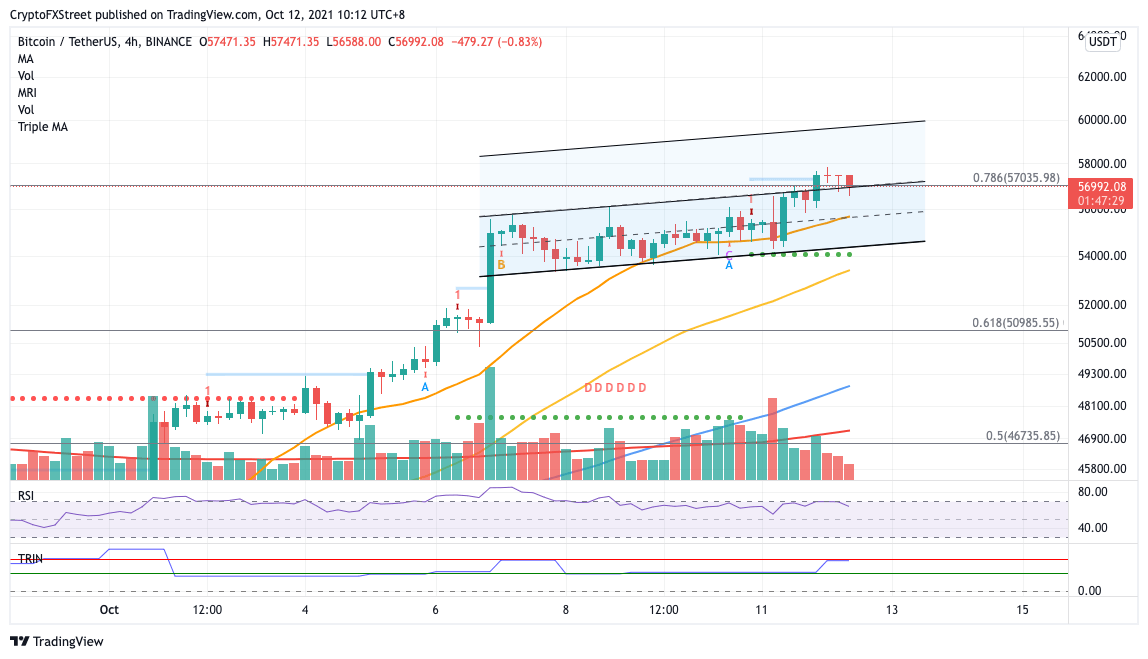

Bitcoin price has formed an ascending parallel channel on the 4-hour chart since October 6. The leading cryptocurrency has now sliced above the upper governing trend line of the pattern, hinting that it is ready to target $60,000.

The upside target given by the prevailing chart pattern is at $60,000 if Bitcoin price manages to secure stable support above the upper boundary of the parallel channel at $57,035, coinciding with the 78.6% Fibonacci retracement level.

BTC/USDT 4-hour chart

Should this level fail to hold, Bitcoin price may test the middle boundary of the governing technical pattern at $55,649 as a line of defense, corresponding to the 20 four-hour Simple Moving Average (SMA). Further support may emerge at the lower boundary of the parallel channel at $54,248, strengthened by the support line given by the Momentum Reversal Indicator (MRI).

Author

Sarah Tran

Independent Analyst

Sarah has closely followed the growth of blockchain technology and its adoption since 2016.