Bitcoin Cash Price Prediction: BCH settles for consolidation while breakdown to $400 looms – Confluence Detector

- Bitcoin Cash is pivotal at $480 after rejection price levels above $500.

- BCH/USD could extend the breakdown back to $400 if the price fails to hold within the ascending parallel channel.

Bitcoin Cash appears to have settled for consolidation after the recent rejection from levels above $500. Support has been provided by an ascending parallel channel's lower boundary. Meanwhile, BCH is pivotal at $480, but odds are starting to align in favor of another breakdown toward $400.

Bitcoin Cash downtrend to begin building traction

The upside resistance is also expected at $500, as highlighted by the 50 Simple Moving Average on the 4-hour chart. If a recovery comes into play, the channel's middle boundary barrier may be tested, but it's unlikely that the selling pressure will be overcome.

On the other hand, if the bulls lose the channel's support provided by the channel's lower boundary, we will likely see losses extending toward $400 (last week's support). The 100 SMA is in line to provide anchorage and perhaps absorb some of the selling pressure. Simultaneously, the Moving Average Convergence Divergence or MACD appears to have validated the bearish outlook.

BCH/USD 4-hour chart

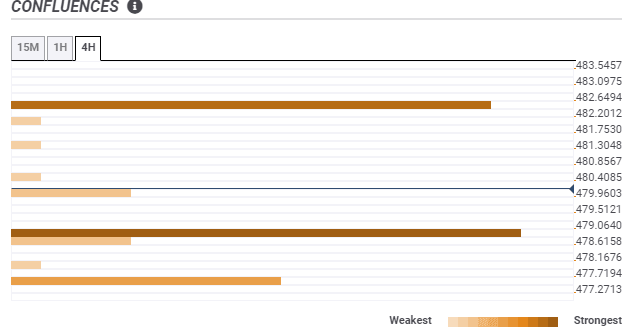

The confluence tool appears to have added credibility to the sideways trading outlook by presenting two critical levels. A robust resistance $482 as highlighted by the one-day 61.8% Fibonacci level. On the downside, support is envisaged at $479, as shown by the 15-minutes previous high. BCH will likely remain in this range a while longer before a breakout or breakdown comes into play.

BCH/USD confluence levels

On the upside, closing the day above the 50 SMA on the 4-hour chart may help confirm an uptrend to levels above $500. Such a price action will also call on many investors to join the market in anticipation of a breakout to $600.

Author

John Isige

FXStreet

John Isige is a seasoned cryptocurrency journalist and markets analyst committed to delivering high-quality, actionable insights tailored to traders, investors, and crypto enthusiasts. He enjoys deep dives into emerging Web3 tren

%2520(56)-637465544909732109.png&w=1536&q=95)