Bitcoin Cash Price Forecast: BCH breakdown to $200 beckons amid heightened volatility

- Bitcoin Cash rejection at $280 opened the Pandora box, leaving the cryptoasset in the bears’ hands.

- The support provided by the 50-day SMA must remain intact if BCH is to invalidate the potential breakdown to $200.

The cryptocurrency market is trading in a period of high volatility, mainly brought about by the ongoing presidential elections in the United States. Bitcoin Cash was recently rejected from $280, leaving the button in the bears’ hands. The reversal that ensued from the resistance stretched beyond tentative support areas at $260 and $240. At the moment, BCH is dancing slightly above $241 while seeking support at $240.

Bitcoin Cash hangs at the edge of a high cliff

The daily chart highlights a recently broken ascending wedge pattern that added weight to the bearish outlook. Bitcoin Cash bears forcefully pushed below the pattern and the 100 Simple Moving Average (SMA), where it refreshed support at $240.

For now, BCH is holding firmly onto the 50 SMA. If this short term support gives in to the selling pressure, the cryptoasset may dive sharply to the primary support at $200. However, buyer congestion at $220 could cushion BCH/USD from the seemingly imminent dive. Besides, the Relative Strength Index (RSI) downward gradient shows that sellers have the upper hand.

BCH/USD daily chart

IntoTheBlock’s IOMAP model reveals intensifying seller congestion ahead of Bitcoin Cash. The most robust resistance runs from $263 to $269. Here, nearly 140,000 addresses previously bought 2.1 million BCH. If BCH managed to rise to this level, a rejection could send it back to $240.

Bitcoin Cash IOMAP chart

On the downside, the model brings to light the lack of a strong enough support to stop the potential breakdown to $200. However, slightly higher buyer congestion between $233 and $240 is in line to cushion the digital asset from the drop. Here, approximately 102,000 addresses previously purchased roughly 458,000 BCH.

Looking at the other side of the picture

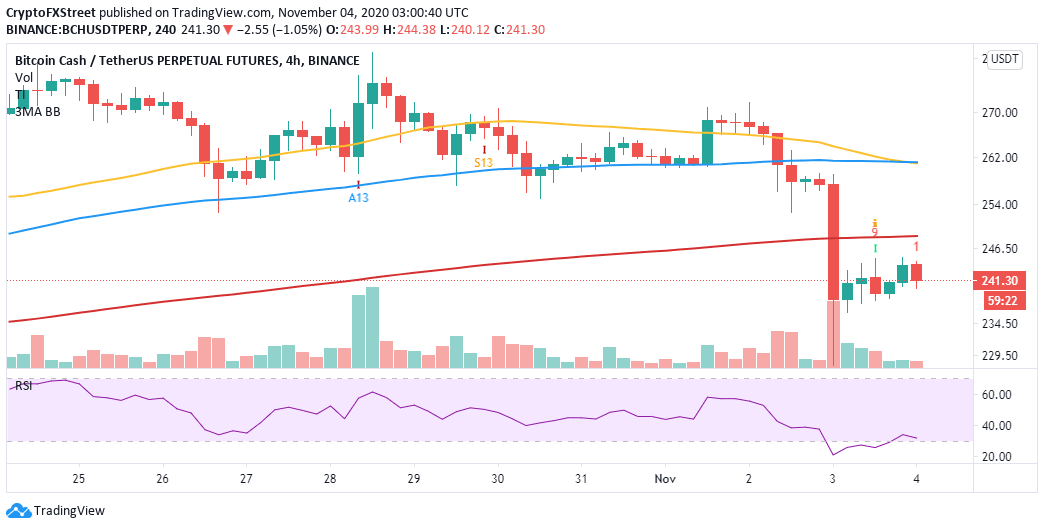

A buy signal presented recently by the TD Sequential indicator on the 4-hour timeframe could help invalidate the bearish outlook. If Bitcoin Cash closes above the 200 SMA, it would call for more buy orders, perhaps creating enough volume to overcome the seller congestion at $260.

BCH/USD 4-hour chart

In the event of an upswing, bulls would have to hold firmly to the 50-day SMA as support to put in jeopardy the bearish scenario.

Author

John Isige

FXStreet

John Isige is a seasoned cryptocurrency journalist and markets analyst committed to delivering high-quality, actionable insights tailored to traders, investors, and crypto enthusiasts. He enjoys deep dives into emerging Web3 tren

%20(44)-637400565128117153.png&w=1536&q=95)

-637400565857396204.png&w=1536&q=95)